FEMSA (FMX) Q2 Earnings Top Estimates on Solid Revenue Growth

Fomento Economico Mexicano S.A.B. de C.V. FMX, alias FEMSA, reported second-quarter 2023 net majority earnings per ADS of $1.00 (Ps. 1.72 per FEMSA unit). The company reported adjusted net majority earnings per ADS of $1.64, surpassing the Zacks Consensus Estimate of $1.21.

Net consolidated income was Ps. 8,926 million (US$522.9 million), reflecting a 16.8% increase from Ps. 7,640 million (US$382.4 million) in the year-ago quarter.

Total revenues were $11,562 million (Ps. 198,220 million), which improved 18.3% year over year in the local currency. Revenues, in U.S. dollar, surpassed the Zacks Consensus Estimate of $11,115 million. Revenue growth was driven by gains across its business units. On an organic basis, total revenues rose 9.5%.

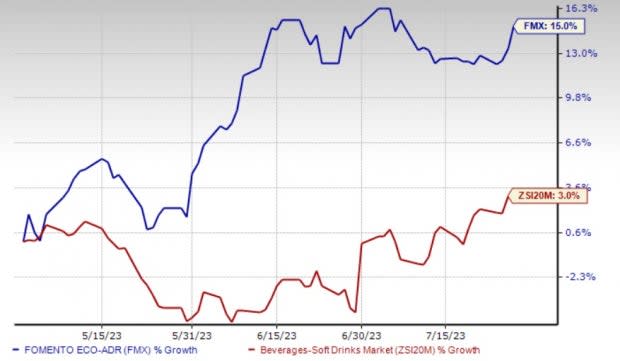

Shares of this Zacks Rank #1 (Strong Buy) company have rallied 15% in the past three months compared with the industry’s growth of 3%.

Image Source: Zacks Investment Research

FEMSA’s gross profit rose 20.1% year over year to Ps. 74,570 million (US$4,349.7 million). The consolidated gross margin expanded 50 basis points (bps) to 37.6%, owing to the gross margin expansion at Coca-Cola FEMSA, Envoy Solutions and FEMSA Health, as well as the consolidation of Proximity Europe. Growth was partly negated by margin declines in the Fuel and Proximity Americas units.

The gross margin expanded 170 bps each at the Health and Envoy Solutions segments, and 30 bps at Coca-Cola FEMSA S.A.B. de C.V. KOF. Meanwhile, Proximity Europe delivered a gross margin of 42.1%. However, the company reported gross margin declines of 20 bps at Proximity Americas and 30 bps at the Fuel division.

FEMSA’s operating income (income from operations) was up 8% year over year to Ps. 16,581 million (US$967.2 million). On an organic basis, operating income improved 4.5%. The consolidated operating margin contracted 80 bps to 8.4%, driven by margin contractions at Proximity Americas, Health, Fuel and Envoy Solutions divisions, as well as the inclusion of Proximity Europe. The gains were partly offset by margin expansions at the Coca-Cola FEMSA Division.

Fomento Economico Mexicano S.A.B. de C.V. Price, Consensus and EPS Surprise

Fomento Economico Mexicano S.A.B. de C.V. price-consensus-eps-surprise-chart | Fomento Economico Mexicano S.A.B. de C.V. Quote

Segmental Discussion

Proximity Americas: Total revenues for the segment rose 19.9% year over year to Ps. 72,099 million (US$4,205.5 million). The increase can primarily be attributed to a 15.3% rise in same-store sales on 7.4% growth each in store traffic and average ticket. The gains mainly stemmed from robust growth across the OXXO categories due to the rising demand for thirst and gathering occasions, such as beer, snacks, and other beverages. The results also benefited from the rise in mobility-driven occasions due to continued recovery across markets.

The Proximity Americas division had 22,059 OXXO stores as of Jun 30, 2023. Operating income accelerated 18% year over year. The operating margin for the segment declined 20 bps to 10%, owing to higher operating expenses.

Proximity Europe: Total revenues for the segment was Ps. 10,833 million (US$631.9 million). The segment has been benefiting from improved traffic trends and favorable pricing actions. Growth of recently acquired Valora’s foodservice and B2B business has also been a key contributor. The Proximity Europe division had 2,784 points of sale as of Jun 30, 2023. Operating income for the segment was Ps. 316 (US$18.4 million) on solid gains from foodservice and operating expense leverage.

Health Division: The segment reported total revenues of Ps. 18,962 million (US$1,106 million), up 0.6% year over year. Revenues benefited from favorable trends across Colombia and Ecuador, offset by an unfavorable comparison base in Chile and Mexico, as well as negative currency translations. On a currency-neutral basis, total revenues increased 14.1%, whereas same-store sales increased 7.9%. The segment had 4,267 locations across all regions as of Jun 30, 2023. The operating income declined 0.5% year over year, while the operating margin contracted 10 bps to 4.8%.

Fuel Division: Total revenues rose 9.3% to Ps. 14,455 million (US$843.2 million). Average same-station sales improved 3.2%, driven by a 0.6% increase in the average volume and 2.6% growth in the average price per liter. Results also gained from volume growth in its institutional and wholesale customer network. The company had 570 OXXO GAS service stations as of Jun 30, 2023. Operating income fell 0.9% and the operating margin contracted 40 bps to 3.9%.

Envoy Solutions: Total revenues for the segment were Ps. 13,482 million (US$786.4 million), up 23.1% year over year. Revenues reflected gains from recent acquisitions. The segment’s operating income declined 7.1% and the operating margin contracted 120 bps to 3.8%. Organic operating income increased 10.9%.

Coca-Cola FEMSA: Total revenues for the segment advanced 7.2% year over year to Ps. 61,428 million (US$3,583.1 million). KOF’s revenues were mainly aided by improved volume across regions, driven by strong performances in Mexico, Brazil, Uruguay and Guatemela. Revenue-management initiatives and favorable mix effects also aided revenues.

On a comparable basis, Coca-Cola FEMSA’s revenues improved 16.9% year over year. KOF’s consolidated operating income increased 11.9% and comparable operating income rose 18.7%. The segment’s operating margin expanded 50 bps to 13.9%.

Financial Position

FEMSA had cash and cash equivalents of Ps. 153,999 million (US$8,982.7 million) as of Jun 30, 2023. Its long-term debt was Ps. 130,547 million (US$7,614.8 million). The company incurred a capital expenditure of Ps. 8,375 million (US$488.5 million) in the second quarter, reflecting higher investments in most businesses.

Stocks to Consider

We highlighted some other top-ranked stocks from the broader Consumer Staples space, namely Molson Coors TAP and PepsiCo PEP.

Molson Coors currently flaunts a Zacks Rank #1. TAP has a trailing four-quarter earnings surprise of 32.1%, on average. It has a long-term earnings growth rate of 7.1%. The company has rallied 14.6% in the past three months. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Molson Coors’ current financial-year sales and earnings per share suggests growth of 6.3% and 16.6%, respectively, from the year-ago quarter’s reported figures. The consensus mark for TAP’s earnings has moved up 5.1% in the past seven days.

PepsiCo currently has a Zacks Rank of 2 (Buy) at present. PEP has a trailing four-quarter earnings surprise of 6.3%, on average. It has a long-term earnings growth rate of 8.1%. The company has dipped 1.6% in the past three months.

The Zacks Consensus Estimate for PepsiCo’s current financial-year sales and earnings per share suggests growth of 6.4% and 9.9%, respectively, from the prior-year reported numbers. The consensus mark for PEP’s earnings per share has moved up 2.2% in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fomento Economico Mexicano S.A.B. de C.V. (FMX) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

Coca Cola Femsa S.A.B. de C.V. (KOF) : Free Stock Analysis Report