Ferguson PLC (FERG) Reports Q2 Earnings Amid Market Challenges

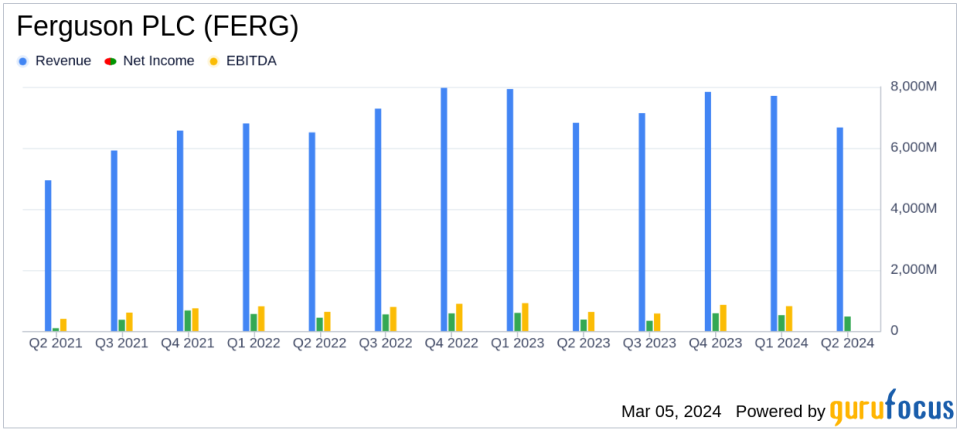

Net Sales: Reported a 2.2% decline to $6.7 billion in Q2, reflecting market deflation and a slight organic revenue drop.

Operating Margin: Achieved a 7.1% operating margin, with an adjusted margin of 7.8%.

Earnings Per Share: Diluted EPS at $1.58, with an adjusted EPS of $1.74.

Operating Cash Flow: Generated $863 million on a fiscal year-to-date basis.

Dividend: Declared a quarterly dividend of $0.79 per share, up 5% from the previous year.

Acquisitions and Share Repurchases: Completed two acquisitions and repurchased $142 million in shares during the quarter.

Financial Leverage: Maintained a strong balance sheet with net debt to adjusted EBITDA at 1.1x.

Ferguson PLC (NYSE:FERG) released its 8-K filing on March 5, 2024, revealing the company's performance for the second quarter. As a leading distributor of plumbing and HVAC products in North America, Ferguson serves a vast customer base through its extensive branch network. Despite facing a challenging market environment, the company's strategic focus on cost management and growth initiatives has allowed it to maintain a solid financial position.

Performance Overview

Ferguson PLC (NYSE:FERG) reported a 2.2% decrease in net sales for the second quarter, totaling $6.7 billion. This decline was largely attributed to a 2% deflation and a modest organic revenue decrease of 3.7%, primarily in residential sales. Despite these challenges, the company's gross margin improved by 20 basis points to 30.4%, thanks to effective pricing strategies. Operating expenses were managed through targeted cost control and productivity initiatives, allowing for an adjusted operating profit of $520 million, which is 10.7% lower than the previous year.

The company's diluted earnings per share (EPS) for the quarter stood at $1.58, a 12.2% decrease from the prior year, while the adjusted EPS was $1.74, down by 8.9%. This decline in EPS was partly offset by the impact of share repurchases. Ferguson's operating cash flow remained robust at $863 million on a fiscal year-to-date basis, and the balance sheet continued to show strength with a net debt to adjusted EBITDA ratio of 1.1x.

Strategic Moves and Market Position

During the quarter, Ferguson completed two acquisitions, contributing to an aggregate annualized revenue of approximately $220 million. These strategic moves, along with a 5% increase in the quarterly dividend to $0.79 per share, underscore the company's commitment to growth and shareholder returns. Additionally, Ferguson repurchased $142 million in shares, further demonstrating confidence in its financial health.

CEO Kevin Murphy commented on the results, stating:

Our associates continued to execute well during our seasonally lightest quarter. While sales were slightly lower than the prior year, organic performance improved from the first quarter. Current open orders and sales per day trends support our expectation of improvement through the balance of the fiscal year against easing comparables. We are appropriately managing costs as we prepare for our seasonally stronger second half. We delivered strong operating cash flow during the first half of our fiscal year and our strong balance sheet positions us for continued investment in organic growth, sustainable dividend growth, consolidation of our fragmented markets through acquisitions and the continued return of capital to shareholders.

Despite the current economic headwinds, Ferguson's management remains optimistic about leveraging structural tailwinds in non-residential construction and opportunities to support the residential trade professional. The unchanged financial guidance for FY2024 reflects this confidence, with expectations for net sales to be broadly flat and an adjusted operating margin between 9.2% and 9.8%.

Financial Health and Future Outlook

Ferguson's financial health remains robust, with a strong balance sheet and disciplined capital management. The company's strategy of investing in organic growth, pursuing acquisitions, and returning capital to shareholders has positioned it well to navigate the current market conditions. With a focus on operational efficiency and customer service, Ferguson is poised to continue its trajectory of sustainable growth and profitability.

For further details on Ferguson PLC (NYSE:FERG)'s financial performance and strategic initiatives, investors and interested parties are encouraged to review the full earnings report and financial statements available through the SEC filing.

Explore the complete 8-K earnings release (here) from Ferguson PLC for further details.

This article first appeared on GuruFocus.