Jackson Hole Preview: Fed will try not to ‘trigger carnage’

This year’s central banking meeting in Jackson Hole, Wyoming appears to have tenser undertones than in previous years. Mounting worries over a U.S. recession and continued pressures from the White House are weighing on a Federal Reserve also trying to defend the U.S. economy from spillover effects of a slowdown in Europe and China.

With financial conditions and global concerns darkening the otherwise tranquil backdrop of the Grand Tetons, market participants will be gleaning Fed commentary in Wyoming for clues about what policymakers may be thinking for next steps. The worry: elevated risks of a communications mistake as a result of market sensitivity and inconsistent Fedspeak in recent months.

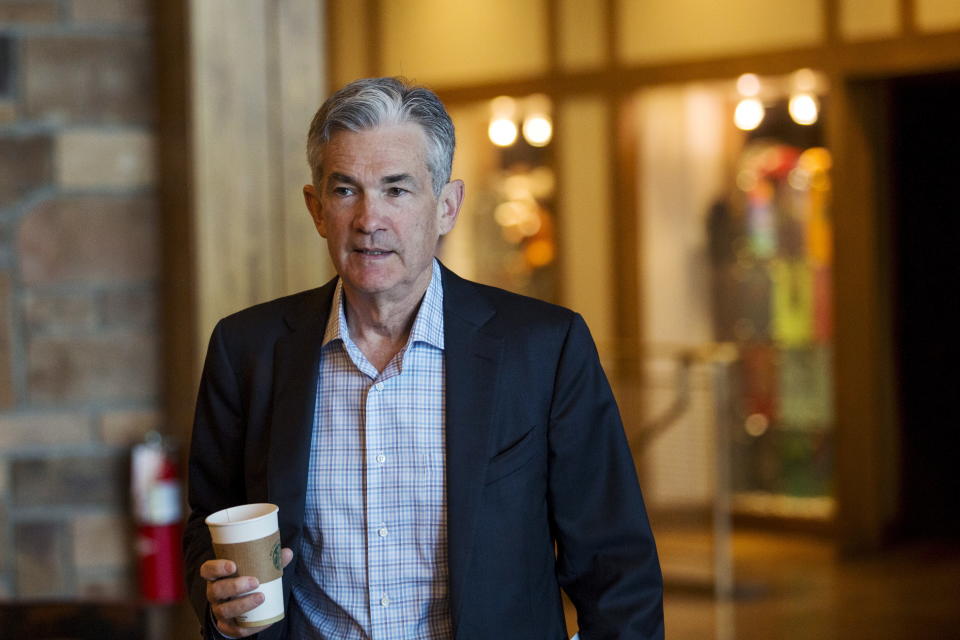

After a few weeks of limited public appearances, policymakers are slated to make public remarks at the Jackson Lake Lodge beginning Thursday. Market participants are specifically marking their calendars for Fed Chairman Jerome Powell’s speech on Friday at 10 a.m. ET, his first public remarks since cutting interest rates for the first time in over a decade.

Since that decision on July 31, a lot has happened. Earlier in the month, President Donald Trump threatened a new round of tariffs in the ongoing trade war with China. Last week, a critical part of the U.S. yield curve inverted as the yield on the 2-year U.S. Treasury blipped above the yield on the 10-year, traditionally a bellwether of a recession within eight to 24 months. The curve has since uninverted.

Capital Economics warned August 16 that commentary in Jackson Hole could “trigger carnage” in the bond and equity markets if they do not signal the additional rate cuts that markets are expecting given recent developments. At a bare minimum, the Fed may be hoping it can just avoid a major communications blunder.

“Frankly, it’s hard to know exactly what message Powell and other officials will deliver next week because Fed communication has become woefully bad,” Capital Economics’s Paul Ashworth said.

‘Challenges for monetary policy’

This year’s conference theme is, appropriately, “challenges for monetary policy.”

Markets would like Powell to address the short-term challenge of whether or not the Fed needs to counteract the possibly adverse effects of the trade war and global risks with another rate cut.

But the bigger conundrum may be wrangling with the market itself.

Based on federal funds futures contracts, markets expect a total of two or three rate cuts by the end of the year, thus projecting more easing that the Fed’s own forecast. In the Fed’s last round of “dot plot” projections released June 19, policymakers telegraphed only up to two 25-basis-point cuts by the end of the year. One of those cuts came in the July 31 Federal Open Market Committee meeting.

Although many trade-related headlines have surfaced since that dot plot print, Fed speakers have been reluctant to commit to any easing cycle, instead pointing to solid consumer data and a tight labor market at home.

That messaging has been hard to pull off. In the July press conference announcing the rate cut, Powell dizzied markets by describing the move as a “mid-cycle adjustment” before clarifying, “I didn’t say it’s just one [cut] or anything like that.”

Analysts expect Powell and other Fed speakers to acknowledge increased risks this week in Jackson Hole, although some say markets are setting themselves up for disappointment by expecting too dovish a tone for the Fed to deliver on,

“Given the gap between market rate expectations and FOMC projections, risks are for a hawkish surprise, in our view,” Credit Suisse Economics wrote August 15.

Separating papers from projections

Barclays wrote August 16 that in past years, policymakers have tried to downplay Jackson Hole’s importance by reiterating that it primarily highlights academic papers, not updates on the current economic outlook.

But last month, New York Fed President John Williams notably had markets on a swivel when he said central banks need to “move more quickly to add monetary stimulus than you otherwise might” when interest rates are near-zero. Markets interpreted his speech, just before the July FOMC, as a sign of aggressive rate cuts, and soared higher until the New York Fed issued a rare clarification noting that the speech was purely academic and “not about potential policy actions” at the next FOMC meeting.

The Jackson Hole conference risks similar gaffes as Fed officials, prominent economists, and central bankers from around the world pour over papers that could touch topics ranging from inflation targeting to central bank independence (a hot topic among pressure from President Donald Trump). The agenda has not been released publicly yet.

Outside of the paper presentations, Fed officials will be doing media interviews where they will be expected to offer some updates on the economic outlook. Yahoo Finance will be interviewing Cleveland Fed President Loretta Mester live at 11:35 a.m. ET on Friday and will feature other interviews throughout the conference.

“[M]arkets may be looking at any opening remarks as a potential platform for Fed leadership to provide a clear message regarding the path forward for rates,” TD Securities wrote in a note August 15.

For Powell and the other Fed speakers, making that message clear may be a tougher task than usual.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Bonds, yields, and why it matters when the yield curve inverts: Yahoo U

YIELD CURVE INVERTS: Recession indicator flashes red for first time

How gas stations and Facebook's Libra pushed the Fed to build a new payments system

Congress may have accidentally freed nearly all banks from the Volcker Rule

Read the latest financial and business news from Yahoo Finance