FEMSA (FMX) Completes BradyIFS & Envoy Solutions Acquisitions

Fomento Economico Mexicano SAB de CV FMX, alias FEMSA, has completed an acquisition transaction that brings together BradyIFS and its Envoy Solutions subsidiary to create a platform within the facility care, foodservice disposables and packaging distribution industries in the United States. This merger has received the required regulatory approvals and is now finalized.

This alliance combines strengths and the complementary geographic coverages of Envoy Solutions and BradyIFS. By doing so, the newly formed entity aims to create a strong customer-focused platform capable of providing high-value solutions to its customers. It also seeks to offer its supplier partners an extended market reach, which will enable them to deliver more products and solutions across various locations in the United States.

This strategic move aligns with FMX's "FEMSA Forward" strategy. FEMSA is a significant player in the beverage and retail industries. It appears that this transaction is part of the company’s broader strategic plan to enhance its position and offerings in the market.

Image Source: Zacks Investment Research

Transaction in Detail

From this transaction, FEMSA will receive $1.7 billion in cash and retain a 37% ownership stake in the combined entity. The combined entity is expected to have pro-forma revenues of $5 billion. The valuation of Envoy Solutions in this transaction implies a double-digit annualized rate of return on the capital invested by FEMSA since entering the business in 2020.

The combined entity will be approximately 63% owned by the existing BradyIFS equity holders, including Kelso & Company and its affiliate funds, funds managed by Warburg Pincus LLC, and the current minority shareholders of Envoy Solutions.

Wrapping Up

FEMSA's focus remains on its long-range plans in retail, beverages and digital, incorporating organic growth and inorganic investments within these core areas to maximize long-term intrinsic value per share, balancing yield and growth.

However, the financial performance of FEMSA in the second quarter of 2023 was impacted by higher operating expenses, particularly due to increased labor costs associated with recent labor reforms in Mexico. This led to a reduction in operating margin in the second quarter, which contracted by 80 basis points (bps) to 8.4%.

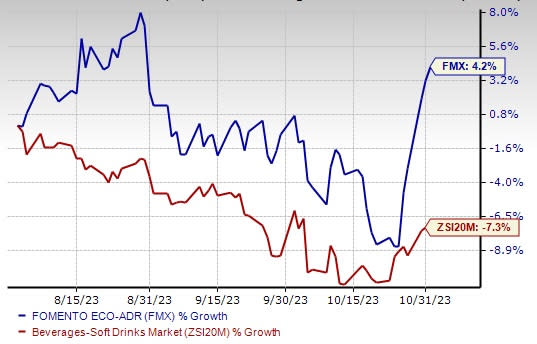

In the past three months, shares of this Zacks Rank #5 (Strongly Sell) company have rallied 4.2% against the industry’s decline of 7.3%.

Bet Your Bucks on These Hot Stocks

We have highlighted three better-ranked stocks, namely Dutch Bros Inc. BROS, PepsiCo, Inc. PEP and Constellation Brands Inc. STZ.

Dutch Bros is an operator and franchisor of drive-thru shops, which focus on serving high quality, hand-crafted beverages with unparalleled speed and superior service. The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Dutch Bros’ current financial-year sales and EPS suggests growth of 29.6% and 31.3%, respectively, from the year-ago reported figures. BROS has a trailing four-quarter earnings surprise of 44.6%, on average.

PepsiCo is involved in the manufacturing, marketing and distribution of grain-based snack foods, beverages and other products. The company currently has a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for PepsiCo’s current financial-year sales and EPS suggests growth of 6.3% and 11.1%, respectively, from the year-ago reported figures. PEP has a trailing four-quarter earnings surprise of 5.6%, on average.

Constellation Brands produces and markets beer, wine and spirits. It currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Constellation Brands’ current fiscal-year sales and EPS suggests growth of 6.7% and 11.5%, respectively, from the year-ago reported figures. STZ has a trailing four-quarter earnings surprise of 4.3%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fomento Economico Mexicano S.A.B. de C.V. (FMX) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Constellation Brands Inc (STZ) : Free Stock Analysis Report

Dutch Bros Inc. (BROS) : Free Stock Analysis Report