FDA Rejects Amgen's (AMGN) NDA Seeking Full Nod for Lumakras

Amgen AMGN announced that the FDA issued a complete response letter (CRL) to its new drug application (NDA) seeking full approval for Lumakras (sotorasib) for adult patients with previously-treated KRAS-mutated non-small cell lung cancer (NSCLC).

Per the CRL, the FDA issued a new post-market requirement for Amgen to conduct an additional confirmatory study on Lumakras to support the drug’s full approval. This study needs to be completed by February 2028.

The accelerated approval status granted to Lumakras in 2021 remains in force, with once-daily dosing at 960 mg.

This decision is in line with the issues raised by an FDA advisory committee on the Lumakras NDA in October. The committee members voted 10-to-2, expressing skepticism on relying on the primary endpoint of progression-free survival (PFS) in Amgen's previously-conducted confirmatory study (CodeBreak 200)to assess Lumakras’ benefits.

Management has yet to disclose its next steps or plans for the drug.

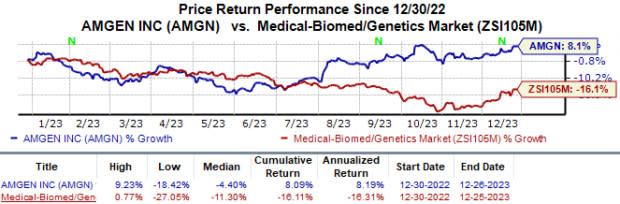

Year to date, Amgen’s shares have risen 8.1% against the industry’s 16.1% decline.

Image Source: Zacks Investment Research

Following the accelerated approval, Lumakras became the first and only targeted treatment for the KRAS G12C-mutated NSCLC, which is the most common KRAS mutation in NSCLC patients. Per management, around 13% of patients with non-squamous NSCLC harbor the KRAS G12C mutation.

Apart from NSCLC, Amgen is also evaluating the drug in clinical studies as a potential treatment for KRAS G12C-mutated colorectal cancer (CRC). In October, Amgen reported data from a phase III study which showed that treatment with Lumakras, combined with Vectibix, demonstrated a statistically significant superiority in PFS over the investigator's choice of therapy in patients with chemorefractory KRAS G12C-mutated metastatic CRC.

This news is likely to benefit rival Mirati Therapeutics MRTX, which received FDA approval in December 2022 for Krazati, a drug comparable to Lumakras, which also targets the same patient population. Currently, the only approved product in MRTX’s portfolio, Krazati, sales are driving its top line. In the first nine months of 2023, Mirati recorded around $36 million from Krazati sales, which is encouraging for a newly approved drug. Mirati is also evaluating Krazati in CRC indication.

The KRAS G12C space is also being eyed by pharma giant Bristol Myers BMY, which recently made a buyout offer for Mirati Therapeutics. Bristol Myers is in a transition mode as it shifts its mature product portfolio, which is facing generic competition due to new drugs. Bristol Myers has been involved in an acquisition spree as it made similar offers this month to acquire neuroscience drugmaker Karuna Therapeutics and radiopharmaceutical therapeutics (RPT) company RayzeBio.

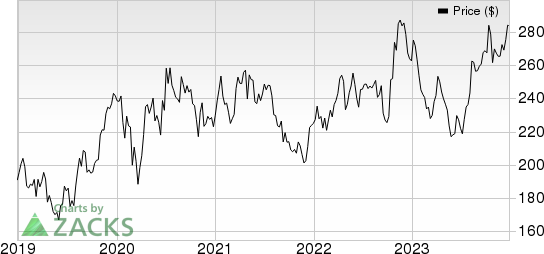

Amgen Inc. Price

Amgen Inc. price | Amgen Inc. Quote

Zacks Rank & A Key Pick

Amgen currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the overall healthcare sector is Galapagos GLPG, which sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, Galapagos’ estimates for 2023 have improved from a loss of $1.96 per share to 79 cents. During the same period, loss estimates per share for 2024 have narrowed from $3.22 to $1.68. Galapagos’ shares have lost 9.6% in the year-to-date period.

Galapagos’ earnings beat estimates in three of the last four quarters while missing the estimates on one occasion. On average, the company witnessed an average surprise of 91.97%. In the last reported quarter, Galapagos’ earnings beat estimates by 140.78%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Amgen Inc. (AMGN) : Free Stock Analysis Report

Mirati Therapeutics, Inc. (MRTX) : Free Stock Analysis Report

Galapagos NV (GLPG) : Free Stock Analysis Report