Can FEMSA (FMX) Stock Retain Momentum on Growth Strategies?

Fomento Economico Mexicano S.A.B. de C.V. FMX alias, FEMSA, retained its position as an investor favorite beverage stock mainly on robust business trends because of effective growth strategies and strong market demand. The company’s Digital@FEMSA initiative, strength in OXXO Mexico and OXXO Gas and expansion in the specialized distribution industry highlight its forward prospects.

FEMSA reported top and bottom line beat for the third consecutive quarter in third-quarter 2023. The company’s upbeat earnings per ADS were driven by robust top-line growth and lower interest expenses. Revenue growth was driven by gains across its business units.

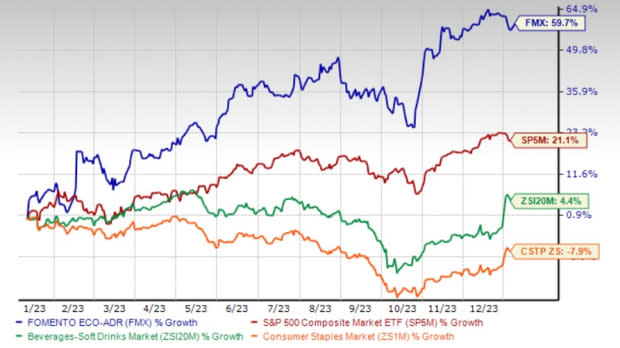

Shares of this Zacks Rank #3 (Hold) company have rallied 59.7% in the past year compared with the industry’s growth of 4.4%. The FMX stock also compared favorably against the sector’s decline of 7.9% and the S&P 500’s 21.1% growth.

The Zacks Consensus Estimate for FMX’s 2023 sales and earnings suggest growth of 32.3% and 60.3%, respectively, from the year-ago numbers.

Image Source: Zacks Investment Research

Key Strategies to Craft Growth

FEMSA’s venture in the specialized distribution industry relates to its plan of investing in adjacent businesses, which can leverage capabilities across different markets, providing an opportunity for attractive growth and risk-adjusted returns.

With the presence of its OXXO business and other retail operations, the company has become an expert in the organization and management of supply chains and distribution systems. FEMSA serves several businesses and retail customers through millions of interactions in different industries.

FEMSA has been on track with its strategy of creating a national distribution platform in the United States through the expansion of its footprint in the specialized distribution industry. Through its Envoy Solutions subsidiary, the company has expanded in the specialized distribution industry with significant acquisitions completed in 2022, including OK Market in Chile; ATRA Janitorial Supply Co., Inc. in the United States; and Sigma Supply of North America Inc. based in Hot Springs, AR.

FEMSA has been gaining pace in the digital space through its tech and innovation business unit – Digital@FEMSA, which focuses on building a value-added digital and financial ecosystem for end customers and businesses. It is also focused on enabling and leveraging the strategic assets of FEMSA’s core business verticals.

The company’s Coca-Cola FEMSA is leading the way with its omni-channel business, while the Proximity division is progressing with the adoption of digital initiatives for the OXXO stores. Within its OXXO store chains, the company is on track with investing in digital offerings, loyalty programs and fintech platforms to grow stronger over the long term. Its OXXO digital wallet, OXXO Premia and loyalty program have been performing well. It made progress on its digital efforts, with the continued addition of Spin Premia and Spin by OXXO customers at an accelerated pace.

Hurdles to Watch

FEMSA has been witnessing an operating margin decline due to contraction at Proximity Americas, Health and Fuel divisions, as well as the inclusion of Proximity Europe. The decline in operating margin at these segments has been caused by higher operating expenses resulting from increased labor expenses related to the recent labor reforms in Mexico.

Lucrative Picks

We have highlighted three better-ranked stocks from the Consumer Staple sector, namely Dutch Bros BROS, The Coca-Cola Company KO and PepsiCo Inc. PEP.

Dutch Bros currently sports a Zacks Rank #1 (Strong Buy). BROS has a trailing four-quarter earnings surprise of 57.1%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Dutch Bros’ current financial-year sales and earnings suggests growth of 30.6% and 81.3%, respectively, from the prior-year levels. The consensus mark for BROS’ earnings per share (“EPS”) has been unchanged in the past 30 days.

Coca-Cola currently has a Zacks Rank #2 (Buy). KO has a trailing four-quarter earnings surprise of 5.1%, on average.

The Zacks Consensus Estimate for Coca-Cola’s current financial year’s sales and earnings per share suggests growth of 5.7% and 8.1%, respectively, from the year-ago period’s reported figures. The consensus mark for KO’s EPS has been unchanged in the past 30 days.

PepsiCo has a trailing four-quarter earnings surprise of 5.6%, on average. PEP currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for PepsiCo’s current financial-year sales and earnings suggests growth of 6.4% and 11.2%, respectively, from the year-ago period's reported figures. The consensus mark for PEP’s EPS has been unchanged in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CocaCola Company (The) (KO) : Free Stock Analysis Report

Fomento Economico Mexicano S.A.B. de C.V. (FMX) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Dutch Bros Inc. (BROS) : Free Stock Analysis Report