Faro Technologies Inc (FARO) Reports Mixed 2023 Financial Results with Strong Cash Flow Performance

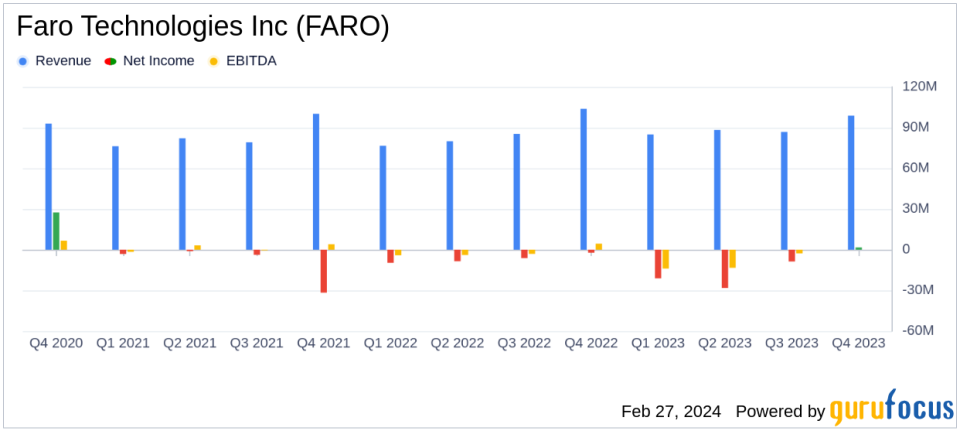

Q4 Revenue: $98.8 million, a 5% decrease year over year.

Full Year Revenue: $358.8 million, a 4% increase from the previous year.

Q4 GAAP EPS: $0.08, with a non-GAAP EPS of $0.36, both exceeding guidance.

Full Year Net Loss: $56.6 million, compared to a net loss of $26.8 million in the prior year.

Adjusted EBITDA: $13.2 million in Q4, a 12% increase year over year.

Cash Flow: Positive Q4 and FY2023 cash flow from operations, with $18.7 million generated in Q4.

Outlook for Q1 2024: Revenue expected to be between $77 to $85 million with a potential net loss per share.

On February 27, 2024, Faro Technologies Inc (NASDAQ:FARO), a global leader in 4D digital reality solutions, released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. FARO's suite of 3D products and software solutions are utilized across various industries for inspection, prototyping, reverse engineering, and more.

Financial Performance and Challenges

FARO's fourth quarter saw a slight decrease in revenue year over year, settling at $98.8 million, which was at the upper end of the company's guidance range. Despite this, FARO achieved a non-GAAP EPS of $0.36, surpassing the high end of their guidance. The full year revenue showed an upward trend with a 4% increase, demonstrating the company's resilience and ability to grow sales amidst challenging market conditions. However, the company reported a significant net loss of $56.6 million for the year, which was more than double the loss from the previous year. This performance highlights the importance of FARO's continued focus on operational execution and cost management.

Financial Achievements and Industry Significance

The company's gross margin improved to 50.9% in Q4 from 49.1% in the prior year period, reflecting better operational efficiency. The non-GAAP operating expenses decreased, contributing to the net income of $1.6 million for the quarter, a notable improvement from the net loss of $2.2 million in the same period last year. These achievements are significant as they demonstrate FARO's ability to manage costs and improve profitability in the competitive hardware industry.

Key Financial Metrics

Adjusted EBITDA for Q4 increased by 12% year over year to $13.2 million, or 13.3% of total sales, indicating a healthy profit margin. The company also expanded its cash position, ending the year with $96.3 million in cash, cash equivalents, and short-term investments, up from $79.9 million as of September 30, 2023. This strong cash flow performance is crucial for FARO's strategic investments and operational flexibility.

"We are pleased with our improved financial performance and remain excited about the long term prospects of our integrated hardware and software solutions strategy to create customer value in our core markets," said Peter Lau, President & Chief Executive Officer.

Analysis of Company Performance

FARO's performance in Q4 demonstrates a company that is navigating market challenges while managing to improve its profitability and cash flow. The full year results, however, indicate that there are still areas that require attention, particularly the significant net loss. The company's outlook for Q1 2024 suggests a cautious approach, with expected revenue lower than Q4 2023 and a potential net loss per share.

For value investors, FARO's ability to generate positive cash flow and improve operational efficiencies may be attractive, but the full year net loss could be a concern. The company's strategic focus on integrated hardware and software solutions could offer long-term growth potential, but investors will likely be looking for signs of sustainable profitability in the coming quarters.

For more detailed information on FARO's financial performance, including financial tables and the reconciliation of GAAP to non-GAAP financial measures, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Faro Technologies Inc for further details.

This article first appeared on GuruFocus.