FDA Expands AbbVie's (ABBV) Qulipta Label in Chronic Migraine

AbbVie ABBV announced that the FDA has approved the label expansion of its migraine drug Qulipta (atogepant) at 60mg dose to include the prevention of chronic migraine in adults.

Following the approval, Qulipta is now the first and only oral calcitonin gene-related peptide (CGRP) receptor antagonist approved to prevent migraine across frequencies, including episodic and chronic migraines.

Qulipta was initially approved by the FDA in 2021 for the preventive treatment of episodic migraine in adults at three different dose levels — 10 mg, 30 mg and 60 mg.

People living with episodic migraine get fewer than 15 headaches in a month while those with chronic migraine experience headaches for at least 15 days a month.

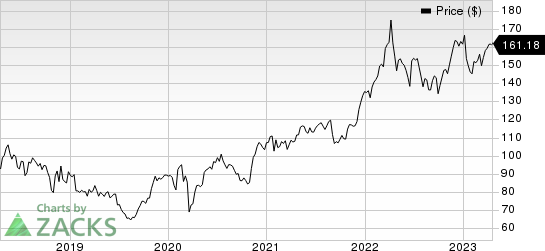

In the year so far, shares of AbbVie have dropped 0.3% against the industry‘s 2.5% rise.

Image Source: Zacks Investment Research

The label-expansion approval is based on the data from the phase III PROGRESS study, which evaluated a 60mg dose of Qulipta in adult patients with chronic migraine. The study met its primary endpoint of Qulipta achieving a statistically significant reduction in mean monthly migraine days from baseline compared with a placebo over a 12-week treatment period.

Data from the PROGRESS study also showed that treatment with Qulipta also achieved all of its six secondary endpoints, including a minimum of 50% reduction in mean monthly migraine days and improvements in function and reduction in activity impairment.

Apart from Qulipta, AbbVie already has two other drugs — Botox (onabotulinumtoxinA) and Ubrelvy (ubrogepant) — approved by the FDA to treat migraine in adults. Botox is approved in the United States for the preventive treatment of chronic migraine while Ubrelvy is approved for the acute treatment of migraine attacks with or without aura. Per management, AbbVie is the only company that has three drugs designed to meet patient needs across the full spectrum of migraine.

AbbVie faces stiff competition from Pfizer PFE, which has two approved CGRP drugs in the migraine-treatment space. Last October, Pfizer acquired Biohaven’s oral CGRP business, following which it acquired Nurtec ODT (rimegepant), an FDA-approved drug for acute treatment of migraine with or without aura in adults and preventive treatment of episodic migraine. Last month, the FDA approved Pfizer’s nasal spray Zavzpret (zavegepant) for acute treatment of migraine with or without aura in adults.

In a separate press release, AbbVie also announced that its blockbuster inflammatory drug Rinvoq (upadacitinib) has received label expansion approval in the European Union for a seventh indication — Crohn’s disease. The drug is already for six indications, including rheumatoid arthritis, psoriatic arthritis, non-radiographic axial spondyloarthritis, ankylosing spondylitis, atopic dermatitis and ulcerative colitis.

AbbVie Inc. Price

AbbVie Inc. price | AbbVie Inc. Quote

Zacks Rank & Stocks to Consider

AbbVie currently carries a Zacks Rank #3 (Hold).A couple of better-ranked stocks in the overall healthcare sector include Novo Nordisk NVO and Sanofi SNY. While Novo Nordisk sports a Zacks Rank #1 (Strong Buy), Sanofi carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Novo Nordisk’s 2023 earnings per share have increased from $4.20 to $4.52. During the same period, the earnings estimates per share for 2024 have risen from $4.90 to $5.26. Shares of Novo Nordisk are up 26.4% in the year-to-date period.

Earnings of Novo Nordisk beat estimates in three of the last four quarters while missing the mark on one occasion. On average, the company’s earnings witnessed a surprise of 3.00%. In the last reported quarter, Novo Nordisk’searnings beat estimates by 2.47%.

In the past 60 days, estimates for Sanofi’s 2023 earnings per share have increased from $4.40 to $4.41. During the same period, the earnings estimates per share for 2024 have risen from $4.86 to $4.89. Shares of Sanofi are up 15.4% in the year-to-date period.

Earnings of Sanofi beat estimates in three of the last four quarters while missing the mark on one occasion. On average, the company’s earnings witnessed a surprise of 7.68%. In the last reported quarter, Sanofi’searnings missed estimates by 3.33%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanofi (SNY) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report