Fewer Investors Than Expected Jumping On Woodbois Limited (LON:WBI)

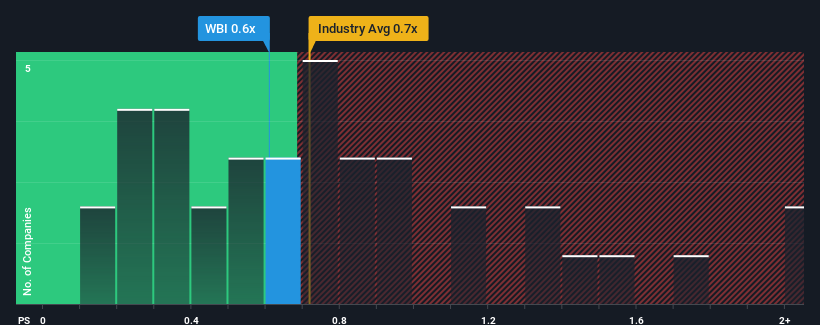

There wouldn't be many who think Woodbois Limited's (LON:WBI) price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S for the Forestry industry in the United Kingdom is similar at about 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Woodbois

How Has Woodbois Performed Recently?

With revenue growth that's superior to most other companies of late, Woodbois has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Woodbois will help you uncover what's on the horizon.

How Is Woodbois' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Woodbois' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 32% last year. As a result, it also grew revenue by 19% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 6.5% during the coming year according to the sole analyst following the company. That would be an excellent outcome when the industry is expected to decline by 7.1%.

In light of this, it's peculiar that Woodbois' P/S sits in-line with the majority of other companies. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

What We Can Learn From Woodbois' P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We note that even though Woodbois trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. Given the glowing revenue forecasts, we can only assume potential risks are what might be capping the P/S ratio at its current levels. The market could be pricing in the event that tough industry conditions will impact future revenues. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You need to take note of risks, for example - Woodbois has 3 warning signs (and 1 which is potentially serious) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here