Fairholme Fund Reduces Stake in The St. Joe Co

On August 9, 2023, Fairholme Fund (Trades, Portfolio), managed by its founder Bruce Berkowitz (Trades, Portfolio), reduced its stake in The St. Joe Co (NYSE:JOE). This article will provide an in-depth analysis of the transaction, the guru's profile, and the traded stock company's basic information. The data and rankings are accurate as of August 10, 2023.

Profile: Fairholme Fund (Trades, Portfolio)

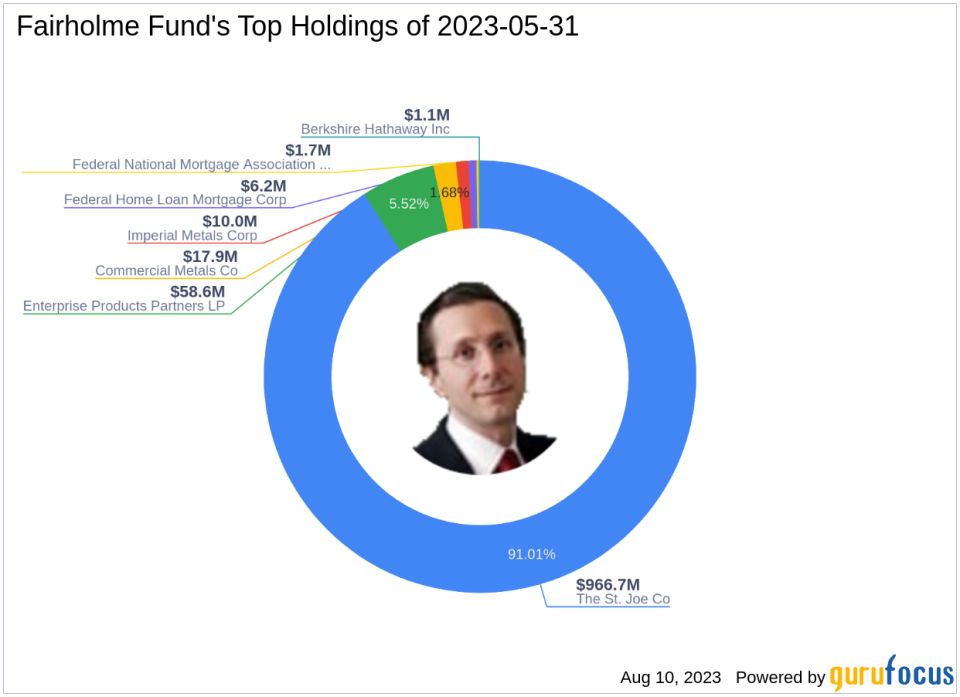

Fairholme Fund (Trades, Portfolio), a firm managed by Bruce Berkowitz (Trades, Portfolio), has gained 253% in the 10-year period after its inception in 1999, while the S&P lost money. Berkowitz concentrates his investments in a relatively small number of companies, looking for those with good management and cash flow. His investment philosophy is to "Ignore the Crowd". The firm's top holdings include Imperial Metals Corp(TSX:III), Commercial Metals Co(NYSE:CMC), Enterprise Products Partners LP(NYSE:EPD), The St. Joe Co(NYSE:JOE), and Federal Home Loan Mortgage Corp(FMCC). The firm's equity stands at $1.06 billion, with Real Estate and Energy being its top sectors.

Transaction Details

The transaction involved a reduction of 151,600 shares in The St. Joe Co, representing a -0.73% change. The shares were traded at a price of $63, leaving Fairholme Fund (Trades, Portfolio) with a total of 20,550,857 shares in the company. This transaction had a -0.9% impact on the guru's portfolio, with the current ratio of the traded stock in the portfolio standing at 123%. The current ratio of the guru's holdings in the traded stock is 35.22%.

The St. Joe Co: Company Profile

The St. Joe Co, a real estate development, asset management, and operating company, was established in the USA and went public on March 10, 1992. The company operates in three segments: Residential, Hospitality, and Commercial. The company's market capitalization stands at $3.71 billion.

Stock Analysis: The St. Joe Co

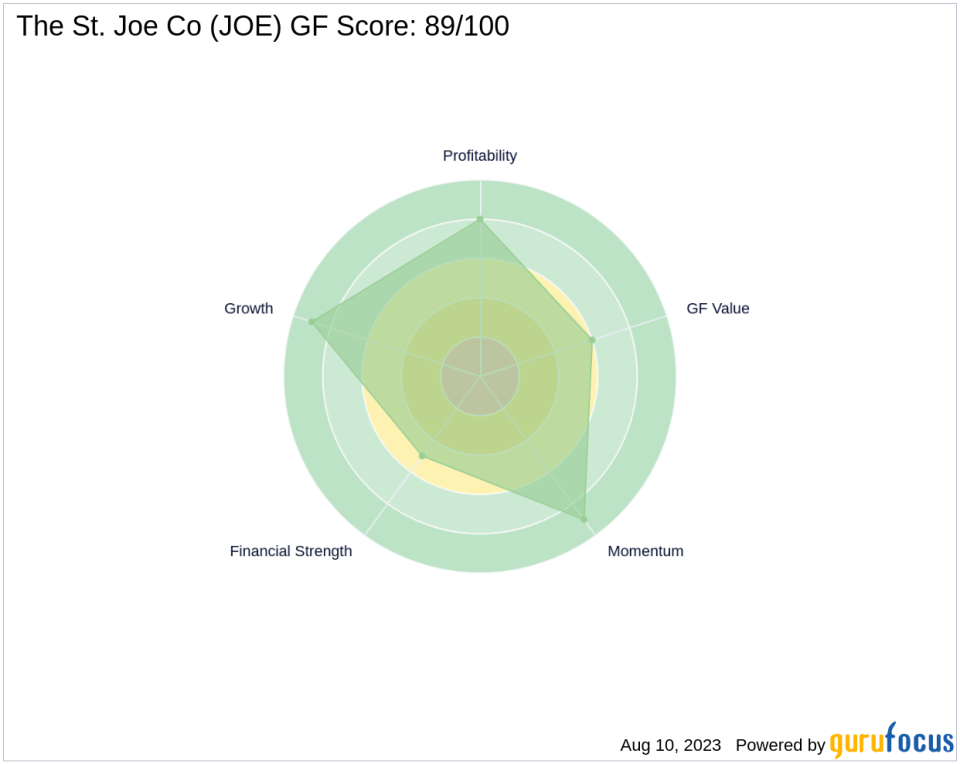

The St. Joe Co's stock (NYSE:JOE) is currently priced at $63.5583, with a PE ratio of 43.24. According to GuruFocus, the stock is fairly valued with a GF Value of $65.53. The stock's price to GF Value stands at 0.97. The stock has gained 0.89% since the transaction and 533.05% since its IPO. The year-to-date price change ratio is 62.14%. The St. Joe Co's GF Score is 89/100, indicating good outperformance potential. The company's Financial Strength is ranked 5/10, Profitability Rank is 8/10, Growth Rank is 9/10, GF Value Rank is 6/10, and Momentum Rank is 9/10.

Other Gurus' Involvement

Other gurus, such as Mario Gabelli (Trades, Portfolio), also hold The St. Joe Co's stock. The largest guru holding the traded stock is Fairholme Capital Management.

Conclusion

The recent transaction by Fairholme Fund (Trades, Portfolio) has slightly reduced its stake in The St. Joe Co. Despite this, the firm still holds a significant position in the company. The St. Joe Co's stock performance and valuation indicate potential for future growth. However, as always, investors are advised to conduct their own comprehensive analysis before making investment decisions.

This article first appeared on GuruFocus.