UP Fintech Holding (NASDAQ:TIGR) investors are sitting on a loss of 26% if they invested a year ago

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in UP Fintech Holding Limited (NASDAQ:TIGR) have tasted that bitter downside in the last year, as the share price dropped 26%. That contrasts poorly with the market decline of 0.02%. The silver lining (for longer term investors) is that the stock is still 9.0% higher than it was three years ago. It's down 28% in about a quarter. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

See our latest analysis for UP Fintech Holding

Given that UP Fintech Holding didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In just one year UP Fintech Holding saw its revenue fall by 16%. That looks pretty grim, at a glance. The stock price has languished lately, falling 26% in a year. What would you expect when revenue is falling, and it doesn't make a profit? It's hard to escape the conclusion that buyers must envision either growth down the track, cost cutting, or both.

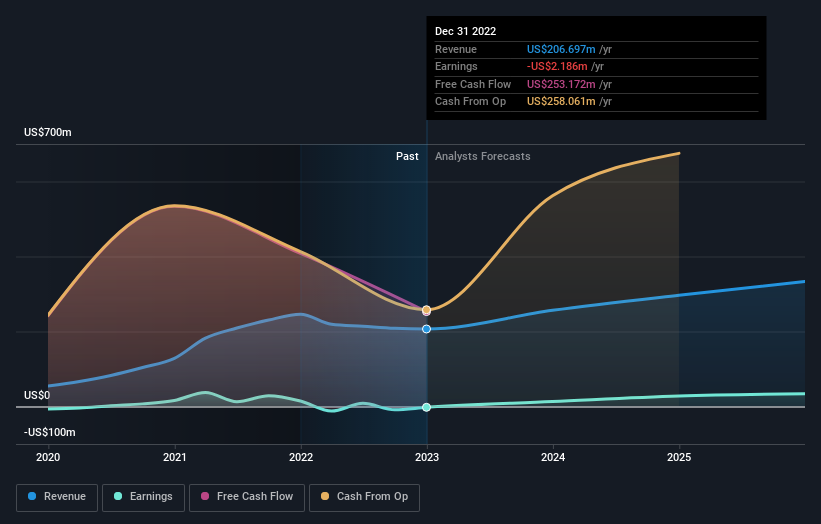

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling UP Fintech Holding stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

The last twelve months weren't great for UP Fintech Holding shares, which performed worse than the market, costing holders 26%. The market shed around 0.02%, no doubt weighing on the stock price. Investors are up over three years, booking 2.9% per year, much better than the more recent returns. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. You could get a better understanding of UP Fintech Holding's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here