Fed Chair Powell says ‘No,’ President Trump cannot fire him

It was a busy weekend for Federal Reserve Chairman Jerome Powell, who spoke on Friday night in California and then on Sunday night on CBS’s 60 Minutes.

Powell did not offer anything new on the central bank’s rate hike path going forward, insisting in both appearances that the Fed will remain “patient” as it assesses the U.S. economy and monitors issues abroad. On the balance sheet, Powell said on Friday he could see the Fed unwindings its assets to a level consistent with projections for the fourth-quarter of 2019.

But Powell made some news regarding the Fed’s independence. He also offered the most detail to-date on the Fed’s efforts to revise its communication and policy frameworks - hinting that the famous dot plot’s days may be numbered.

Powell’s commentary comes just ahead of the Fed’s “blackout” period, the stretch of time just before the Federal Open Market Committee meeting where Fed speakers are barred from making public remarks. The next FOMC meeting will be March 19-20.

Powell says ‘no’ the president cannot fire him

It’s no secret that President Donald Trump hasn’t been pleased with Powell. The president has criticized the Fed on Twitter and suggested that the economy would be in even better shape if the central bank hadn’t raised rates.

“I think the Fed has gone crazy,” Trump said on another occasion.

In the 60 Minutes interview, Powell attempted to dodge a question about the president’s open criticism of the Fed, saying he didn’t think “it would be appropriate for me to comment on other elected officials or on the president.”

But asked if the president has the authority to fire him, Powell said, “the law is clear that I have a four-year term.”

“So, no in your view?” CBS’s Scott Pelley responded.

Powell’s answer: “No.”

The Federal Reserve Act clarifies that the president can only remove a chairman “for cause,” but because no White House has ever tried to remove a Fed chair, it is unclear what types of activities would warrant removal.

Earlier in the year, Powell said he would not resign from his post if Trump asked him to do so.

To be fair, Trump has eased up on the Fed now that the central bank is on pause on interest rate hikes, which Powell maintains is not because of political pressure but because of muted inflationary pressures and geopolitical concerns abroad. Still, their relationship is still complicated; even though Powell had dinner with the president in early February, Trump again lashed out at the Fed in early March for “taking money out of the market” through its balance sheet unwind process.

Dot plots no more?

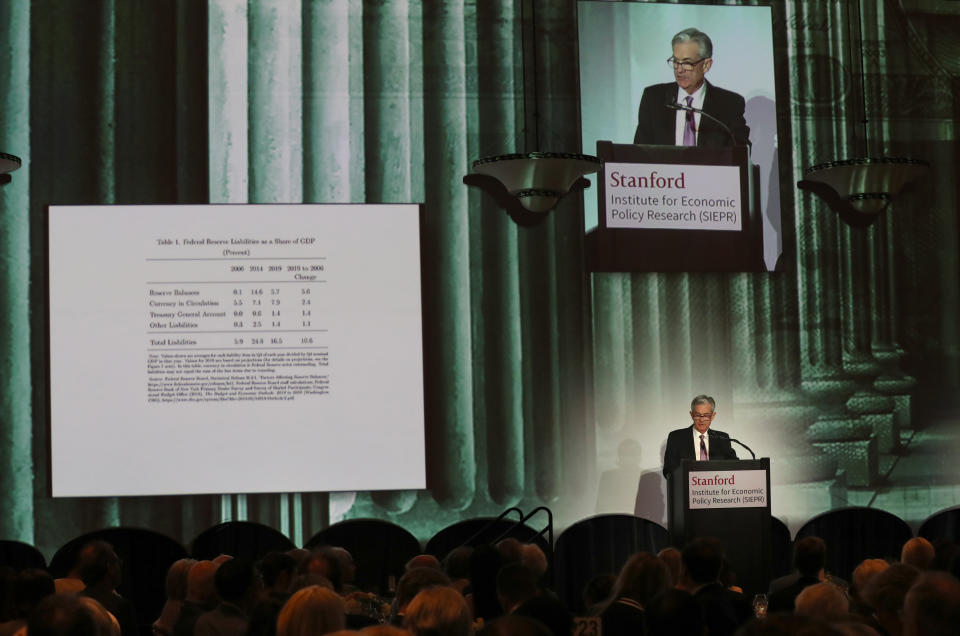

Powell’s speech on Friday at Stanford University focused on the Fed’s ongoing review of its communication practices and policy strategies.

As part of its review, the Fed is willing to reconsider the way it publicly messages policy on rates in addition to the way it approaches its 2% inflation target.

Powell specifically discussed the “dot plot,” the visual representation of the Federal Open Market Committee’s future projections for the federal funds rate. The policy was implemented to give market participants a loose understanding of the Fed’s gradual rate hike path, but Powell said the dot plot ended up as a “source of confusion” at times.

Powell likened the dot plots to a Georges Seurat painting, saying that paying too much attention to the dots themselves may risk “miss[ing] the larger picture.” He elaborated that as the Fed gets to the point where the Fed no longer needs to promise rate hikes nor rate cuts - known as the “neutral rate” of the economy - the Fed should seriously question the use of the dot plots.

“If the Committee remains largely out of the business of explicit forward guidance, we will need to find other ways to address the collateral confusion that sometimes surrounds the dots,” Powell said. He said the current federal funds rate - in a target range of 2.25% to 2.5% - is “now within the broad range of estimates for the neutral rate.”

On inflation, acknowledged that the Fed faces “low-inflation syndrome” as the central bank continues to undershoot its 2% target. Powell said the Fed is considering “makeup strategies” that could compensate for the spell of tepid inflation.

The review will also ask if the Fed needs expanded monetary policy tools.

Powell said all of these questions need to be answered ahead of a possible slowdown or recession which could push the Fed back to the zero lower bound again.“We owe it to the public to find out now, during good times when were not at the zero lower bound, what we would do in that situation because it’s much more likely to arise,” Powell said.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Read more:

The bull market is almost 10 – here are some facts and figures

NY Fed's Williams on the outlook for monetary policy: 'It depends'

Larry Summers: Modern Monetary Theory is 'grotesque'

The Fed may be suffering from a 'credibility' issue with its inflation target

Congress may have accidentally freed nearly all banks from the Volcker Rule