Will Fidelity National (FIS) Q4 Earnings Witness Lower Profits?

Fidelity National Information Services, Inc. FIS is set to report its fourth-quarter 2023 results on Feb 26, before the opening bell.

What Do the Estimates Say?

The Zacks Consensus Estimate for fourth-quarter earnings per share (EPS) of 95 cents suggests a 44.4% decrease from the prior-year figure of $1.71. The consensus mark remained stable over the past week. The consensus estimate for fourth-quarter revenues of $2.5 billion indicates a 32.2% decrease from the year-ago reported figure.

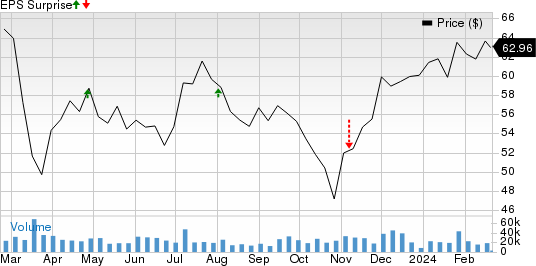

Fidelity National beat the consensus estimate for earnings in three of the trailing four quarters and missed once, with the average surprise being negative 7%. This is depicted in the graph below:

Fidelity National Information Services, Inc. Price and EPS Surprise

Fidelity National Information Services, Inc. price-eps-surprise | Fidelity National Information Services, Inc. Quote

Before we get into what to expect for the to-be-reported quarter in detail, it’s worth taking a look at FIS’ previous-quarter performance first.

Q3 Earnings Rewind

The banking and payments technology solutions provider reported adjusted EPS of 94 cents for the previous quarter, missing the Zacks Consensus Estimate by 40.9% due to an elevated interest expense level. Nevertheless, higher recurring revenues, as well as strong contributions from the Banking Solutions and Capital Market Solutions businesses, partly offset the negatives.

Now, let’s see how things have shaped up before the fourth-quarter earnings announcement.

Q4 Factors to Note

Fidelity National's fourth-quarter performance is poised to capitalize on the global digital transformation trend. Its strategic investments in mobile banking and expanded product offerings align with evolving consumer preferences, enhancing financial results. The consensus mark for Banking Solutions’ adjusted EBITDA signals a 3.2% increase from the year-ago quarter’s reported figure, whereas our model predicts a 4.6% increase.

The company’s investments in technology and innovation across high-growth markets are anticipated to have helped expand its total addressable market in the quarter under review. However, expenses are likely to have risen due to the investments.

Its long-established relationships with financial and commercial institutions help it to generate recurring revenues. The Zacks Consensus Estimate for revenues from the Capital Market Solutions segment suggests 1.4% year-over-year growth, while our estimate indicates a 0.6% rise.

However, considering its geographical presence, both the Zacks Consensus Estimate and our model estimate suggest 29.7% and 39.1% year-over-year declines in North America and All Other regions’ revenues, respectively, in the fourth quarter. Also, the Zacks Consensus Estimate for revenues from the Banking Solutions segment indicates a 0.5% year-over-year decline, whereas our model estimate suggests a marginal fall.

The company is expected to have witnessed increased expenses due to improvements in platforms and applications, as well as some inflationary pressures. This is likely to have reduced the profit margins in the to-be-reported quarter, making an earnings beat uncertain.

Our estimate for selling general and administrative costs is pegged at $504.4 million. We expect the cost of revenues to have reached well over $1.5 billion in the fourth quarter. The consensus mark for Capital Market Solutions’ adjusted EBITDA signals a 3.2% decrease from the year-ago figure, whereas we expect it to fall 2.6%. Furthermore, its results may have experienced a slight setback due to the divestiture of non-strategic businesses.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Fidelity National this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here, as you will see below.

Earnings ESP: The company has an Earnings ESP of 0.00%. This is because the Most Accurate Estimate currently stands at 95 cents per share, in line with the Zacks Consensus Estimate.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Fidelity National currently carries a Zacks Rank #3.

Stocks to Consider

While an earnings beat looks uncertain for Fidelity National, here are some companies from the broader Business Services space that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this time around:

Flywire Corporation FLYW has an Earnings ESP of +23.64% and a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Flywire Corporation’s bottom line for the to-be-reported quarter remained stable over the past month. FLYW beat earnings estimates in two of the past four quarters, met once and missed on the other occasion, with an average surprise of 27.7%. The consensus mark for its revenues indicates 31.2% year-over-year growth.

Marathon Digital Holdings, Inc. MARA has an Earnings ESP of +100.00% and is a Zacks #3 Ranked player.

The Zacks Consensus Estimate for Marathon Digital’s bottom line for the to-be-reported quarter is pegged at 5 cents per share, which indicates 135.7% growth from the year-ago period. The estimate remained stable over the past week. Furthermore, the consensus mark for MARA’s revenues is pegged at more than $138 million, suggesting an exponential jump.

Marqeta, Inc. MQ has an Earnings ESP of +20.75% and a Zacks Rank of 3.

The Zacks Consensus Estimate for Marqeta’s bottom line for the to-be-reported quarter remained stable over the past month. MQ beat earnings estimates in three of the past four quarters and missed once, with an average surprise of 18.1%. The consensus mark for its revenues is pegged at around $110.4 million.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fidelity National Information Services, Inc. (FIS) : Free Stock Analysis Report

Marathon Digital Holdings, Inc. (MARA) : Free Stock Analysis Report

Flywire Corporation (FLYW) : Free Stock Analysis Report

Marqeta, Inc. (MQ) : Free Stock Analysis Report