Federal Agricultural Mortgage Corp (AGM.A) Announces Record Earnings and Dividend Increase for 2023

Net Interest Income: Grew by 21% year-over-year to $327.5 million.

Net Effective Spread: Increased 28% from the prior year to a record $327.0 million.

Net Income: Attributable to common stockholders rose to $172.8 million from $151.0 million.

Core Earnings: Reached a record $171.2 million, a 38% growth year-over-year.

Dividend Increase: Quarterly common stock dividend raised by 27% to $1.40 per share.

Capital Position: Total core capital of $1.5 billion with a Tier 1 Capital Ratio of 15%.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

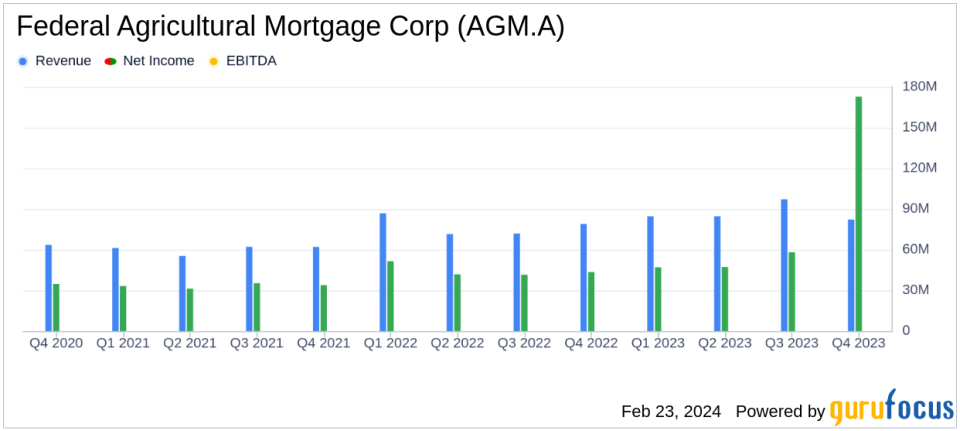

On February 23, 2024, Federal Agricultural Mortgage Corp (NYSE:AGM.A) released its 8-K filing, revealing a year of significant financial growth and strategic achievements. The company, a key player in the U.S. secondary agricultural mortgage market, reported a substantial increase in net interest income and net effective spread, leading to a notable rise in net income attributable to common stockholders.

Federal Agricultural Mortgage Corp operates across various segments, including Farm & Ranch, Corporate AgFinance, and Renewable Energy, among others. It specializes in purchasing eligible mortgage loans secured by first liens on agricultural real estate and rural housing, contributing to the financing accessibility for American agriculture and rural infrastructure.

Financial Highlights and Performance Metrics

The company's performance in 2023 was marked by a 21% year-over-year growth in net interest income, which amounted to $327.5 million. The net effective spread, a non-GAAP measure, saw an even more impressive increase of 28% from the previous year, reaching a record $327.0 million. This metric is crucial as it reflects the net spread earned between interest-earning assets and the related net funding costs, excluding certain items from net interest income and including others that net interest income does not contain.

Net income attributable to common stockholders was $172.8 million, up from $151.0 million in the same period last year, while core earnings, another non-GAAP measure, surged to $171.2 million, or $15.65 per diluted common share, reflecting a 38% growth year-over-year. The robust core earnings, which exclude the effects of fair value fluctuations and specified infrequent or unusual transactions, underscore the company's strong operational performance and financial health.

Brad Nordholm, President and CEO, commented on the results:

"In 2023, Farmer Mac recorded another year of remarkable success, marked by double-digit earnings growth, record net effective spread, and outstanding business volume. This achievement builds on our consistent performance over the past several years, with a dedication to strategic initiatives and organizational alignment."

The company's total core capital stood at $1.5 billion with a Tier 1 Capital Ratio of 15% as of December 31, 2023. In a move reflecting confidence in its earnings potential and capital position, the Board of Directors raised the quarterly common stock dividend by 27% to $1.40 per share, marking the thirteenth consecutive annual increase.

Balance Sheet and Income Statement Insights

The balance sheet showed a healthy increase in total assets, from $27.3 billion in the previous year to $29.5 billion. The company's investment in securities and loans held for investment also saw an uptick, contributing to the overall asset growth. On the liabilities side, notes payable were the largest component, amounting to $26.3 billion.

The income statement revealed a solid performance with total interest income for the year ending December 31, 2023, at $1.39 billion, and a net interest income after release of/(provision for) losses at $326.7 million. The company also reported a net income of $200.0 million for the year, with preferred stock dividends subtracted, resulting in a net income attributable to common stockholders of $172.8 million.

The detailed financial tables and metrics, along with management's commentary, provide a comprehensive view of Federal Agricultural Mortgage Corp's financial position and outlook. The company's strategic initiatives and disciplined execution of its business model have positioned it for continued success in the agricultural finance sector.

For more in-depth analysis and the full earnings report, visit Federal Agricultural Mortgage Corp's investor relations page or access the complete 8-K filing.

Explore the complete 8-K earnings release (here) from Federal Agricultural Mortgage Corp for further details.

This article first appeared on GuruFocus.