FEMSA (FMX) Q3 Earnings Beat, Revenues Lag Estimates

Fomento Economico Mexicano S.A.B. de C.V. FMX, alias FEMSA, reported third-quarter 2023 net majority earnings per ADS of $1.56 (Ps. 2.72 per FEMSA unit). The company posted adjusted net majority earnings per ADS of $1.75, surpassing the Zacks Consensus Estimate of $1.16.

Net consolidated income was Ps. 12,758 million (US$732.9 million), reflecting a 3.8% decrease from Ps. 13,268 million (US$653.3 million) in the year-ago quarter.

Total revenues were $10,806.1 million (Ps. 188,095 million), which improved 19.3% year over year in the local currency. Revenues in U.S. dollars missed the Zacks Consensus Estimate of $11,220 million. Revenue growth was driven by gains across its business units. On an organic basis, total revenues rose 11.9%.

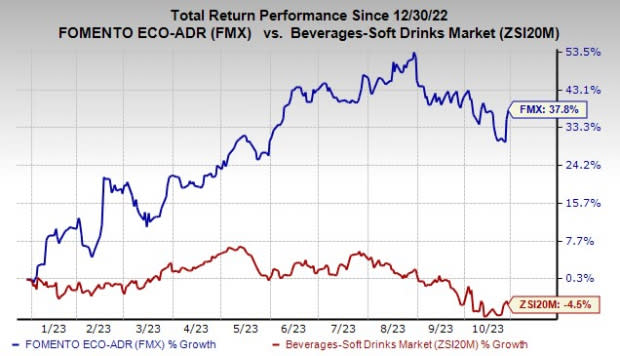

Shares of FMX have advanced 37.8% year to date against the industry’s decline of 4.5%.

Image Source: Zacks Investment Research

FEMSA’s gross profit rose 22.1% year over year to Ps. 72,081 million (US$4,141.1 million) while our model predicted the metric to be Ps. 72,175.4 million. The consolidated gross margin expanded 90 basis points (bps) to 37.6%, owing to the gross margin expansion at Coca-Cola FEMSA, Proximity and the consolidation of Proximity Europe. Growth was partly negated by margin declines in Fuel and Health. Meanwhile, our model estimated gross margin to expand 110 bps year over year.

The gross margin contracted 30 and 40 bps in the Health and Fuel segments, respectively. Meanwhile, Proximity Europe delivered a gross margin of 41.8%. However, the company’s gross margin expanded 100 bps at Proximity Americas and 140 bps at the Coca-Cola FEMSA S.A.B. de C.V. (KOF).

FEMSA’s operating income (income from operations) was up 12.6% year over year to Ps. 15,929 million (US$915.1 million) and lagged our estimate of Ps. 18,403.9 million. On an organic basis, operating income improved 9.8%. The consolidated operating margin contracted 50 bps to 8.5%, driven by margin contractions at Proximity Americas, Health, Fuel and the inclusion of Proximity Europe. The gains were partly offset by margin expansions at the Coca-Cola FEMSA Division.

Segmental Discussion

Proximity Americas: Total revenues for the segment rose 20.8% year over year to Ps. 72,099 million (US$4,142.1 million) and came ahead of our estimate of Ps. 67,477.3 million. The increase can primarily be attributed to a 15.1% rise in same-store sales on 8% growth in store traffic and a 6.6% rise in average ticket. The gains mainly stemmed from robust growth across the OXXO categories due to the rising demand for thirst and gathering occasions, such as beer, snacks and other beverages.

The Proximity Americas division had 22,352 OXXO stores as of Sep 30, 2023. Operating income accelerated 14.7% year over year. The operating margin for the segment declined 50 bps to 8.9%, owing to higher operating expenses.

Proximity Europe: Total revenues for the segment grew 8.7% to Ps. 11,194 million (US$643.1 million) and came ahead of our estimate of Ps. 10,649.2 million. The segment has been benefiting from improved traffic trends and favorable pricing actions. Growth of the recently acquired Valora’s foodservice and B2B business has also been a key contributor. The

Proximity Europe division had 2,810 points of sale as of Sep 30, 2023. Operating income for the segment was Ps. 348 (US$20 million) on solid gains from foodservice and operating expense leverage.

Health Division: The segment reported total revenues of Ps. 18,569 million (US$1,066.8 million), up 0.2% year over year but came below our estimate of Ps. 19,107.9 million. Revenues benefited from favorable trends across Colombia and Chile, offset by an unfavorable comparison base in Mexico and negative currency translations. On a currency-neutral basis, total revenues increased 13.6%, whereas same-store sales increased 14.7%. The segment had 4,347 locations across all regions as of Sep 30, 2023. The operating income rose 1.4% year over year, while the operating margin contracted 60 bps to 4.5%.

Fuel Division: Total revenues rose 14.2% to Ps. 15,782 million (US$906.7 million) and came ahead of our estimate of Ps. 14,022.6 million. Average same-station sales improved 8.1%, driven by a 4% increase in the average volume and 4% growth in the average price per liter. Results also gained from volume growth in its institutional and wholesale customer network. The company had 571 OXXO GAS service stations as of Sep 30, 2023. Operating income rose 3.3% and the operating margin contracted 40 bps to 6.5%.

Coca-Cola FEMSA: Total revenues for the segment advanced 10.1% year over year to Ps. 62,853 million (US$3,610.9 million) and came ahead of our estimate of Ps. 60,398.3 million. KOF’s consolidated operating income increased 15.3%. The segment’s operating margin expanded 70 bps to 13.5%.

Fomento Economico Mexicano S.A.B. de C.V. Price, Consensus and EPS Surprise

Fomento Economico Mexicano S.A.B. de C.V. price-consensus-eps-surprise-chart | Fomento Economico Mexicano S.A.B. de C.V. Quote

Financial Position

This Zacks Rank #5 (Strong Sell) company had cash and cash equivalents of Ps. 160,442 million (US$9,105.7 million) as of Sep 30, 2023. The company’s long-term debt was Ps. 132,354 million (US$7,511.6 million). It incurred a capital expenditure of Ps. 9,791 million (US$562.5 million) in the third quarter, reflecting higher investments in most businesses.

Other Stocks to Consider

Lamb Weston LW, which offers frozen potato products, currently sports a Zacks Rank #1. LW delivered an earnings surprise of 46.2% in the last reported quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Lamb Weston’s current financial-year sales and earnings suggests growth of 27.8% and 21.8%, respectively, from the year-ago reported numbers.

The J. M. Smucker Company SJM, a branded food and beverage product company, currently carries a Zacks Rank #2 (Buy). SJM has a trailing four-quarter earnings surprise of 7.3%, on average.

The Zacks Consensus Estimate for J. M. Smucker’s current fiscal-year earnings suggests growth of 8.9% from the year-ago reported figure.

Celsius Holdings CELH, which offers functional drinks and liquid supplements, currently carries a Zacks Rank #2. CELH delivered an earnings surprise of 100% in the last reported quarter.

The Zacks Consensus Estimate for Celsius Holdings’ current fiscal-year sales and earnings suggests growth of 88.9% and 170.3%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fomento Economico Mexicano S.A.B. de C.V. (FMX) : Free Stock Analysis Report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report