Fastenal Co (FAST): A Fair Valuation or an Overlooked Opportunity?

Fastenal Co (NASDAQ:FAST) experienced a daily gain of 6.55%, with a 3-month loss of -4.43%, and an Earnings Per Share (EPS) of 1.97. The question that arises is: Is Fastenal Co fairly valued? This article aims to answer this question by providing a comprehensive valuation analysis of Fastenal Co. Read on to gain valuable insights into the intrinsic value of this stock.

Introducing Fastenal Co

Fastenal Co opened its first fastener store in 1967 in Winona, Minnesota. Since then, it has expanded its footprint and diversified its products and services. Today, Fastenal serves 400,000 active customers through approximately 1,600 branches, over 1,600 on-site locations, and 14 distribution centers. Fasteners remain its largest category, contributing about 30%-35% of sales. Fastenal also offers supply-chain solutions, such as vending and vendor-managed inventory.

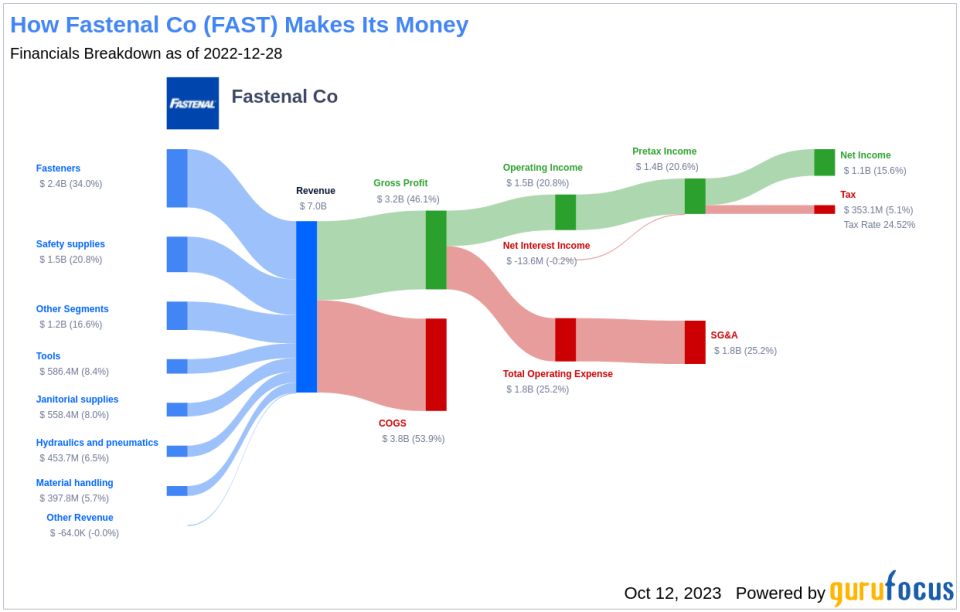

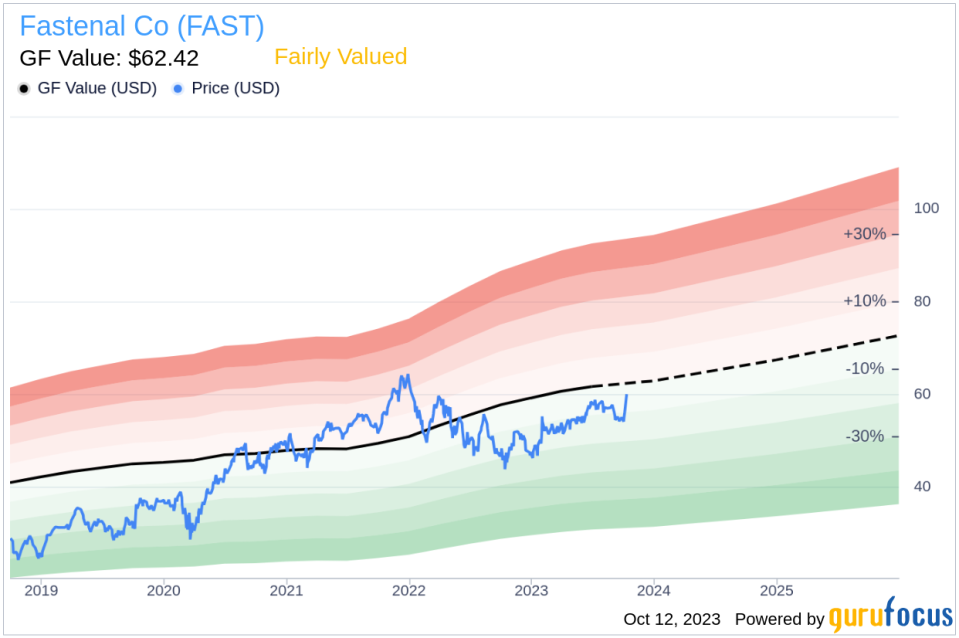

Comparing the stock price and the GF Value, an estimation of fair value, provides a snapshot of the company's value. This approach allows for a deeper exploration of the company's value, integrating financial assessment with essential company details. Here is the income breakdown of Fastenal Co:

Understanding the GF Value

The GF Value represents the current intrinsic value of a stock derived from our exclusive method. The GF Value Line on our summary page provides an overview of the fair value that the stock should be traded at. It is calculated based on three factors:

Historical multiples (PE Ratio, PS Ratio, PB Ratio, and Price-to-Free-Cash-Flow) that the stock has traded at.

GuruFocus adjustment factor based on the company's past returns and growth.

Future estimates of the business performance.

As per the GF Value, Fastenal Co stock is believed to be fairly valued at its current price of $59.68 per share. This valuation is based on historical multiples, an internal adjustment based on the company's past business growth, and analyst estimates of future business performance. If the share price is significantly above the GF Value Line, the stock may be overvalued with poor future returns. Conversely, if the share price is significantly below the GF Value calculation, the stock may be undervalued with higher future returns.

Because Fastenal Co is fairly valued, the long-term return of its stock is likely to be close to the rate of its business growth.

Link: These companies may deliver higher future returns at reduced risk.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.