Financially Sound Materials Stocks Selling At A Discount

A favourable economic condition has been a large driver of growth for companies in the materials industry. Therefore, this industry is a macroeconomic play with the opportunity of riding the wave in times of robust demand for commodities. Pan African Resources and RPC Group are materials industry stocks on my list that are potentially undervalued, which means their current share prices are trading well-below what the companies are actually worth. Investors can profit from the difference by investing in these cyclical stocks as the current market prices should eventually move towards their true values. If capital gains are what you’re after in your next investment, I’ve put together a list of undervalued stocks you may be interested in, based on the latest financial data from each company.

Pan African Resources PLC (AIM:PAF)

Pan African Resources PLC engages in the exploration of precious metals in South Africa. Founded in 2000, and now run by Jacobus Loots, the company size now stands at 3,932 people and has a market cap of GBP £138.11M, putting it in the small-cap group.

PAF’s stock is now hovering at around -62% under its actual worth of £0.2, at a price of UK£0.077, based on my discounted cash flow model. This difference in price and value gives us a chance to buy low. What’s even more appeal is that PAF’s PE ratio stands at around 9.68x relative to its Metals and Mining peer level of, 12.38x implying that relative to its comparable set of companies, we can invest in PAF at a lower price. PAF also has a healthy balance sheet, as near-term assets sufficiently cover liabilities in the near future as well as in the long run.

More on Pan African Resources here.

RPC Group Plc (LSE:RPC)

RPC Group Plc operates as a plastic product design and engineering company worldwide. Formed in 1991, and headed by CEO Pim Vervaat, the company provides employment to 25,000 people and with the stock’s market cap sitting at GBP £3.38B, it comes under the mid-cap group.

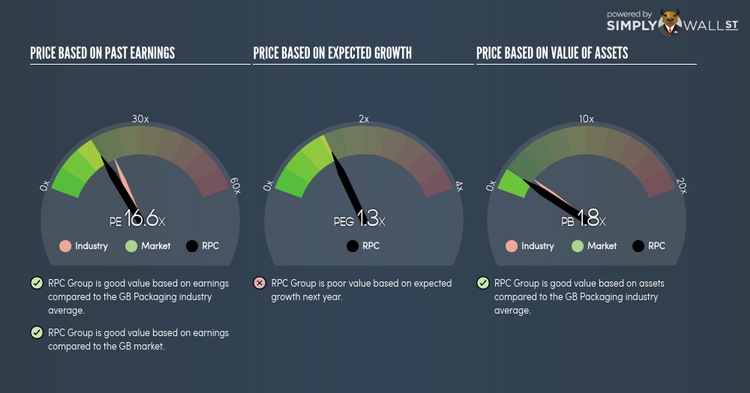

RPC’s shares are now floating at around -34% under its true level of £12.6, at a price of UK£8.32, according to my discounted cash flow model. This mismatch indicates a potential opportunity to buy low. Also, RPC’s PE ratio is around 16.62x against its its Packaging peer level of, 20.29x implying that relative to its competitors, we can invest in RPC at a lower price. RPC also has a healthy balance sheet, as current assets can cover liabilities in the near term and over the long run. It’s debt-to-equity ratio of 76.16% has been declining over time, showing its capability to pay down its debt. Interested in RPC Group? Find out more here.

Polymetal International Plc (LSE:POLY)

Polymetal International plc operates as a precious metals mining company in the Russia Federation, Kazakhstan, and Armenia. Founded in 1998, and now run by Vitaly Nesis, the company currently employs 11,575 people and with the stock’s market cap sitting at GBP £3.38B, it comes under the mid-cap stocks category.

POLY’s stock is currently hovering at around -40% below its actual worth of $13.17, at a price of UK£7.85, based on my discounted cash flow model. This price and value mismatch indicates a potential opportunity to buy the stock at a low price. In terms of relative valuation, POLY’s PE ratio is trading at 13.33x while its index peer level trades at, 17.2x implying that relative to other stocks in the industry, you can buy POLY for a cheaper price. POLY is also strong in terms of its financial health, with short-term assets covering liabilities in the near future as well as in the long run.

Continue research on Polymetal International here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks. Or create your own list by filtering AIM and LSE companies based on fundamentals such as intrinsic discount, health score and future outlook using this free stock screener.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.