Federal Realty (FRT) Beats Q2 FFO, Raises '23 View & Dividend

Federal Realty Investment Trust’s FRT second-quarter 2023 funds from operations (FFO) per share of $1.67 surpassed the Zacks Consensus Estimate of $1.62. This also marked a rise of 1.2% from the year-ago quarter’s tally of $1.65.

Results reflect healthy leasing activity and occupancy levels at its properties. FRT shares were up 1.75% in the after-hours trading session on the NYSE yesterday.

While quarterly revenues of $280.7 million improved 6.3% from the year-ago quarter’s tally, the same exceeded the Zacks Consensus Estimate of $277 million. Federal Realty generated 4.6% comparable property operating income growth, excluding lease termination fees and COVID-19 pandemic-related prior-period rents collected for the second quarter. FRT has also increased its guidance for 2023 FFO per share and hiked its dividend.

Per Donald C. Wood, Federal Realty's chief executive officer, "Continued robust leasing activity demonstrates the strength of retail demand for the high-quality product that Federal Realty offers."

Quarter in Detail

On the leasing aspect, during the reported quarter, Federal Realty signed 112 leases for 602,911 square feet of retail space. On a comparable space basis, the company signed 107 leases for 576,345 square feet of space at an average rent of $35.34 per square foot. This denotes cash-basis rollover growth of 7% and 19% on a straight-line basis. It marks the highest second-quarter comparable leasing volume on record.

On the operational front, occupancy rates in the portfolio increased by 80 basis points (bps) year over year to 92.8% as of Jun 30, 2023. Leased rates also increased by 20 bps year over year to 94.3% as of the same date. Our estimate for the same was also 94.3%. Moreover, FRT’s comparable residential properties were 98% leased as of the same date.

Federal Realty exited the second quarter of 2023 with cash and cash equivalents of $98.06 million, up from the $85.6 million recorded at the end of 2022.

Guidance

For 2023, Federal Realty increased its guidance for FFO per share in the range of $6.46-$6.58 from the $6.38-$6.58 range guided earlier. The Zacks Consensus Estimate of $6.50 also lies within this range.

Dividend

Concurrent with the second-quarter earnings release, Federal Realty announced a regular quarterly cash dividend of $1.09 per share, up from the prior payment of $1.08 per share. This indicates an annual rate of $4.36 per share.

This hike marks the 56th consecutive year that FRT has increased its common dividend, which represents the longest record of consecutive annual dividend increases in the REIT sector, per the company. The dividend will be paid out on Oct 16 to shareholders of record as of Sep 22, 2023.

Federal Realty currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

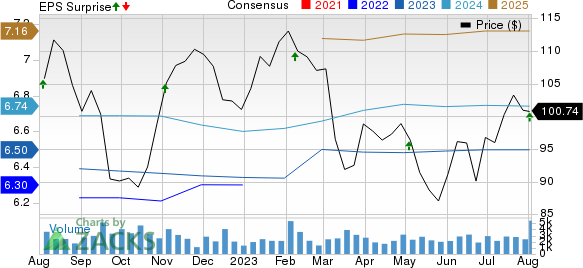

Federal Realty Investment Trust Price, Consensus and EPS Surprise

Federal Realty Investment Trust price-consensus-eps-surprise-chart | Federal Realty Investment Trust Quote

Conclusion

Federal Realty's decent second-quarter 2023 performance demonstrates the company's ability to adapt to the evolving needs of consumers and retailers, particularly in the affluent first-ring suburbs of major metropolitan areas where it operates. With its strong leasing volume, growing property operating income and improving occupancy rates, FRT is well-positioned to continue its success throughout 2023. Investors should closely monitor Federal Realty as the company maintains its momentum, delivering solid financial results.

Performance of Other Retail REITs

Simon Property Group’s SPG second-quarter 2023 FFO per share of $2.88 missed the Zacks Consensus Estimate of $2.91. Also, the figure declined 1% year over year.

Results reflected better-than-anticipated revenues on healthy leasing activity and a rise in the base rent per square foot and occupancy levels. However, higher operating expenses and interest expenses acted as dampeners. Nevertheless, this retail behemoth raised its 2023 FFO per share outlook and quarterly dividend.

Kimco Realty Corp. KIM reported a second-quarter 2023 FFO per share of 39 cents, in line with the Zacks Consensus Estimate. The figure was only a cent lower than the year-ago quarter’s tally.

KIM’s results reflected better-than-anticipated revenues, aided by rental rate growth and a rise in occupancy levels. Kimco revised its 2023 FFO per share outlook.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Simon Property Group, Inc. (SPG) : Free Stock Analysis Report

Kimco Realty Corporation (KIM) : Free Stock Analysis Report

Federal Realty Investment Trust (FRT) : Free Stock Analysis Report