Farmers National Banc Corp. Reports Year-End Growth Amidst Economic Challenges

Net Income: $14.6 million for Q4 2023, a 9% increase from Q4 2022.

Earnings Per Share (EPS): Remained stable at $0.39 for Q4 2023, same as Q4 2022.

Total Assets: Grew to $5.08 billion, up from $4.08 billion at the end of 2022.

Loan Growth: Loans increased by $793.4 million since December 31, 2022.

Deposits: Total deposits stood at $4.18 billion, a decrease from $4.51 billion at the end of 2022.

Asset Quality: Non-performing loans to total loans ratio improved to 0.47%.

Net Interest Margin: Decreased to 2.78% in Q4 2023 from 2.99% in Q4 2022.

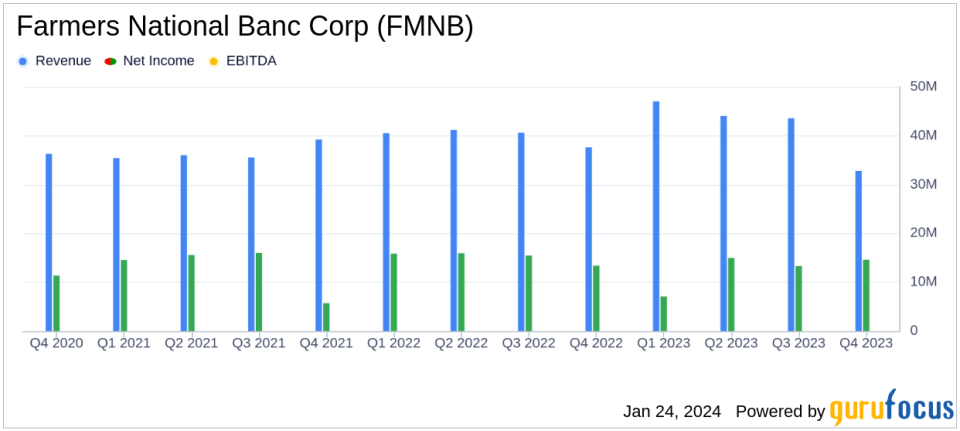

Farmers National Banc Corp (NASDAQ:FMNB) released its 8-K filing on January 24, 2024, revealing a resilient performance for the fourth quarter of 2023. The company, a one-bank holding entity operating primarily through its Bank and Trust segments, reported a net income of $14.6 million, or $0.39 per diluted share, for the quarter ended December 31, 2023. This represents a 9% increase from the $13.4 million, or $0.39 per diluted share, reported in the same period of the previous year.

Financial Performance and Challenges

FMNB's performance in the fourth quarter reflects its ability to navigate a challenging economic environment, marked by intense competition for deposits and a volatile bond market. The company's total assets increased significantly, primarily due to the acquisition of Emclaire Financial Corp., which added $977.6 million in assets. Loan growth was robust, with a $793.4 million increase since the end of 2022, concentrated in commercial real estate. However, deposits experienced a decrease, attributed to the maturity of brokered time deposits and seasonal fluctuations in public funds.

Despite these challenges, FMNB's asset quality remained strong, with a decrease in non-performing loans and an improved non-performing loans to total loans ratio of 0.47%. The company's credit quality metrics indicate a healthy portfolio, with low levels of early-stage delinquencies and a stable allowance for credit losses to total loans ratio.

Income Statement and Balance Sheet Highlights

Net interest income for Q4 2023 totaled $32.8 million, a decrease from the $33.8 million reported in the previous quarter but an increase from the $29.4 million in Q4 2022. The net interest margin, however, contracted to 2.78% from 2.99% in the same quarter of the previous year, reflecting higher funding costs and the impact of the Federal Reserve's rate hikes.

Noninterest income showed a significant increase, rising to $12.2 million in Q4 2023 from $8.2 million in Q4 2022, bolstered by the Emclaire acquisition and growth in trust fees, insurance agency commissions, and investment commissions. Noninterest expense also rose to $27.0 million, up from $21.1 million in Q4 2022, primarily due to the Emclaire acquisition and severance expenses.

"Our solid fourth quarter results demonstrate our success enhancing profitability throughout an extremely challenging operating environment," stated Kevin J. Helmick, President and CEO. "We expect the economic environment will remain fluid in 2024, but we believe Farmers is well positioned to navigate this period."

Liquidity and Capital Strength

FMNB's liquidity position remains strong, with a loan to deposit ratio of 76.6% and access to substantial Federal Home Loan Bank (FHLB) borrowing capacity. The company's total stockholders equity increased to $404.4 million at the end of 2023, up from $292.3 million at the end of 2022, reflecting the acquisition of Emclaire, retained earnings growth, and a decrease in accumulated other comprehensive loss.

Looking Forward

As FMNB looks ahead to 2024, the company is poised to continue its focus on maintaining strong asset quality and profitability. The acquisition of Emclaire has significantly expanded FMNB's asset base and revenue streams, positioning the company for continued growth despite the uncertain economic outlook.

For value investors and potential GuruFocus.com members, FMNB's earnings report underscores the company's resilience and strategic growth initiatives. The solid financial performance, despite economic headwinds, highlights FMNB's potential as an attractive investment opportunity in the banking sector.

For a detailed analysis of FMNB's financial results, including balance sheets and income statements, please visit the full 8-K filing.

Explore the complete 8-K earnings release (here) from Farmers National Banc Corp for further details.

This article first appeared on GuruFocus.