Finding the Best Highly-Ranked Value Stocks to Buy in November

Stocks soared on Tuesday morning following the release of October CPI data that showcased cooling inflation. Prices were flat month-over-month, while core CPI edged 0.2% higher to come in below expectations.

The bulls are now revving up their engines on bets that Jay Powell and the Fed are done raising rates. Wall Street is also growing more optimistic that the central bank will slowly start to cut interest rates in the back half of 2024.

More bears are likely getting flushed out of positions as the market continues to rip off its late October lows and higher above its 200-day and 50-day moving averages. Therefore, investors likely want to remain exposed to the upside potential to close out the year.

Now, of course, many investors might not want to ‘chase’ stocks at some lofty valuations. So today we show investors how to find stocks that offer a wonderful combination of strong value and improving earnings outlooks.

Screen Basics

The screen we are digging into today comes loaded with the Research Wizard and aims to sort through highly-ranked Zacks stocks to find some of the top value names.

This value-focused screen searches only for stocks that boast Zacks Rank #1 (Strong Buys) or #2 (Buys). It also focuses on stocks with price-to-earnings (P/E) ratios under the median for its industry. The screen also looks for stocks with price-to-sales (P/S) ratios under the median for its industry to help lock in relative value compared to its peers, since basing it off the wider market is not always the most useful tool.

The screen then digs into quarterly earnings rates above the median for its industry. This particular Zacks screen also uses a special blend of upgrades and estimates revisions to select the best seven stocks in this list.

The screen basics are listed below…

· Only Zacks Rank #1 (Strong Buy) or #2 (Buy) Stocks

· P/E (using 12-month EPS) - Under the Median for its Industry

· P/S - Under the Median for its Industry

· Percentage Change Act. EPS Q(0)/Q(-1)

· Rating Change and Revisions Factors (to help narrow the list to the 7 best stocks in this list)

This strategy comes loaded with the Research Wizard and it is called bt_sow_value_method1. It can be found in the SoW (Screen of the Week) folder.

The screen is pretty simple, yet powerful. Here are two of the seven stocks that made it through this week's screen…

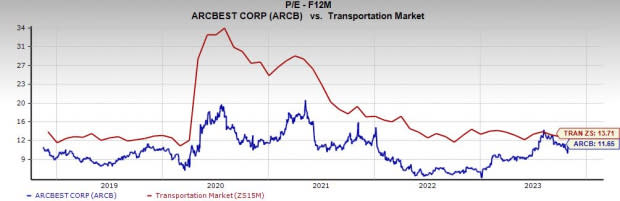

ArcBest (ARCB)

ArcBest is a supply chain logistics firm that boasts it offers access to 90% of U.S. LTL (less-than-truckload) capacity with its easy-to-use quote tool. The Fort Smith, Arkansas-headquartered firm is actively expanding its network and it posted back-to-back years of over 30% revenue growth. ArcBest is projected to see its adjusted earnings and revenue slip in 2023 as it faces that tough-to-compete-against stretch.

ArcBest is then projected to return to sales and earnings growth next year. ARCB blew away our Q3 earnings estimates at the end of October and provided upbeat guidance that helps it land a Zacks Rank #2 (Buy) right now. ArcBest shares have climbed 275% in the past five years vs. the Zacks Transportation Sector’s 30% run.

Image Source: Zacks Investment Research

ARCB stock has popped 75% in the last 12 months, including a huge post-release sure that coincided with the wider market comeback that has ArcBest trading near fresh highs. On top of that, ArcBest trades at a 40% discount to its own five-year highs and solidly below its sector at 11.7X forward 12-month earnings. And it pays a dividend.

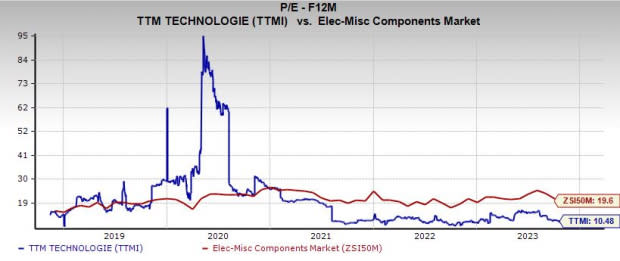

TTM Technologies (TTMI)

TTM Technologies, which stands for time-to-market, is a manufacturer of tech solutions such as mission systems, radio frequency components, RF microwave/ microelectronic assemblies, quick-turn and technologically advanced printed circuit boards, and more. TTM Technologies aims to shorten the time it takes its customers to bring a new product to market.

TTM Technologies crushed our adjusted earnings estimate in consecutive periods, including a 54% bottom-line beat on November 1. TTMI’s upbeat outlook helps it grab a Zacks Rank #1 (Strong Buy) right now. The stock also earns “A” grades for both Value and Momentum in our Style Scores system.

Image Source: Zacks Investment Research

TTM Technologies stock has climbed 21% in the last five years to outpace its industry’s 3% gain. TTMI shares are also currently trading about 27% below their average Zacks price target. On the valuation end, TTMI stock now sits at 10.5X forward 12-month earnings, representing a roughly 50% discount compared to its industry and 30% vs. its own five-year median.

Click here to sign up for a free trial to the Research Wizard today.

Want more articles from this author? Scroll up to the top of this article and click the FOLLOW AUTHOR button to get an email each time a new article is published.

Disclosure: Officers, directors and/or employees of Zacks Investment Research may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material. An affiliated investment advisory firm may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material.

Disclosure: Performance information for Zacks’ portfolios and strategies are available at: https://www.zacks.com/performance/.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TTM Technologies, Inc. (TTMI) : Free Stock Analysis Report

ArcBest Corporation (ARCB) : Free Stock Analysis Report