FedEx Corp (FDX) Surpasses Earnings Expectations with Strategic Cost Reductions and Share ...

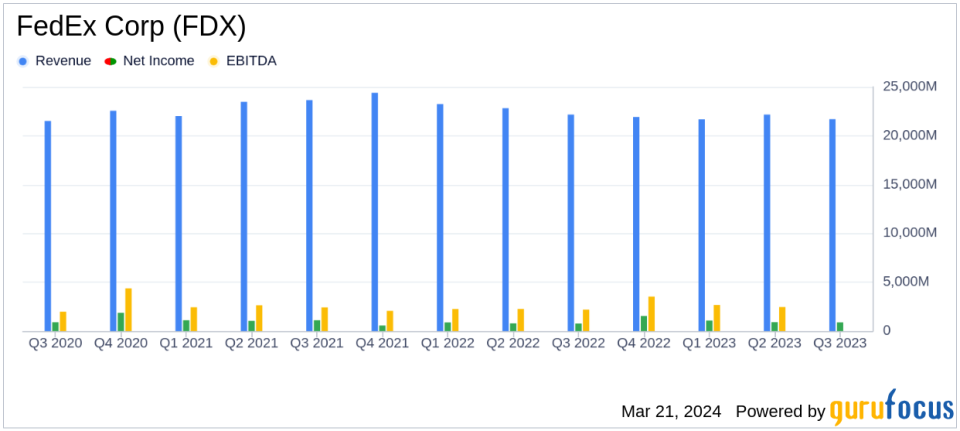

Revenue: Reported at $21.7 billion, slightly below the estimated $22.057 billion.

Net Income: Achieved $879 million, outperforming the estimated $919.1091 million.

Earnings Per Share (EPS): Delivered a strong $3.51, surpassing the estimated $3.4622.

Operating Income: Increased by 19% year-over-year to $1.24 billion.

Share Repurchase: Announced an additional $500 million buyback in Q4 and a new $5 billion repurchase program.

Capital Spending Forecast: Reduced to $5.4 billion from the prior forecast of $5.7 billion.

Outlook: Narrows full-year earnings outlook, projecting EPS between $15.65 and $16.65 before adjustments.

FedEx Corp (NYSE:FDX) released its 8-K filing on March 21, 2024, revealing a robust performance for the third quarter ended February 29, 2024. Despite a challenging demand environment, the company reported a higher diluted EPS of $3.51 and an adjusted diluted EPS of $3.86, indicating a significant improvement in profitability. This performance is particularly noteworthy as it comes at a time when FedEx, a pioneer in overnight delivery and the world's largest express package provider, faces a low-single-digit percentage decline in year-over-year revenue.

Strategic Initiatives Drive Performance

FedEx's strategic cost reduction initiatives, particularly its DRIVE program, have been central to its improved operating income, which saw a 19% increase year-over-year. The program's focus on efficiency and revenue quality has allowed FedEx to navigate a difficult demand environment successfully. Additionally, the company's share repurchase activities, including a completed $1 billion accelerated share repurchase transaction and the announcement of an additional $500 million buyback in the fourth quarter, underscore its commitment to delivering shareholder value.

Segment Performance and Future Outlook

Performance across FedEx's segments was mixed, with FedEx Express and FedEx Ground reporting improved operating results due to lower structural costs and higher base yield, while FedEx Freight faced challenges from lower fuel surcharges and reduced shipment weights. Looking ahead, FedEx has narrowed its full-year earnings outlook, reflecting confidence in its strategic direction and ongoing transformation efforts. The company expects to achieve permanent cost reductions of $1.8 billion from the DRIVE program and has adjusted its capital spending forecast to prioritize investments in efficiency and modernization.

The company's resilience and strategic adjustments in the face of fluctuating market conditions highlight its commitment to long-term growth and shareholder returns. As FedEx continues to execute on its transformation initiatives and optimize its network, investors and stakeholders have reasons to remain optimistic about its path forward.

For more detailed financial information and future updates on FedEx Corp (NYSE:FDX), please visit investors.fedex.com.

Explore the complete 8-K earnings release (here) from FedEx Corp for further details.

This article first appeared on GuruFocus.