Few black families will benefit from the historic stock market rally

A surging stock market despite a global pandemic and nationwide protests is calling attention to the wealth gap faced by black communities in the United States.

Optimism over an economic rebound has inspired a week of positive movement in the equities market, as the Dow Jones Industrial Average rose almost 7%. Since market lows on March 23, the S&P 500 has had the largest 50-day rally in its history, according to LPL Financial.

But every day after market close, protesters in cities across the country have taken to the streets following the death of George Floyd under the custody of Minneapolis police.

The protests have sparked conversations not just on police brutality but on socioeconomic factors that support the systemic racism faced by black communities.

The stock market is one example of the wealth divide.

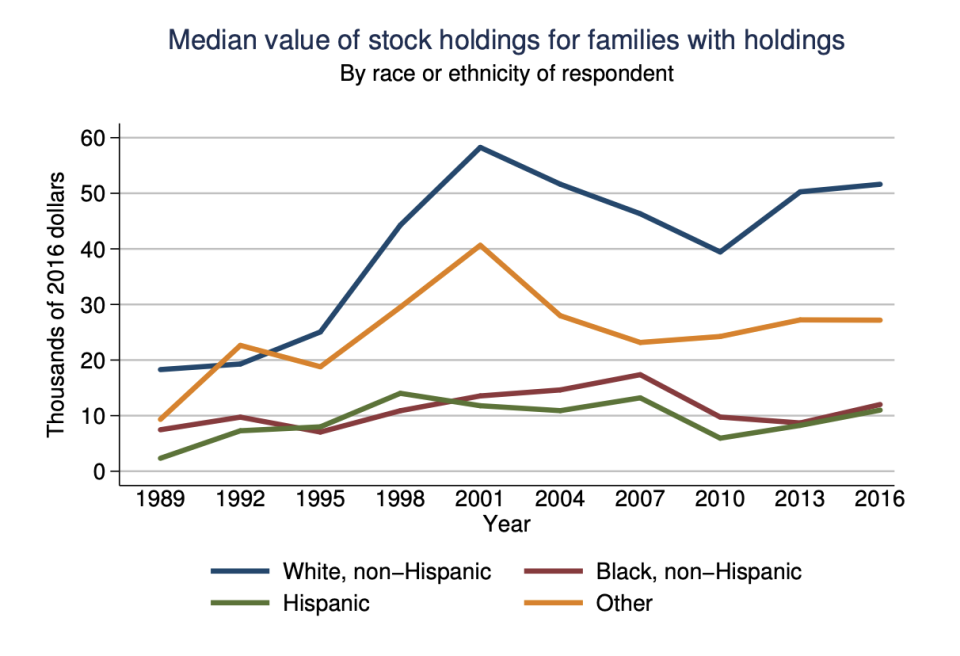

Data from the Federal Reserve’s 2016 Survey of Consumer Finances shows that 61% of white families have some stock holdings, compared to only 31% of black families.

Not only do fewer black families have stock holdings, but those that do also have far smaller stock holdings. The median white family had over $51,000 in stock holdings whereas the median black family had only $12,000.

With only a third of black families seeing a benefit from the stock market rise, more families are likely to have no cushion against the backdrop of massive job losses in the face of the COVID-19 crisis.

Although 59% of all adult black Americans were employed prior to the COVID-19 crisis, figures from the Bureau of Labor Statistics show that less than half (49.6%) now have a job.

The worry: that wealth inequality will only worsen.

“Wealth is assets minus liabilities,” Dr. Fenaba Addo, an associate professor at the University of Wisconsin at Madison told Yahoo Finance. “But it means so much more: it’s power, it’s connections, it’s insurance.”

The wealth gap

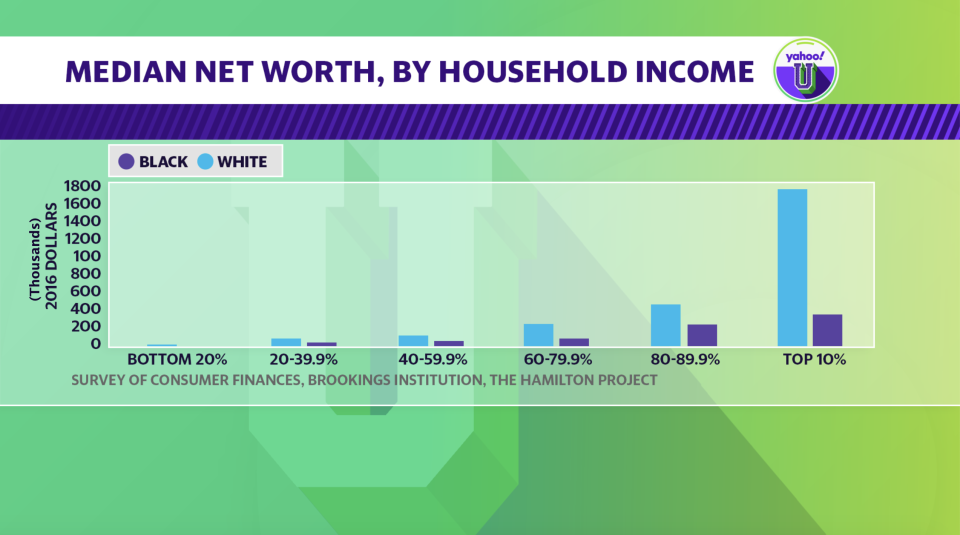

The same Fed survey, as analyzed by the Brookings Institution and the Hamilton Project, shows that the median white family has a net worth of $171,000, a dramatic difference compared to the median black family’s net worth of just $17,600.

Net worth is not the same as net income and measures the value of assets accumulated over time (for example, a retiree with no income can have a high net worth). But income, most commonly achieved through wages from one’s job, has a heavy weight in being able to amass wealth.

But even black families with higher incomes have difficulty building up wealth.

The median family in the top quintile of black income earners only had a fraction of the net worth compared to the median family in the top quintile of white income earners. The suggestion: that wealth preservation is just as hard as wealth accumulation.

Addo, who studies money, relationships, and equality, noted that home equity has been a big reason for an inability to build up financial worth.

White households have far higher levels of homeownership compared to black households. An analysis from the Pew Research Center shows that 58% of black households rent, compared to just 28% of white households. And because of a history of redlining and discrimination in housing policies dating back to the 1930s, black communities have faced lower housing values and higher borrowing costs.

For young black workers, Addo also worries about the piling student debt that could further depress wealth among the middle class ranks.

“Racial wealth gaps are intergenerational and persistent,” Addo said.

Fixing the racial wealth gap will not come from any single policy, but Michigan State University economics professor Dr. Lisa Cook says higher wage occupations should be a priority.

Cook told Yahoo Finance that getting minorities and women into basic Science, Technology, Engineering, and Math (STEM) educational programs could someday bring diversity into the ranks of the top 10 wealthiest people.

“Closing the racial wealth gap should be the big focus right now because it is widening, it is not diminishing,” Cook said.

Brian Cheung is a reporter covering the Fed, economics, and banking for Yahoo Finance. You can follow him on Twitter @bcheungz.

COVID-19 crisis highlights housing inequality faced by black Americans

Fed officials warn of long road ahead for U.S. economic recovery

Congress tells Fed to hurry up on cheap loan program for Main Street

A glossary of the Federal Reserve's full arsenal of 'bazookas'

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.