Favourable Signals For Rubicon Organics: Numerous Insiders Acquired Stock

Usually, when one insider buys stock, it might not be a monumental event. But when multiple insiders are buying like they did in the case of Rubicon Organics Inc. (CVE:ROMJ), that sends out a positive message to the company's shareholders.

Although we don't think shareholders should simply follow insider transactions, we do think it is perfectly logical to keep tabs on what insiders are doing.

Check out our latest analysis for Rubicon Organics

The Last 12 Months Of Insider Transactions At Rubicon Organics

Over the last year, we can see that the biggest insider purchase was by insider Eric Savics for CA$210k worth of shares, at about CA$0.70 per share. That means that an insider was happy to buy shares at above the current price of CA$0.52. Their view may have changed since then, but at least it shows they felt optimistic at the time. To us, it's very important to consider the price insiders pay for shares. It is generally more encouraging if they paid above the current price, as it suggests they saw value, even at higher levels.

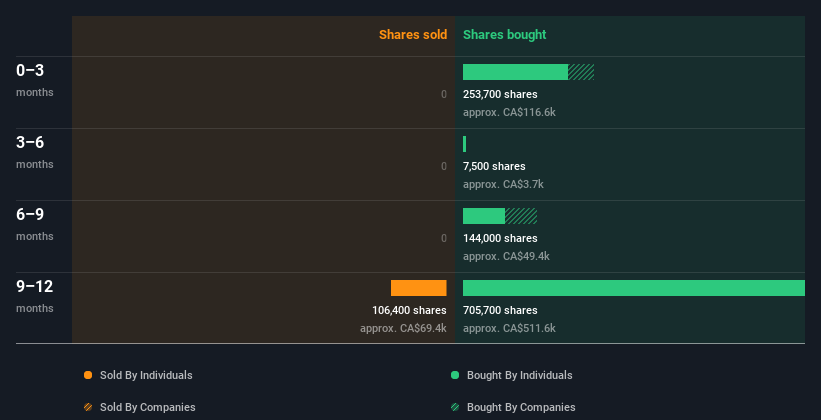

Over the last year, we can see that insiders have bought 997.40k shares worth CA$621k. On the other hand they divested 106.40k shares, for CA$72k. In total, Rubicon Organics insiders bought more than they sold over the last year. They paid about CA$0.62 on average. These transactions suggest that insiders have considered the current price attractive. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

Rubicon Organics is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Rubicon Organics Insiders Bought Stock Recently

Over the last three months, we've seen significant insider buying at Rubicon Organics. Independent Director John Pigott spent CA$93k on stock, and there wasn't any selling. This is a positive in our book as it implies some confidence.

Does Rubicon Organics Boast High Insider Ownership?

Many investors like to check how much of a company is owned by insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Rubicon Organics insiders own 44% of the company, currently worth about CA$13m based on the recent share price. I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

So What Do The Rubicon Organics Insider Transactions Indicate?

It is good to see the recent insider purchase. We also take confidence from the longer term picture of insider transactions. However, we note that the company didn't make a profit over the last twelve months, which makes us cautious. Once you factor in the high insider ownership, it certainly seems like insiders are positive about Rubicon Organics. Nice! In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Rubicon Organics. For example - Rubicon Organics has 2 warning signs we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.