FIL Ltd Bolsters Portfolio with iShares MSCI South Africa ETF Acquisition

On November 10, 2023, FIL Ltd (Trades, Portfolio), a prominent asset management firm, expanded its investment portfolio by adding 3,877,298 shares of iShares MSCI South Africa ETF (EZA). This transaction marked a significant increase in the firm's holdings, with a trade impact of 0.18% at a trade price of $38.69. Following the acquisition, FIL Ltd (Trades, Portfolio) now holds a total of 3,880,000 shares in EZA, representing a substantial 48.50% of the company's portfolio in the traded stock.

Understanding FIL Ltd (Trades, Portfolio)'s Market Presence

FIL Ltd (Trades, Portfolio), known as Fidelity Worldwide Investments, is a global asset management company with a rich history dating back to 1969. With a presence in 24 countries and a team of over 7,000 employees, including more than 400 investment professionals, FIL Ltd (Trades, Portfolio) has established itself as a powerhouse in the investment world. The firm's client base is diverse, encompassing retail clients, financial institutions, and corporations. Fidelity Worldwide Investments is renowned for its active, research-driven investment approach, covering a significant portion of the global market capitalization and investment-grade credit universe.

FIL Ltd (Trades, Portfolio)'s Investment Philosophy and Strategy

FIL Ltd (Trades, Portfolio)'s investment philosophy is rooted in the belief that markets are semi-efficient. The firm employs a bottom-up investment strategy, heavily reliant on meticulous research. This approach has led to a portfolio dominated by top holdings in sectors such as Technology and Financial Services, with major positions in companies like Alphabet Inc (NASDAQ:GOOGL) and Microsoft Corp (NASDAQ:MSFT). With an equity portfolio valued at $84.84 billion, FIL Ltd (Trades, Portfolio)'s investment decisions are closely watched by the market.

Snapshot of iShares MSCI South Africa ETF (EZA)

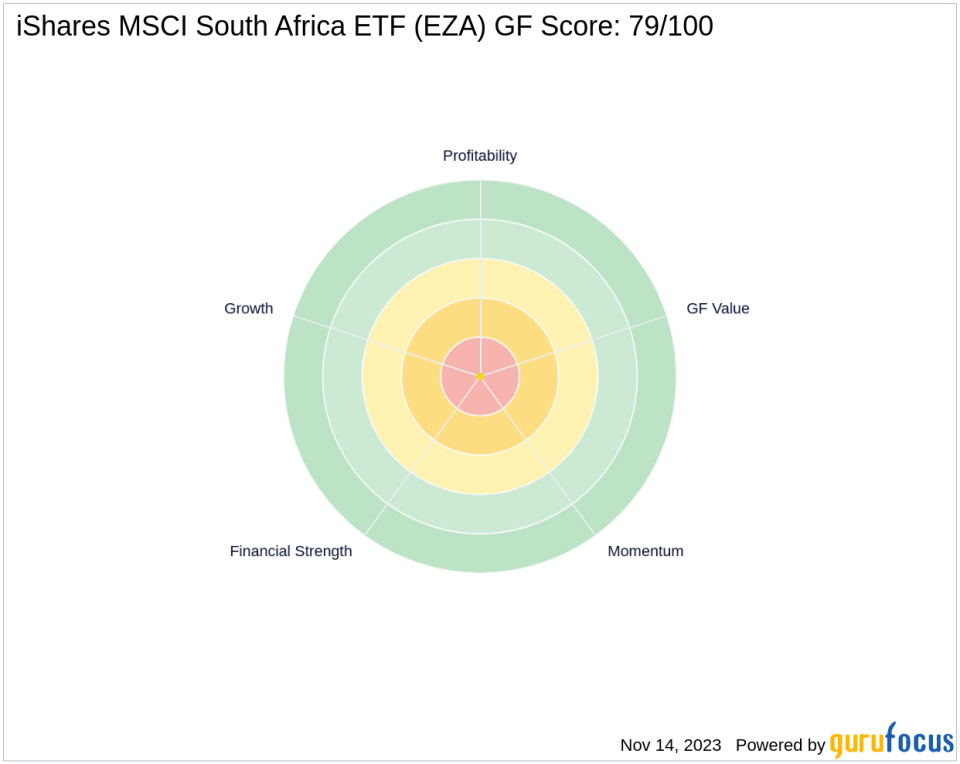

The iShares MSCI South Africa ETF (EZA) is designed to track the investment results of an index composed of South African equities. With a market capitalization of $326.24 million, EZA offers investors exposure to the South African market. As of the latest data, the ETF's stock price stands at $40.78, reflecting a 5.4% gain since the trade date. Despite a year-to-date decline of 6.77%, EZA boasts a GF Score of 79/100, indicating a likely average performance potential.

Trade Impact on FIL Ltd (Trades, Portfolio)'s Portfolio

The recent acquisition of EZA shares by FIL Ltd (Trades, Portfolio) has a moderate impact on the firm's portfolio, with a trade position of 0.18%. This move aligns with FIL Ltd (Trades, Portfolio)'s strategy of diversifying its investments and tapping into emerging markets. The significant stake in EZA now accounts for nearly half of the firm's holdings in the traded stock, underscoring the firm's confidence in the ETF's potential.

EZA's Market Performance and Prospects

Since the trade, EZA has shown a positive trajectory, with its stock price increasing by 5.4%. The ETF has also experienced a substantial growth of 107.43% since its IPO. However, due to the lack of data on financial metrics such as PE percentage and GF Valuation, it is challenging to evaluate EZA's intrinsic value and future performance accurately.

Deciphering FIL Ltd (Trades, Portfolio)'s Motivation for the EZA Trade

While the specific reasons behind FIL Ltd (Trades, Portfolio)'s decision to invest in EZA are not publicly disclosed, it is plausible that the firm's investment strategy and market conditions played a role. The addition of EZA to FIL Ltd (Trades, Portfolio)'s portfolio may reflect a strategic move to capitalize on potential growth opportunities within the South African market, aligning with the firm's global investment outlook.

Concluding Thoughts on FIL Ltd (Trades, Portfolio)'s Strategic Move

FIL Ltd (Trades, Portfolio)'s recent trade indicates a strategic enhancement of its portfolio, with potential implications for both the firm and the iShares MSCI South Africa ETF. This investment decision is consistent with FIL Ltd (Trades, Portfolio)'s history of active, research-based value investing and its focus on diversifying across various sectors and geographies. As the market continues to evolve, the performance of EZA will be an area of interest for investors monitoring FIL Ltd (Trades, Portfolio)'s portfolio dynamics.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.