Fintech startup EduFi secures $6.1m led by Zayn VC to launch student loans with Study Now Pay Later

EduFi launches the first-ever digital student loan platform in Pakistan, on a mission to empower more students to achieve their academic pursuits.

Singapore --News Direct-- EduFi

Education is a lever of economic growth and social development in any country but poor quality state school provision often drives many families to fee-paying schools. Helping these families manage the financial challenges of school fees, EduFi is today announcing a $6.1m funding round for its Study Now, Pay Later lending platform. It has launched in Pakistan, a country where 40% of students are attending a fee-paying school and spending over $14 billion for their education every year.

The pre-seed funding round was led by Zayn VC with participation from Palm Drive Capital, Deem Ventures Ltd, Q Business, Abhi, Adalfi, Techlogix and other angel investors. EduFi is a fintech platform and mobile app that enables students to secure loans for their school fees. EduFi works with liquidity providers and schools to drive successful student loans. The platform is underpinned by a proprietary education sector focused credit scoring model using advanced machine learning algorithms and artificial intelligence.

Aleena Nadeem, Founder & CEO of EduFi commented: “We conceived and built this product to serve markets that have low credit penetration. Pakistan presented an ideal opportunity to launch because the need is the greatest and we had a first-mover advantage. Firstly, banks don’t offer student loans, instead users take personal loans which are riddled with a high cost of origination owing to physical verification of identity, personal assets and financial health. The absence of credit scoring has restricted credit access to a thin, top tier of customers. We want to expand the credit and student loan opportunity to a much wider audience of students across the country. Secondly, we feel student loans can be a bridge to the country’s two biggest problems - high levels of poverty and low literacy rates - and catalyze economic growth”.

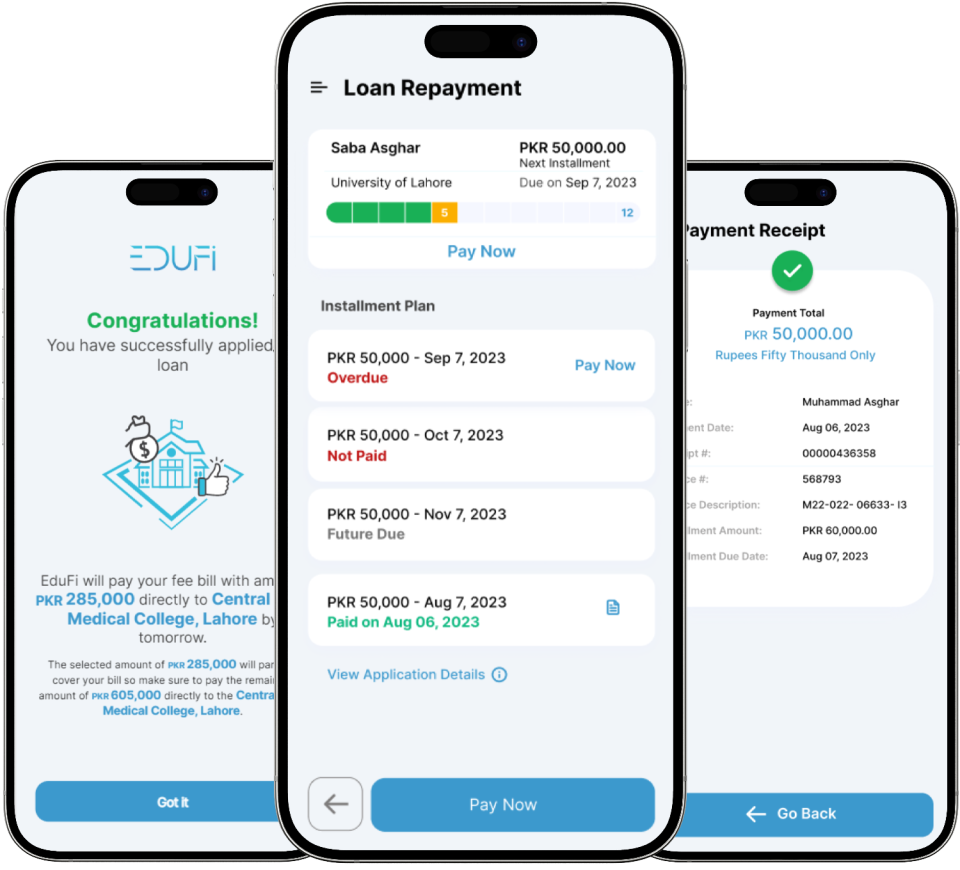

The EduFi team has created a full tech stack that provides visibility to liquidity providers on their capital performance and enables schools to capture student performance metrics such as attendance, overdue fees, drop out rates and academic performance of the students. In addition, the EduFi App UX offers an unparalleled pathway for users to quickly and easily access student loans. Combined, this end-to-end tech stack powers the EduFi credit scoring system to disperse student loans within 48 hours of application.

The loan journey offers a faster and simpler application process, fast loan disbursement, flexible repayment options and provides more convenience and accessibility than the traditional lenders. EduFi has ended the weeks of manual work to a few minutes in offering and making a student loan.

Headquartered in Singapore, EduFi was founded in 2021 by Aleena Nadeem. Having benefited from an MIT education and a successful finance career, her conviction that education opens pathways was the genesis for EduFi. The wider team has over several decades combined experience across banking, education and technology. The EduFi model is based on research and analysis the team conducted on the cultural, social, and economic factors that shape the decisions and behaviors of parents regarding education and finance. Based on these insights, EduFi is designed to be intuitive, transparent, and secure for the users.

EduFi’s vision is to be more than a platform but a lifeline and community for aspiring students to unlock their true potential. Through its partnerships with 15 colleges across Pakistan, EduFi is now available to over 200,000 students to pay their school fees.

Aleena Nadeem, CEO and founder of EduFi commented: “Education offers hope and can change the lives of people. I am one example of millions out there. EduFi offers this hope and will be a trigger for change in the lives of people as we lift one of the biggest burdens on aspiring families. For example, students in dental or medical schools have to pay upwards of $8,000 upfront which is not sustainable for many in Pakistan. Every student we’ve helped is testament to the ambition, opportunity and empowerment we are striving for at EduFi.”

According to a recent Unesco report, families in Pakistan spend 57% of their income on children's education, a sum total of $14 billion annually. Pakistan ranks second across South Asia and Southeast Asia in terms of expenditure on education. This presents a significant opportunity for EduFi to support students on their academic journey.

Faisal Aftab, General Partner & Founder at Zayn VC commented: “We are thrilled to support Aleena's vision for EduFi, which aims to provide financing options for families to fund their children's higher education. This is a significant step towards achieving financial inclusion for middle and low-income families. In Pakistan, families spend more than 50% of their income on their children's education, which has become increasingly challenging due to inflationary pressures. EduFi's innovative approach will help alleviate this burden and empower families to invest in their children's future.”

About EduFi

Headquartered in Singapore, EduFi was founded in 2021 by Aleena Nadeem. It is Pakistan's first student loan platform, helping students finance and plan for their education. The innovative platform streamlines the borrowing process, making it easy for students to apply for loans and access funds quickly. For more information please visit: https://www.edufi.tech/

About Zayn VC

Zayn Venture Capital (Zayn.VC) is a prominent Venture Capital Fund, spearheaded by Faisal Aftab, that is dedicated to supporting and financing innovative Pakistani start-ups that are leveraging technology to revolutionize various industries. Zayn VC primarily focuses on early-stage tech companies and, although they are sector-agnostic, they meticulously analyze each company through a FinTech lens. For further details, please visit www.zayn.vc.

Contact Details

EduFi

Bilal Mahmood

+44 7714 007257

b.mahmood@stockwoodstrategy.com

Company Website

View source version on newsdirect.com: https://newsdirect.com/news/fintech-startup-edufi-secures-6-1m-led-by-zayn-vc-to-launch-student-loans-with-study-now-pay-later-135068986