Fifth Third Bancorp (FITB) Faces Headwinds Despite Solid Capital Position in Q4 2023

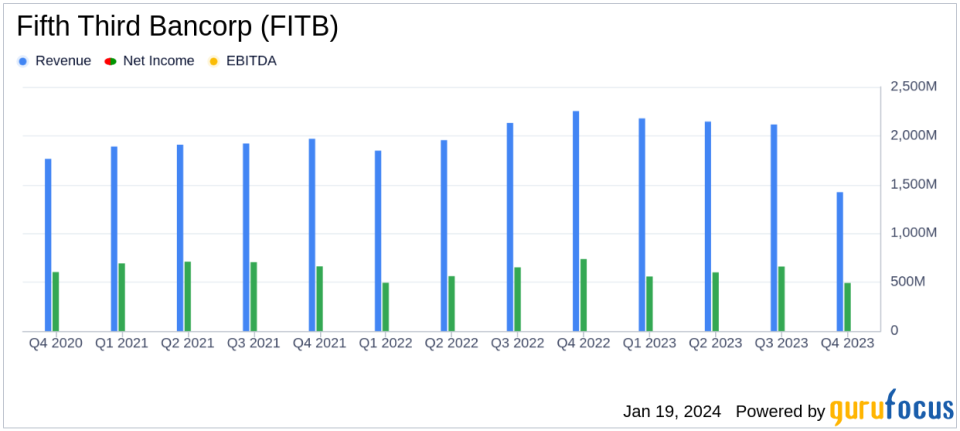

Net Income: Reported Q4 net income of $530 million, a decrease from $660 million in Q3 and $737 million year-over-year.

Earnings Per Share: Diluted EPS at $0.72, down from $0.91 in Q3 and $1.01 in the same quarter last year.

Net Interest Income: Declined by 10% year-over-year to $1.423 billion.

Noninterest Income: Increased slightly by 1% year-over-year to $744 million.

Deposits and Loan Ratios: Average deposits grew by 5% compared to last year; loan-to-core deposit ratio stood at 72%.

Capital and Liquidity: CET1 capital increased to 10.29%; maintained full Category 1 LCR compliance.

Branch Expansion: Opened 19 new branches, with 18 in high-growth Southeast markets.

On January 19, 2024, Fifth Third Bancorp (NASDAQ:FITB) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The diversified financial-services company, with over $200 billion in assets, operates numerous full-service banking centers and ATMs across several states. Despite a challenging economic environment, Fifth Third Bancorp reported solid capital accretion and continued deposit growth.

Performance and Challenges

Fifth Third Bancorp's performance in Q4 2023 reflected a mixed financial landscape. The bank's net income available to common shareholders decreased to $492 million, a 21% decline from the previous quarter and a 30% decrease from the fourth quarter of the previous year. This was partly due to a negative $0.27 impact from certain items, including an FDIC special assessment and valuation adjustments. The diluted earnings per share followed suit, dropping to $0.72.

Despite these challenges, the bank's average deposits increased by 2% compared to Q3 2023 and by 5% compared to Q4 2022, indicating a solid deposit growth trajectory. The bank also maintained full Category 1 Liquidity Coverage Ratio (LCR) compliance and reported a loan-to-core deposit ratio of 72%, showcasing a strong liquidity position.

Financial Achievements

The bank's Common Equity Tier 1 (CET1) capital increased by 49 basis points sequentially to 10.29%, reflecting the institution's strong earnings power and balance sheet optimization efforts. This capital strength is crucial for banks like Fifth Third Bancorp, as it provides a buffer against potential losses and supports the bank's growth initiatives.

Furthermore, Fifth Third Bancorp's tangible book value per share increased by 28%, indicating an improvement in the intrinsic value of the company's shares. This metric is particularly important for banks as it provides a more accurate measure of a bank's net asset value by excluding intangible assets and goodwill.

Income Statement and Balance Sheet Analysis

The bank's net interest income (FTE) saw a decrease of 10% year-over-year, coming in at $1.423 billion. Noninterest income showed a modest increase of 1% over the same period last year, totaling $744 million. Noninterest expense rose by 19% year-over-year to $1.455 billion, reflecting higher costs associated with the bank's strategic initiatives and investments.

On the balance sheet, average portfolio loans and leases decreased by 2% from the previous year, while average deposits showed a 5% increase. The bank's net charge-off ratio improved, declining 9 basis points from the previous quarter to 0.32%.

From Tim Spence, Fifth Third Chairman, President and CEO: "Fifth Third delivered strong operating results in 2023 while continuing to successfully navigate the challenging environment. We generated record revenue while prudently managing expenses and continuing to invest in our businesses. Our credit metrics reflect disciplined credit risk management, with net charge-offs for the quarter in-line with our expectations."

Outlook and Strategic Focus

Despite the headwinds faced in the fourth quarter, Fifth Third Bancorp remains committed to its guiding principles of stability, profitability, and growth. The bank's strategic branch expansion, particularly in high-growth Southeast markets, and its focus on consumer household growth, which increased by 3% compared to the prior year, position it well for future performance.

The bank's solid capital position, coupled with its disciplined approach to risk management, provides a foundation for resilience in the face of economic and regulatory uncertainties. As Fifth Third Bancorp continues to invest in growth and navigate the evolving landscape, it remains well-positioned to respond to a range of potential outcomes.

For more detailed information and analysis, investors and stakeholders are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Fifth Third Bancorp for further details.

This article first appeared on GuruFocus.