Fair Isaac's (FICO) Solutions Aid Itau Unibanco Avoid Fraud

Fair Isaac FICO has helped the largest Latin American bank Itaú Unibanco avoid losses of more than $20 million a month with its cloud-based fraudulent solutions.

Itaú manages a third of all credit cards issued in Brazil and registered more than 3 billion transactions in 2021. Fraud attacks have risen approximately 70% to 80%, along with the increase in transactions during the coronavirus-induced lockdown period.

Payment modes involving credit cards, debit cards, prepaid cards and digital payment systems are evolving day by day, and as such, it is absolutely necessary to have a proper support system to defend against fraud and reduce losses.

Itaú has been benefiting from the implementation of FICO Falcon fraud manager systems on-premise, which helps it defend customers’ capital and reduce fraud losses.

Falcon provides a portfolio of super supervised, unsupervised, and semi-supervised machine learning techniques that allows cross-channel and real-time profiling of legitimate and fraudulent financial transactions.

With the recent migration of FICO Falcon fraud manager systems to the cloud, Itaú has managed to reduce cost per customer account by 15% and increase fraud detection by 20%.

Itaú has gained from the integration of FICO Customer Communication Services for Fraud (CCS). CCS is the primary communication service of Itaú for transaction communication with customers. CCS utility increased substantially by 25% during the pandemic, which reflected a significant jump in participation by cardholders in the resolution process.

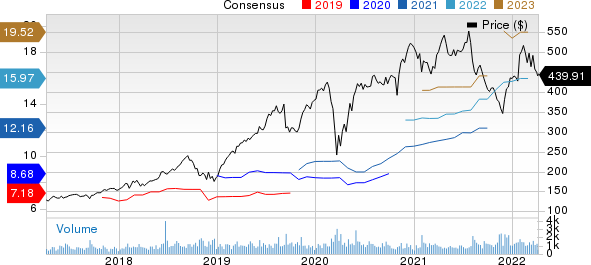

Fair Isaac Corporation Price and Consensus

Fair Isaac Corporation price-consensus-chart | Fair Isaac Corporation Quote

New FICO Score Update Provides Better Credit Risk Decisions

Fair Isaac is also expanding its international footprint. The company recently released the updated version of its flagship FICO Score, FICO Score 10, in Canada. FICO Score is designed to provide a more precise assessment across various credit product lines like mortgages, auto loans, credit cards and personal loans.

The newest version of the FICO score will provide lenders with a 10% predictive lift over prior FICO Scores. FICO Score 10 helps in assessing credit risk better by analyzing trended credit data that excludes the paid collection of debt entirely.

For over two decades, FICO Score has been one of the key credit scoring technologies in Canada, providing credit scoring for risk management in partnership with Equifax EFX and TransUnion TRU.

Zacks Rank and a Stock to Consider

FICO currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the year-to-date period, the company’s shares have appreciated 1.5% against the Zacks Computers - IT Services industry’s and the Zacks Computer and Technology sector’s decline of 14.4% and 9%, respectively.

Here is a stock worth considering in the broader Computer and Technology Sector.

ASGN ASGN carries a Zacks Rank #2 (Buy).

ASGN shares have fallen 7.5% in the year-to-date period, compared with the Zacks Computers - IT Services industry’s decline of 14.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Fair Isaac Corporation (FICO) : Free Stock Analysis Report

ASGN Incorporated (ASGN) : Free Stock Analysis Report

TransUnion (TRU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research