Federal Realty Investment Trust (FRT) Reports Mixed Results Amidst Economic Headwinds

Net Income: Year-over-year decrease to $2.80 per diluted share in 2023 from $4.71 in 2022.

FFO: Funds from operations per diluted share rose to $6.55 in 2023, up from $6.32 in 2022.

Occupancy Rates: Portfolio occupancy at 92.2% and leased at 94.2% as of Q4 2023.

Leasing Activity: Signed 426 leases for 2.1 million square feet of retail space in 2023.

Capital Management: Raised $685 million in capital and repaid $600 million senior unsecured notes at maturity.

Dividends: Declared regular quarterly cash dividend of $1.09 per common share.

2024 Guidance: Earnings per diluted share projected at $2.72 to $2.94 and FFO per diluted share at $6.65 to $6.87.

On February 12, 2024, Federal Realty Investment Trust (NYSE:FRT) released its 8-K filing, detailing the financial results for the year and quarter ended December 31, 2023. The company, a retail-focused real estate investment trust, owns high-quality properties in prime metropolitan markets, boasting a portfolio of 102 properties, including 25.8 million square feet of retail space and over 3,100 multifamily units.

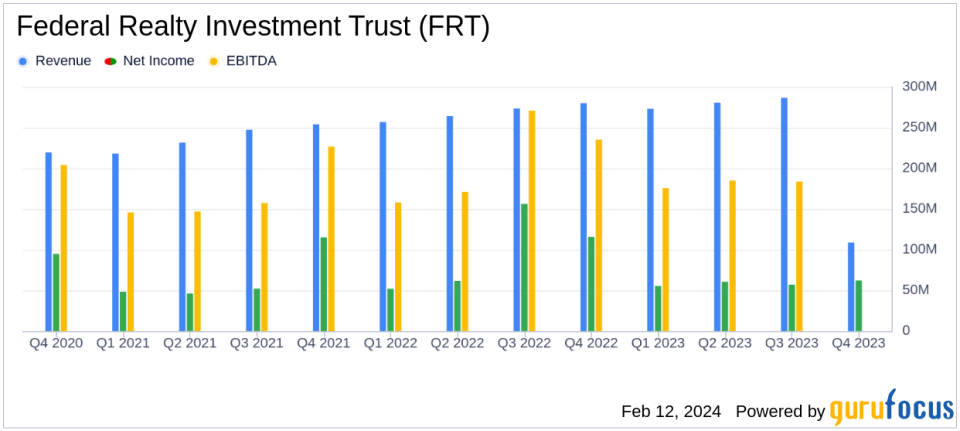

Despite a challenging economic environment characterized by elevated interest rates and potential risks such as tenant bankruptcies and natural disasters, Federal Realty reported a net income available for common shareholders of $229.0 million, or $2.80 per diluted share for the full year 2023. This represents a decrease from the $377.5 million, or $4.71 per diluted share, reported for the full year 2022. The decrease in net income year-over-year is partly attributed to the absence of significant one-time gains from transaction activity that were present in the previous year.

Financial Performance and Strategic Initiatives

Despite the dip in net income, Federal Realty's funds from operations (FFO) per diluted share reached an all-time high of $6.55 in 2023, up from $6.32 in 2022. The Trust's CEO, Donald C. Wood, attributed this growth to the company's multi-faceted business plan, which includes growth in the comparable pool, contributions from redevelopment and expansion programs, and accretive acquisition activity.

In 2023, Federals FFO per diluted share reached an all-time high, showcasing the Company's resilience in the face of elevated interest rates," said Donald C. Wood, Federal Realtys Chief Executive Officer. "Our multi-faceted business plan drove FFO growth, marked by continued growth in our comparable pool, contributions from our redevelopment and expansion program and accretive acquisition activity. We believe that Federal's high-quality open-air shopping centers and mixed-use communities located in the first-tier suburbs of major metropolitan markets remain the real-estate of choice for todays top-tier tenants. We head into 2024 energized and optimistic, poised for another exceptional year ahead."

The Trust's portfolio was 92.2% occupied and 94.2% leased at the end of the fourth quarter, with strong leasing activity throughout the year. Federal Realty signed 426 leases for 2,091,071 square feet of retail space in 2023, with a cash basis rollover growth of 10% on comparable spaces.

Strategically, Federal Realty has been active in capital management. The Trust raised $685.0 million in two separate financings and repaid $600.0 million in senior unsecured notes at maturity. Additionally, the Board of Trustees declared a regular quarterly cash dividend of $1.09 per common share, underscoring the Trust's commitment to delivering shareholder value.

Looking Ahead: 2024 Guidance

Looking forward to 2024, Federal Realty has introduced earnings guidance with an estimated earnings per diluted share of $2.72 to $2.94 and FFO per diluted share of $6.65 to $6.87. These projections are based on assumptions including comparable properties growth of 2% to 3.5% and general and administrative expenses of $48 to $52 million.

Investors and stakeholders are encouraged to review the detailed financial statements and notes, including the consolidated income statements and balance sheets, to gain a comprehensive understanding of Federal Realty's financial position and performance. The Trust's management team will further discuss the operating performance on the fourth quarter 2023 earnings conference call.

For more in-depth analysis and updates on Federal Realty Investment Trust (NYSE:FRT) and other valuable investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Federal Realty Investment Trust for further details.

This article first appeared on GuruFocus.