FEMSA (FMX) Rises 20% in Six Months: Will the Rally Continue?

Fomento Economico Mexicano S.A.B. de C.V. FMX, alias FEMSA, has been reaping the benefits of its diversified business, continued strength in OXXO Mexico as well as OXXO Gas, expansion into newer businesses and digital initiatives. Gains of these positives have been well reflected in its stock performance.

The company has been on track with its strategy of creating a distribution platform in the United States through the expansion of its footprint in the specialized distribution industry. The company is also poised for growth through investments in digital and technology-driven initiatives. Moreover, FEMSA displays strong financial flexibility.

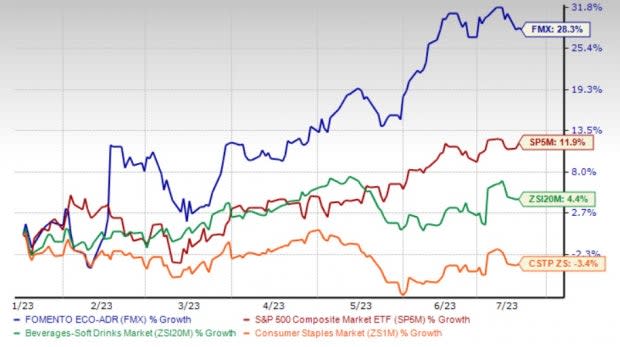

Shares of this Zacks Rank #3 (Hold) company have rallied 28.3% in the past six months compared with the industry’s growth of 4.4% and the S&P 500’s 11.9% rise. The FMX stock also compared favorably against the sector’s decline of 3.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Factors Positioning FEMSA for Growth

FEMSA has been on track with its expansion in the specialized distribution industry. This expansion relates to its plan of investing in adjacent businesses to leverage capabilities across different markets, providing an opportunity for attractive growth and risk-adjusted returns.

With the presence of its OXXO business and other retail operations, the company has become an expert in the organization and management of supply chains and distribution systems. FEMSA serves several businesses and retail customers through millions of interactions in different industries.

FEMSA stands to benefit from its wide exposure to industries like beverage, beer and retail. This gives the company an edge over its competitors. The company participates in the beverage industry through its subsidiary Coca-Cola FEMSA KOF, one of the largest franchise bottlers for Coca-Cola KO products.

In the beer industry, FMX enjoys a notable position with its 14.76% stake in Heineken, a leading brewer with operations in 70 countries. The company operates in the retail space through the FEMSA Comercio subsidiary.

Coca-Cola FEMSA is the flagship segment engaged in the production and distribution of carbonated beverages. The division is the largest Coca-Cola bottler in Latin America and the second-largest Coca-Cola bottler globally in terms of sales volumes.

Coca-Cola is on track with its strategy of becoming a total beverage company through last year’s streamlining of its portfolio, focusing on core brands and investing in its portfolio of brands to meet evolving consumer needs. KO is diversifying its portfolio to tap the rapidly growing RTD category. The company’s expansion initiatives are likely to aid Coca-Cola FEMSA’s results.

Additionally, FEMSA continues to focus on offering customers more options to make contactless purchases by intensifying digital and technology-driven initiatives across operations. The company’s Coca-Cola FEMSA is leading the way with its omnichannel business, while FEMSA Comercio is progressing with the adoption of digital initiatives.

Within its OXXO store chains, the company is on track with investing in digital offerings, loyalty programs and fintech platforms to evolve stronger after the pandemic and over the long term. Its OXXO digital wallet, OXXO Premia and loyalty programs have been performing well. The company has made progress in its digital efforts with the continued addition of Spin Premia and Spin by OXXO customers at an accelerated pace.

Anheuser-Busch InBev BUD, alias AB InBev, is another beverage company focused on investing in new capabilities for several years to better connect with customers and consumers. BUD has been rapidly growing its digital platform and leveraging technology, such as B2B sales and other e-commerce platforms.

AB InBev is witnessing an acceleration in B2B platforms, e-commerce and digital marketing trends. BUD’s digital transformation initiatives have been on track, with B2B digital platforms contributing about 62% of its revenues in the first quarter.

Conclusion

Supply-chain disruptions and higher raw material costs have been major hurdles for FEMSA. Although FEMSA continues to witness operating margin declines due to a contraction in the Proximity, Health and Envoy Solutions divisions, it is well-poised for growth in the long term, backed by its expansion and growth plans.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CocaCola Company (The) (KO) : Free Stock Analysis Report

Fomento Economico Mexicano S.A.B. de C.V. (FMX) : Free Stock Analysis Report

Anheuser-Busch InBev SA/NV (BUD) : Free Stock Analysis Report

Coca Cola Femsa S.A.B. de C.V. (KOF) : Free Stock Analysis Report