Top 3 US Dividend Stocks for February 2024

In the array of investment options, dividend stocks are the threads that weave together growth potential with a comforting stream of income. They stand as beacons of stability in the often-turbulent seas of the stock market, offering investors a dual delight of regular payouts and the prospect for share price appreciation. As we explore the financial landscape this February 2024, let's unwrap a trio of solid dividend stocks in the US that could grow your portfolio's income.

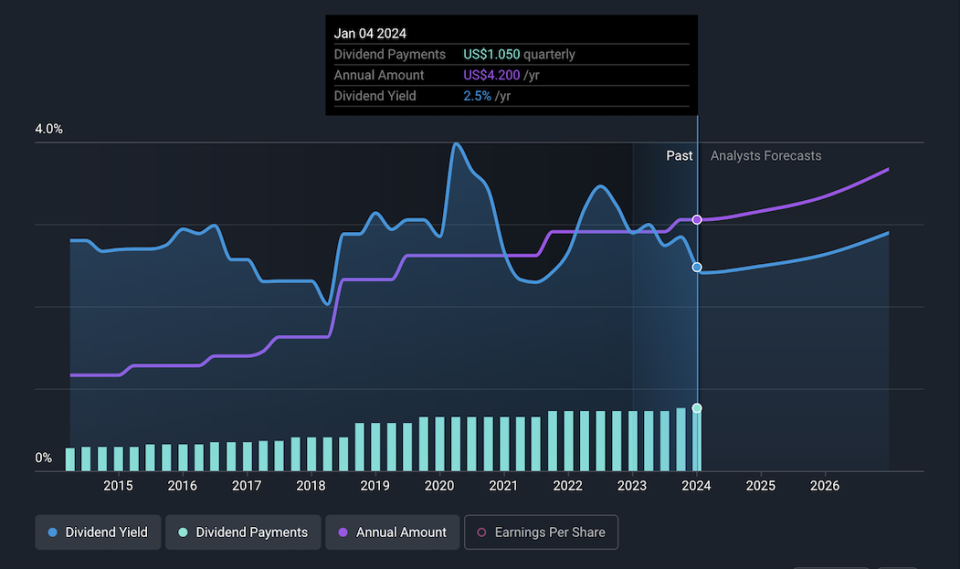

JPMorgan Chase (NYSE:JPM)

JPMorgan Chase stands as a global behemoth in financial services, with operations spanning Consumer & Community Banking, Corporate & Investment Bank, Commercial Banking, and Asset & Wealth Management. Its diverse offerings include everything from personal banking to complex investment solutions for institutional clients. With a market cap hovering around $507 billion and revenue streams led by its Consumer & Community Banking segment at approximately $63 billion, the company's financial footprint is substantial.

Analysis of JPMorgan Chase reveals a firm with robust risk management; its allowance for bad loans is more than adequate at 324%, and non-performing loans are kept low at 0.5%. The company has demonstrated consistent profit growth over the past five years and an improved net profit margin year-over-year. Importantly for dividend seekers, JPMorgan has maintained a sustainable payout ratio around 25%, indicating that dividends are well-covered by earnings—a trend expected to continue in the near term. However, it's worth noting that while dividends have shown stability and reliability over the past decade, their yield isn't among the highest compared to other top dividend payers in the US market. Additionally, forecasts suggest slower revenue growth ahead and potential declines in earnings over the next three years—factors that could influence future dividend dynamics. Access our complete analysis report to understand the dynamics of JPMorgan Chase.

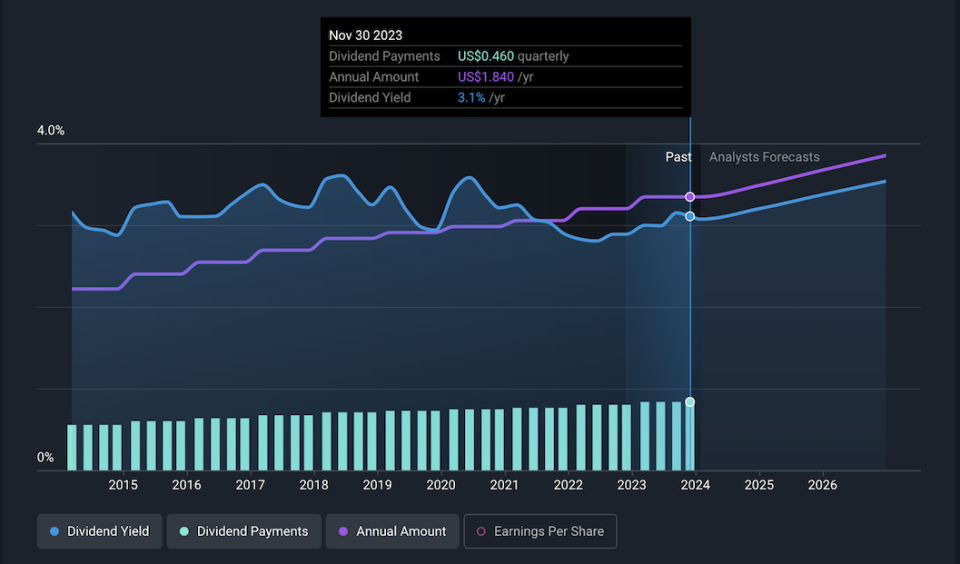

Coca-Cola (NYSE:KO)

Coca-Cola stands as a global behemoth in the nonalcoholic beverage industry, offering an array of products from sparkling drinks to plant-based beverages. Its operations span across a network of independent bottlers and distributors, with significant revenue generated from its flagship sodas and diversified drink portfolio. Delving into Coca-Cola's dividend stock profile, we observe a company that's not at the pinnacle among US dividend payers but nonetheless showcases merits for consideration. Over the past five years, Coca-Cola has trimmed its debt-to-equity ratio significantly and sustained earnings growth, albeit at a pace below its own historical average. The firm's profit margins have improved modestly year over year, indicating efficiency gains.

Coca-Cola’s dividends are well-supported by both earnings and cash flow—crucial indicators of sustainability—with a history of reliability over the last decade. However, it’s worth noting that while dividends have been growing consistently, their yield doesn't compete with the top quartile in the US market. Additionally, while debt levels are high relative to equity, they are comfortably serviced by operating cash flow and interest payments are well covered by profits—a reassuring sign for investors focused on stability rather than aggressive growth. In summary, Coca-Cola presents itself as a steady ship with modest growth forecasts; it may not dazzle among dividend stocks but offers dependability in shareholder returns amidst shifting market tides. Unlock comprehensive insights into our analysis of Coca-Cola stock.

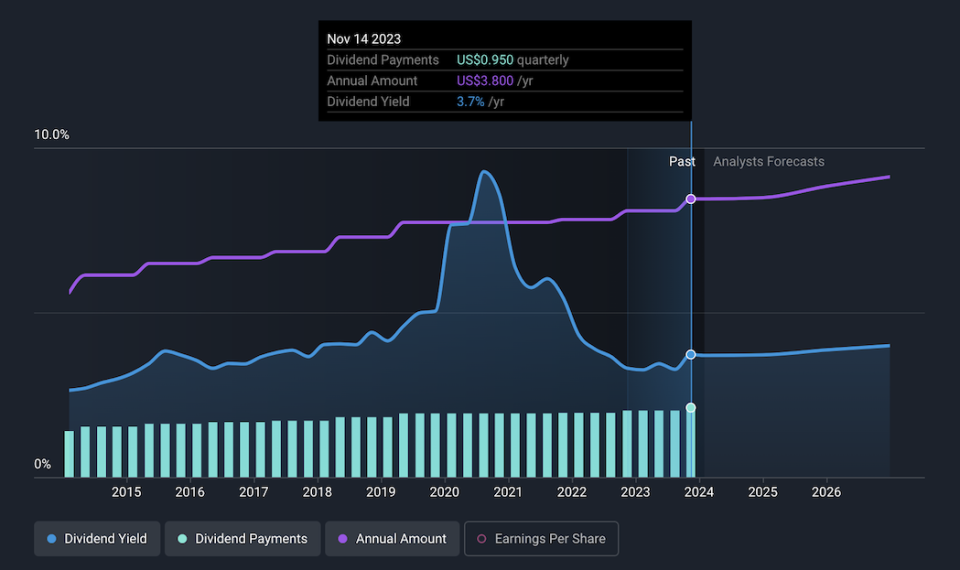

Exxon Mobil (NYSE:XOM)

Exxon Mobil, a titan in the oil and gas industry since 1870, casts a wide net with operations spanning from crude oil and natural gas exploration to the production of specialty chemicals and performance products. Its financial backbone is supported by robust segments like Energy Products in both the US and international markets, which contribute significantly to its revenue stream. In analyzing Exxon Mobil as a dividend stock, we find a mixed bag; while it's not leading the pack in terms of yield among US companies, there are bright spots. The company has managed to reduce its debt-to-equity ratio modestly over five years and maintains satisfactory debt levels backed by strong operating cash flow—over 150% coverage—which speaks well for financial health. Earnings have seen notable growth annually over half a decade but have recently hit a snag with negative growth this past year.

Dividend sustainability appears solid with low payout ratios ensuring that dividends are comfortably covered by earnings and cash flows alike. Despite dividends growing over the past decade, their yield remains shy of top-tier status when compared against peers. Looking ahead though, projections suggest both earnings and revenue may face headwinds with expected declines on the horizon. Nonetheless, interest payments on debt are exceedingly well-covered by profits—a reassuring detail for those prioritizing income stability from their investments. Explore a detailed breakdown of our findings on Exxon Mobil.

Taking Advantage

Embarking on the quest for robust dividend stocks can be as exciting as it is rewarding, especially when you have a trusty compass to guide you through the financial wilderness. Simply Wall Street's Screener has been our compass in this exploration, leading us to the Top Dividend Stocks that we've showcased. While we tread carefully around promises of performance, this tool offers a clear path to a range of possibilities. Ready to chart your own course? Click here to access our Top Dividend Stocks screeener see where it takes your portfolio!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com