Fair Isaac's (FICO) Prospects Ride on Expanding Clientele

Fair Isaac FICO recently announced that StepChange has adopted its FICO Platform to assess individuals in debt.

The FICO Platform enables businesses to absorb data, gain deep new insights through artificial intelligence and machine learning, make hyper-personalized decisions at scale and deliver world-class business outcomes.

The microservice-oriented design of the FICO Platform is a more manageable approach that fits effectively with StepChange's new IT environment. It will enable StepChange to import more data sets than its legacy system can manage, hence boosting consumer advice. FICO Platform is also user-friendly, which decreases StepChange’s training requirements.

StepChange intends to use the platform's flexibility and hyper-personalization to offer the best-personalized conclusion to each client, with the goal of assisting them in becoming debt-free.

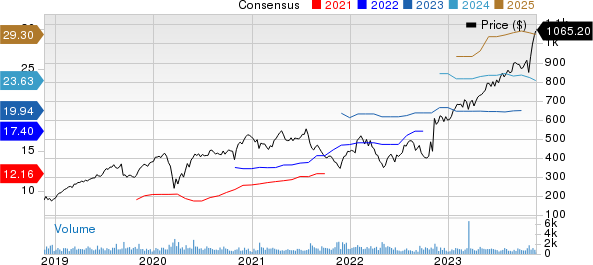

Fair Isaac Corporation Price and Consensus

Fair Isaac Corporation price-consensus-chart | Fair Isaac Corporation Quote

Fair Isaac's commitment to providing hyper-personalized debt advice and the ability to explain customer decisions in real time enables StepChange to achieve the best possible outcome for each consumer.

Fair Isaac’s Prospects Strong

Fair Isaac shares have gained 76.2% year to date, outperforming the Zacks Computer & Technology sector’s rise of 45.5%.

The company reported fourth-quarter fiscal 2023 revenues of $389.7 million, which increased 12% year over year. Revenues from scores and software have been driving growth.

The company’s revenues from scores grew 12% year over year to $195.5 million. Revenues from software grew 11% year over year to $194.2 million.

Expanding clientele has been a key catalyst. Recently, FICO collaborated with Historically Black Colleges and Universities to launch the Educational Analytics Challenge, which encourages students to use AI and analytics to innovate and promote diversity, equity, and inclusion in data science, engineering, and technology fields.

Fair Isaac's new enhancements to the FICO Platform Power Customer Connections earlier in 2023 enabled enterprise-wide transformation. It improved the customer experience with hyper-personalization and significantly boosted enterprise transformation success rates.

The company also Launched Inclusion Accelerator Program and Financial Inclusion Lab to aid Lender Financial Inclusion Initiatives, allowing the market to quickly test and deploy alternative data solutions by creating an incubator for lenders to test new credit decision tools.

Fair Isaac intends to invest more in speeding up the development and dissemination of the FICO Platform soon. The company also plans to invest rigorously in cybersecurity to maintain its position as a leading standard for both the protection of its clients and the FICO assets.

Fiscal 2024 View Strong

For fiscal 2024, Fair Issac expects total revenues to be $1.68 billion.

The Zacks Consensus Estimate for first-quarter 2024 revenues is pegged at $385.8 million, indicating 11.86% year-over-year growth.

The consensus mark for fiscal 2024 revenues is pegged at $1.9 billion, indicating 12.83% year-over-year growth.

The Zacks Consensus Estimate for first-quarter 2024 earnings is pegged at $4.80 per share, indicating 12.7% year-over-year growth.

The consensus mark for fiscal 2024 earnings is pegged at $2.30 per share, indicating 24% year-over-year growth.

Zacks Rank & Stocks to Consider

Fair Isaac currently has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader technology sector are Badger Meter BMI, NVIDIA NVDA and Arista Networks ANET. While Badger Meter and NVIDIA sport a Zacks Rank #1 (Strong Buy) each, Arista Networks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Badger Meter’s shares have gained 35.1% in the year-to-date period. Badger Meter’s long-term earnings growth rate is currently projected at 20.39%.

NVIDIA’s shares have gained 238.4% in the year-to-date period. NVIDIA’s long-term earnings growth rate is currently projected at 13.5%.

Arista Networks’ shares have gained 76.8% in the year-to-date period. Arista Networks' long-term earnings growth rate is currently projected at 19.77%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Fair Isaac Corporation (FICO) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report