Fidelity National (FIS) Q2 Earnings Beat, '23 View Raised

Fidelity National Information Services, Inc. FIS reported second-quarter 2023 adjusted earnings per share of $1.55, which outpaced the Zacks Consensus Estimate by 4.7%. However, the bottom line declined 10% year over year.

Revenues inched up 1% year over year to $3,746 million. The top line beat the consensus mark by 1.2%. The organic revenue growth came in at 2% in the quarter under review.

The better-than-expected quarterly results benefited from well-performing Banking and Capital Markets businesses. FIS’ Future Forward enterprise transaction program reaped results in the form of cash savings this quarter. Recurring revenue growth and lower costs aided the second-quarter results. The company also reported a $6.8 billion charge regarding the upcoming separation of the Worldpay Merchant Solutions business.

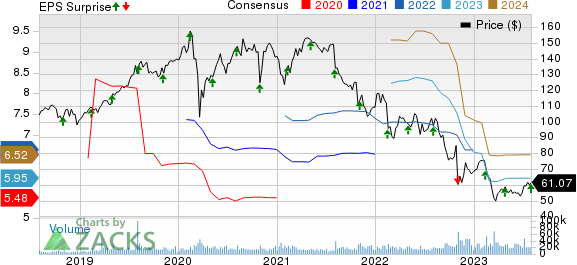

Fidelity National Information Services, Inc. Price, Consensus and EPS Surprise

Fidelity National Information Services, Inc. price-consensus-eps-surprise-chart | Fidelity National Information Services, Inc. Quote

Q2 Performance

The cost of revenues of $2,188 million slipped 2.1% year over year, below our model estimate of $2,215.6 million. Selling, general and administrative expenses also declined 4.5% year over year to $1,033 million in the second quarter and remained below our estimate of $1,070.2 million.

Adjusted earnings before interest, tax, depreciation and amortization (EBITDA) of Fidelity National fell 3% year over year to $1,551 million but beat our estimate of $1,510.1 million. The adjusted EBITDA margin of 41.4% deteriorated 160 basis points (bps) year over year.

Inside FIS’ Segments

Revenues from Banking Solutions improved 1% year over year to $1,702 million in the second quarter, beating our estimate of $1,680.3 million. It was supported by increased recurring revenues from processing volumes, as well as professional services. The organic revenue growth was 2%. Adjusted EBITDA margin of 42.5% deteriorated 200 bps year over year due to the lower-margin revenue mix.

Merchant Solutions’ revenues were $1,312 million, which climbed 1% year over year and beat our estimate of $1,290.9 million thanks to higher volumes and eCommerce strength. The organic revenue growth came in at 1%. Adjusted EBITDA margin improved 120 bps year over year to 48.3% due to cost efficiencies.

Revenues from Capital Market Solutions increased 6% year over year to $672 million in the quarter under review and beat our estimate of $655.9 million, on the back of recurring revenue growth. The organic revenue growth was reported at 7%. Adjusted EBITDA margin of 50.2% improved 100 bps year over year on the back of solid contribution margins from growing revenues.

The Corporate and Other segment’s revenues of $60 million plunged 43% year over year but beat our estimate of $50.1 million.

Balance Sheet & Cash Flow

Fidelity National exited the second quarter with cash and cash equivalents of $1,982 million, which fell from $2,188 million at 2022-end. Total assets of $53,574 million decreased from $63,278 million at 2022-end.

Long-term debt, excluding the current portion, came in at $13,589 million at the second-quarter end. The figure decreased from $14,207 million as of Dec 31, 2022. The current portion of long-term debt was $785 million while short-term borrowings were $5,144 million.

Total equity of $20,273 million declined from the 2022-end level of $27,226 million.

In the second quarter of 2023, net cash provided by operations of $1,087 million rose from the $1,024 million figure in the prior-year quarter. FIS generated a free cash flow of $953 million in the second quarter, which jumped from $806 million a year ago.

Capital Deployment

Fidelity National rewarded $309 million to its shareholders via dividends in the quarter under review.

Divestiture of Merchant Solutions Business Announced

FIS agreed to divest a 55% stake in its Worldpay Merchant Solutions business in July, to private equity funds managed by GTCR. The deal is likely to close by the first quarter of next year, following which, it will report ownership interest in Worldpay as income from minority interest. Operating results from the unit will be presented as discontinued operations from the third quarter of 2023.

Update on Enterprise Transformation Program

FIS achieved annualized Future Forward cash savings of more than $315 million as of Jun 30, 2023. The company revised its guidance for cash savings of $1 billion by 2024-end.

3Q23 View

Revenues are expected to remain between $3,640 million and $3,690 million, while adjusted EBITDA is estimated to be in the $1,580-$1,625 millionband.

2023 Guidance

Management revised the guidance for net revenues upward, which is expected to be between $14,500 million and $14,631 million compared with the 2022 reported figure of $14,528 million.

Adjusted EBITDA is forecasted within $6,025-$6,146 million for 2023, with the margin expected in the range of 41.6-42%.

Zacks Rank & Key Picks

Fidelity National currently has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader Business Services space are Paychex, Inc. PAYX, Envestnet, Inc. ENV and Marqeta, Inc. MQ, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Paychex’s current year bottom line suggests 9.6% year-over-year growth. Headquartered in Rochester, NY, PAYX beat earnings estimates in three of the past four quarters and missed once, with an average surprise of 3.4%.

The Zacks Consensus Estimate for Envestnet’s current year earnings indicates a 16.7% year-over-year increase. Berwyn, PA-based ENV beat earnings estimates in all the past four quarters, with an average surprise of 5.7%.

The Zacks Consensus Estimate for Marqeta’s current year top line suggests 21.8% year-over-year growth. Based in Oakland, MQ beat earnings estimates in two of the past four quarters, met once and missed on the remaining occasion, with an average surprise of 11.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Paychex, Inc. (PAYX) : Free Stock Analysis Report

Fidelity National Information Services, Inc. (FIS) : Free Stock Analysis Report

Envestnet, Inc (ENV) : Free Stock Analysis Report

Marqeta, Inc. (MQ) : Free Stock Analysis Report