Financial Institutions (FISI) in Focus on Solid Dividend

With the banking industry continuing to face turmoil due to deposit outflows and expectations of economic slowdown/recession, investors should keep an eye on robust dividend-yielding stocks. Today, we are discussing one such stock, Financial Institutions, Inc. FISI.

Based in Warsaw, NY, FISI offers banking and financial services to individuals, municipalities and businesses in New York. The company has increased the dividend annually for the last 13 years. The latest dividend hike of 3.4% to 30 cents per share was announced this February.

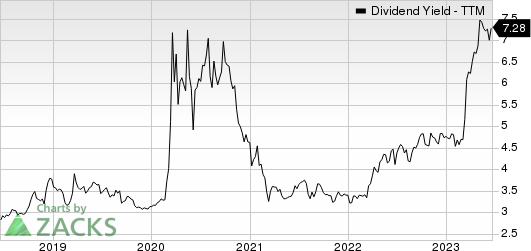

Considering the last day’s closing price of $16.49, FISI’s dividend yield currently stands at 7.28%. This is quite impressive compared with the industry average of 2.97% and attractive for income investors as it represents a steady income stream.

Financial Institutions, Inc. Dividend Yield (TTM)

Financial Institutions, Inc. dividend-yield-ttm | Financial Institutions, Inc. Quote

Is the Financial Institutions stock worth watching to earn a robust dividend yield? Let’s check out the company’s fundamentals to understand risk and rewards. This will help us make a correct investment decision.

Apart from regular dividend payouts, FISI has a share repurchase program in place. In June 2022, the board of directors authorized the buyback of up to 766,447 shares. As of Mar 31, 2023, the whole authorization was available.

FISI has been witnessing consistent organic growth. The company’s net revenues recorded a compound annual growth rate (CAGR) of 7.7% over the last five years (2017-2022). The rise was mainly driven by solid loan and deposit balances and business restructuring initiatives. During the same time frame, net loans witnessed a CAGR of 8.2% and deposits saw a CAGR of 9%. Supported by steady loan demand and higher rates, along with the efforts to strengthen fee income, Heritage Commerce’s top-line growth is expected to continue.

Further, with the Federal Reserve expected to keep interest rates high in the near term to control inflation, Financial Institutions’ net interest margin is likely to keep rising. However, the pace of growth is expected to slow down a bit on higher funding costs.

FISI’s inorganic expansion efforts are impressive and have majorly supported the expansion of its wealth management business. In May 2023, the company announced the merger of its wholly-owned SEC-registered investment advisory firms HNP Capital, LLC and Courier Capital, LLC.

Martin K. Birmingham, president and CEO, said, “In addition to supporting Courier Capital’s growth, this merger streamlines our ability to provide innovative financial products and services to current and prospective clients, including those of Five Star Bank and SDN Insurance Agency, LLC.” FISI forayed into the investment advisory space in 2016 and, since then, has been striving to further strengthen its wealth offerings.

Financial Institutions has a solid balance sheet position. As of Mar 31, 2023, the company’s total borrowings were $240.3 million (almost 48% is short-term in nature), while total cash and cash equivalents were $140 million. Given the earnings strength and robust liquidity position, the company will be able to meet its debt obligations even if the economic situation worsens.

Despite near-term headwinds that include rising expenses, worsening asset quality and a tough operating environment, FISI is fundamentally solid. So far this year, shares of this Zacks Rank #3 (Hold) company have plunged 32.4% compared with the industry’s fall of 18.3%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Hence, income investors should keep Financial Institutions stock on their radar as it will help generate robust returns over time.

Other Bank Stocks With Robust Dividends

A couple of major bank stocks, like Associated Banc-Corp ASB and Columbia Banking System COLB, are worth a look as these have robust dividend yields.

Considering the last day’s closing price, Associated Banc-Corp’s dividend yield currently stands at 5%. Over the past three months, shares of ASB have lost 6.2%.

Based on the last day’s closing price, Columbia Banking System’s dividend yield currently stands at 6.37%. Over the past three months, shares of COLB have rallied 6.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Financial Institutions, Inc. (FISI) : Free Stock Analysis Report

Columbia Banking System, Inc. (COLB) : Free Stock Analysis Report

Associated Banc-Corp (ASB) : Free Stock Analysis Report