Fairmount Funds Management LLC Acquires New Stake in Kiniksa Pharmaceuticals Ltd

Philadelphia-based investment firm, Fairmount Funds Management LLC, recently made a significant addition to its portfolio. The firm acquired a new stake in Kiniksa Pharmaceuticals Ltd (NASDAQ:KNSA), a clinical-stage biopharmaceutical company. This article provides an in-depth analysis of this transaction, the profiles of both the guru and the traded company, and the potential impact on the stock's performance.

Overview of the Transaction

On August 2, 2023, Fairmount Funds Management LLC purchased 2,143,052 shares of Kiniksa Pharmaceuticals Ltd at a trade price of $19 per share. This new holding now represents 6.54% of the firm's portfolio, making it a significant investment. The firm now holds a 6.10% stake in Kiniksa Pharmaceuticals Ltd.

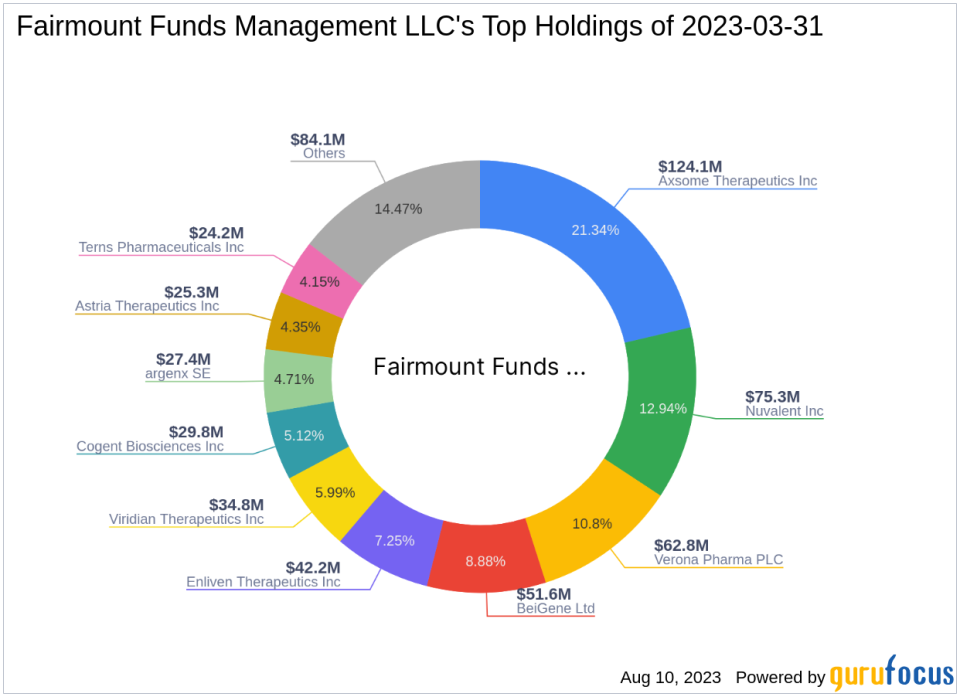

Profile of Fairmount Funds Management LLC

Fairmount Funds Management LLC is an investment firm located at 2001 Market Street Suite 2500, Philadelphia, PA 19103. The firm currently manages 16 stocks in its portfolio, with a total equity of $581 million. Its top holdings include Axsome Therapeutics Inc (NASDAQ:AXSM), BeiGene Ltd (NASDAQ:BGNE), Verona Pharma PLC (NASDAQ:VRNA), Nuvalent Inc (NASDAQ:NUVL), and Enliven Therapeutics Inc (NASDAQ:ELVN).

Profile of Kiniksa Pharmaceuticals Ltd

Kiniksa Pharmaceuticals Ltd, based in Bermuda, is a clinical-stage biopharmaceutical company focused on discovering, acquiring, developing, and commercializing therapeutic medicines for patients suffering from debilitating diseases. The company went public on May 24, 2018. As of the date of this article, the company has a market capitalization of $1.22 billion and a stock price of $17.4. The company's PE percentage stands at 5.32, indicating that it is currently profitable.

Analysis of Kiniksa Pharmaceuticals Ltd's Stock Performance

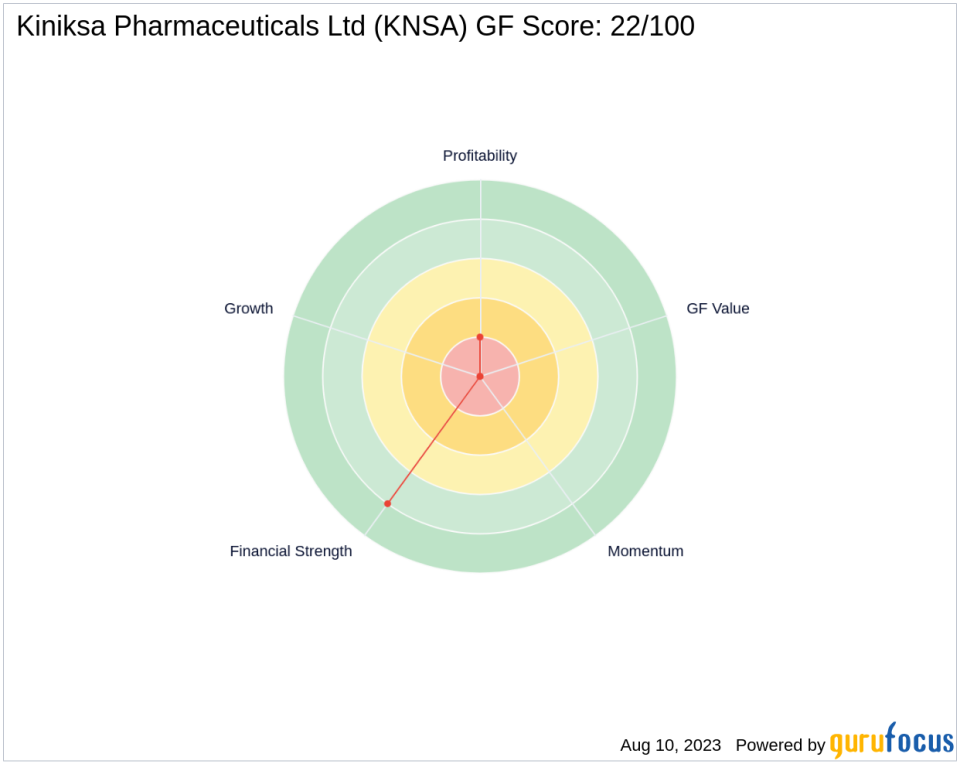

Since the transaction, the stock's price has decreased by 8.42%, and it has seen a decrease of 28.83% since its IPO. However, the stock has seen a year-to-date increase of 20.5%. The company's GF Score is 22/100, indicating poor future performance potential.

Evaluation of Kiniksa Pharmaceuticals Ltd's Financial Health

Kiniksa Pharmaceuticals Ltd has a balance sheet rank of 8/10, indicating a strong financial position. However, its profitability rank is 2/10, and its growth rank is 0/10, suggesting that the company has struggled with profitability and growth. The company's Piotroski F-Score is 6, and its Altman Z score is 10.27, indicating financial stability. The company's cash to debt ratio is 13.68, ranking it 669th in the industry.

Kiniksa Pharmaceuticals Ltd's Industry Position

Kiniksa Pharmaceuticals Ltd operates in the biotechnology industry. The company's return on equity (ROE) is 66.63, and its return on assets (ROA) is 56.20, ranking it 17th and 7th in the industry, respectively. However, the company has not seen any growth in its gross margin, operating margin, or 3-year revenue.

Conclusion

In conclusion, Fairmount Funds Management LLC's acquisition of a new stake in Kiniksa Pharmaceuticals Ltd represents a significant addition to its portfolio. Despite the stock's recent decrease in price and poor GF Score, the company's strong balance sheet and financial stability may offer potential for future growth. However, investors should keep an eye on the company's profitability and growth ranks, as these could impact the stock's performance.

This article first appeared on GuruFocus.