Fidelity National Information Services Inc (FIS) Announces Full-Year 2023 Results and Raises ...

Adjusted EPS: Full-year adjusted EPS at $3.37 for continuing operations, and $6.17 including discontinued operations.

Revenue: Full-year revenue increased 1% to approximately $9.8 billion, excluding discontinued operations.

Share Repurchase: FIS increases share repurchase goal to $4.0 billion by the end of 2024, up from $3.5 billion.

Dividend: Quarterly dividend approved at $0.36 per common share, payable on March 22, 2024.

Future Forward Program: Outperformed expectations with over $550 million in annualized run-rate cash savings.

2024 Outlook: Accelerated revenue growth, expanding adjusted EBITDA margins, and year-over-year adjusted EPS growth projected.

Capital Allocation: Continued commitment to returning capital to shareholders through dividends and share repurchases.

On February 26, 2024, Fidelity National Information Services Inc (NYSE:FIS) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. The company, a global leader in financial services technology, has expanded its operations through strategic acquisitions, including Sungard in 2015 and Worldpay in 2019, positioning itself as a key player in banking solutions, capital market services, and payment processing.

Financial Performance and Challenges

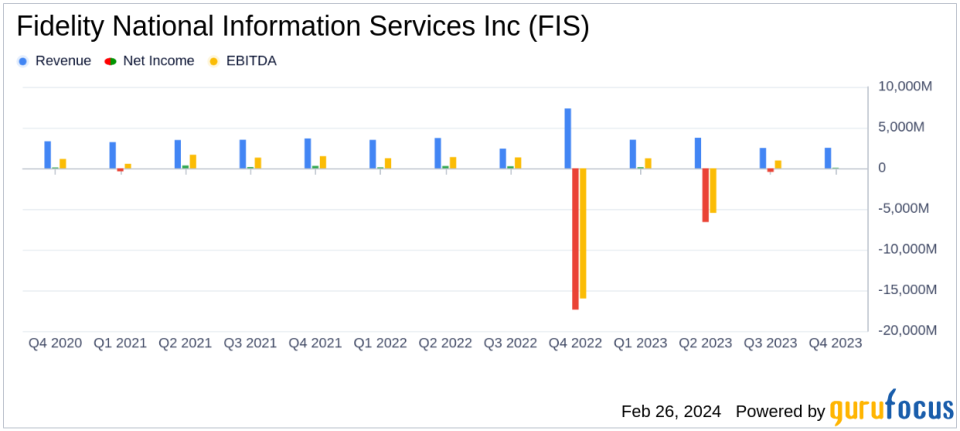

FIS reported a slight decrease in GAAP revenue for the fourth quarter of 2023, down 1% to approximately $2.5 billion, excluding $1.2 billion classified as discontinued operations. The adjusted EPS for continuing operations saw a 4% decrease to $0.94, primarily due to higher interest costs. The full-year GAAP net earnings from continuing operations were $503 million, translating to $0.85 per diluted share. However, including discontinued operations, the company faced a net loss of $(6,654) million, or $(11.26) per diluted share, largely due to a non-cash goodwill impairment charge related to the Merchant Solutions reporting unit.

The challenges faced by FIS, particularly the goodwill impairment, highlight the importance of strategic business evaluations and the potential volatility in the valuation of acquired entities. For investors, the company's ability to navigate these challenges while maintaining operational efficiency and growth is crucial.

Financial Achievements and Industry Significance

FIS's financial achievements, including the outperformance of its Future Forward program, are significant as they demonstrate the company's commitment to operational excellence and cost management. The program's success, with over $550 million in annualized run-rate cash savings, underscores FIS's ability to optimize its operations in a competitive financial technology landscape.

Key Financial Metrics

Important metrics from the financial statements include:

- Banking Solutions Revenue: Full-year revenue increased by 2% to $6.7 billion.

- Capital Market Solutions Revenue: Full-year revenue increased by 5% to $2.8 billion.

- Adjusted EBITDA Margin: Full-year adjusted EBITDA margin contracted by 40 basis points to 40.4%.

- Free Cash Flow: Approximately $3.6 billion for the full year.

These metrics are important as they provide insight into the company's core operations, profitability, and cash generation capabilities, which are key considerations for value investors.

Management Commentary

Our 2023 results and our 2024 outlook reflect the continued positive momentum of the business as we delivered on our financial commitments for the fourth consecutive quarter and successfully closed the Worldpay transaction," said FIS CEO and President Stephanie Ferris.

Analysis of Performance

FIS's performance in 2023, despite the challenges, indicates a resilient business model and a strategic focus on long-term growth. The increase in share repurchase goals and the introduction of a positive 2024 outlook suggest management's confidence in the company's financial health and future prospects.

For more detailed information on FIS's financial results, including the full earnings release and supplemental financial information, please visit the Investor Relations section of FIS's website at www.fisglobal.com.

Explore the complete 8-K earnings release (here) from Fidelity National Information Services Inc for further details.

This article first appeared on GuruFocus.