Fastenal Co (FAST) Reports Solid Growth Amidst Economic Headwinds

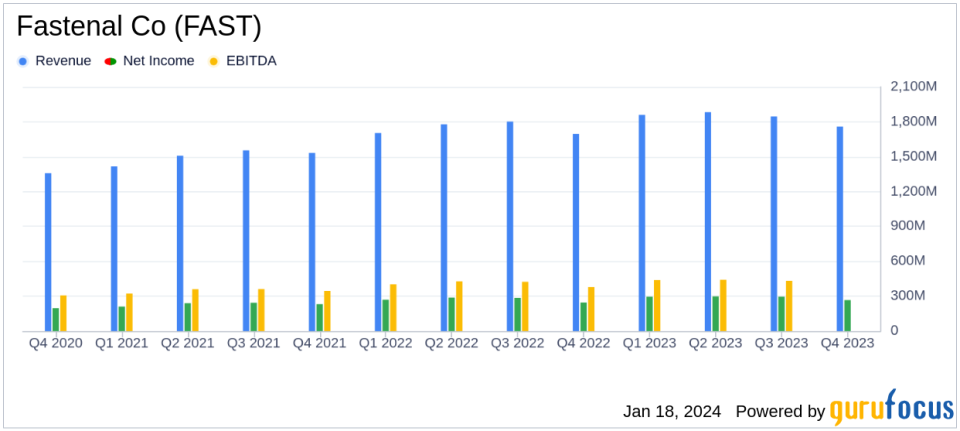

Net Sales: Increased by 5.2% annually to $7.34 billion and 3.7% quarterly to $1.76 billion.

Gross Profit: Improved marginally to 45.5% in Q4, reflecting positive price-cost dynamics.

Operating Income: Rose by 5.2% annually and 6.3% quarterly, showcasing operational efficiency.

Net Earnings: Grew by 6.3% to $1.15 billion annually, with an 8.5% increase in Q4.

Diluted EPS: Increased by 6.7% annually to $2.02 and 8.4% quarterly to $0.46.

Operating Cash Flow: Demonstrated a strong 52.3% annual increase, signifying robust cash generation.

On January 18, 2024, Fastenal Co (NASDAQ:FAST), a leading name in the industrial and construction supplies sector, disclosed its financial outcomes for the year and final quarter of 2023 through its 8-K filing. The company, which began as a fastener store in 1967, has since expanded its offerings and now operates through a vast network of branches, on-site locations, and distribution centers, providing a range of products and supply-chain solutions.

Financial Performance and Strategic Growth

Fastenal's performance in 2023 was marked by resilience in the face of economic challenges. The company's net sales saw a 5.2% increase to $7.34 billion for the year, with a 3.7% rise in the fourth quarter to $1.76 billion. This growth was driven by higher unit sales, particularly from new Onsite locations and large customers. The daily sales rate (DSR) also reflected positive trends, with a 5.7% annual and 3.7% quarterly increase.

Despite a modest impact from product pricing, Fastenal managed to enhance its gross profit margin to 45.5% in the fourth quarter, up from 45.3% in the same period of the previous year. This improvement was attributed to better product margins in fasteners and safety supplies, as well as a favorable price-cost relationship.

Operational Efficiency and Cash Flow Strength

Operating income for the year matched the net sales growth rate at 5.2%, indicating consistent operational efficiency. The fourth quarter saw an even more robust 6.3% increase in operating income, with the operating margin improving to 20.1% from 19.6% year-over-year. Operating and administrative expenses were well-managed, improving to 25.3% of net sales in Q4 from 25.7% in the prior year's quarter.

Fastenal's cash flow generation was particularly strong, with operating cash flow in 2023 surging by 52.3% from the previous year, representing 124.0% of the period's net earnings. This was a significant improvement from 86.6% in 2022, reflecting the normalization of global supply chains and slower business activity, which reduced the need for working capital expansion.

Investments and Shareholder Returns

The company's investment in property and equipment was prudent, totaling $160.6 million for the year, aligning with the previous year's investment and below the anticipated range. Fastenal returned $1.02 billion to shareholders in 2023 through dividends, including a special dividend reflecting strong cash balances and a positive outlook for future cash generation.

Fastenal's balance sheet remained robust, with a decrease in total debt to 7.2% of total capital at the end of 2023, down from 14.9% at the end of 2022. This financial prudence positions the company well for future growth and investment.

Looking Ahead

Fastenal's strategic initiatives, such as the expansion of Onsite locations and investments in Fulfillment Management Innovation (FMI) technology, are expected to continue driving growth. The company's digital footprint, which represents sales through FMI and eCommerce, accounted for 58.1% of sales in Q4, up from 52.6% in the same quarter of the previous year, underscoring the increasing importance of digital capabilities in the company's growth strategy.

The company's outlook remains focused on expanding its Onsite and FMI offerings, with goals set for new signings and device installations in 2024. Fastenal's commitment to operational excellence, strategic expansion, and digital transformation suggests a continued trajectory of growth and shareholder value creation in the face of economic headwinds.

Fastenal will host a conference call to discuss the quarterly and annual results, providing further insights into its operations and future plans. Interested parties can access the webcast on the Fastenal Company Investor Relations website.

For detailed financial tables and additional monthly and quarterly information, investors and analysts are encouraged to visit the 'Investor Relations' page of Fastenal's website.

Explore the complete 8-K earnings release (here) from Fastenal Co for further details.

This article first appeared on GuruFocus.