First Advantage Corp (FA) Navigates Economic Headwinds with Solid 2023 Earnings, Announces ...

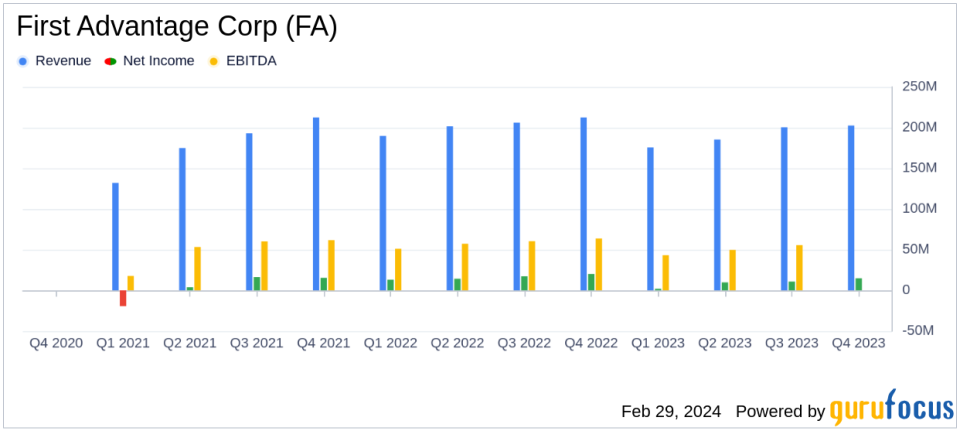

Revenue: Full year 2023 revenue decreased by 5.7% to $763.8 million.

Net Income: Net income for 2023 stood at $37.3 million, a 42.3% decline from the previous year.

Adjusted EBITDA: Adjusted EBITDA reached $237.6 million for the year, down 4.6%.

Earnings Per Share: GAAP Diluted Net Income Per Share was $0.26, with Adjusted Diluted Earnings Per Share at $1.00.

Cash Flow: Operations generated $162.8 million in cash flow for 2023.

Acquisition: Announced agreement to acquire Sterling Check Corp. in a $2.2 billion deal expected to drive shareholder returns.

2024 Guidance: Provided full-year 2024 guidance with revenue expected between $750 million and $800 million.

On February 29, 2024, First Advantage Corp (NASDAQ:FA), a global leader in employment background screening and verification solutions, disclosed its financial results for the full year and fourth quarter ended December 31, 2023. The company, which operates in both the Americas and International segments, released its 8-K filing showcasing a year of strategic execution despite economic uncertainties.

Financial Performance and Challenges

First Advantage Corp's revenue for 2023 was $763.8 million, a 5.7% decrease from the previous year's $810.0 million. The company's net income also saw a significant reduction, falling 42.3% to $37.3 million. Despite these challenges, the company achieved an Adjusted EBITDA of $237.6 million and maintained a strong Adjusted EBITDA Margin of 31.1%. The Adjusted Diluted Earnings Per Share for the year was $1.00.

The company's performance reflects resilience in the face of a challenging macroeconomic environment and evolving labor market. The ability to maintain solid margins and generate substantial cash flow from operations, which amounted to $162.8 million, is particularly important for a business services company like First Advantage Corp, as it indicates a robust underlying business model and operational efficiency.

Strategic Acquisitions and Capital Allocation

First Advantage Corp announced a definitive agreement to acquire Sterling Check Corp. in a transformative $2.2 billion cash and stock transaction. This acquisition is expected to deliver at least $50 million in run-rate synergies and is seen as a significant step in First Advantage's growth strategy, enhancing its customer offerings and market position.

As of December 31, 2023, First Advantage had a healthy liquidity position with cash and cash equivalents of $213.8 million, after significant capital allocation activities, including a $217.7 million one-time special dividend payment, $59.0 million in share repurchases, and the $41.0 million acquisition of Infinite ID.

2024 Outlook and Guidance

Looking ahead, First Advantage provided full-year 2024 guidance, projecting revenues between $750 million and $800 million, and Adjusted EBITDA between $228 million and $248 million. The guidance reflects the company's expectations of the current hiring environment and macroeconomic conditions persisting through 2024.

CEO Scott Staples expressed confidence in the company's flexible business model and disciplined cost management, which were instrumental in achieving a record Adjusted EBITDA Margin and strong cash flow. CFO David Gamsey highlighted the company's balanced approach to capital allocation and the strategic acquisition of Sterling, which is expected to drive improved margins and cash flows.

Value investors and potential GuruFocus.com members interested in the business services sector may find First Advantage Corp's strategic initiatives and financial discipline to be compelling reasons to consider the company as part of their investment portfolio.

For more detailed information on First Advantage Corp's financial results, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from First Advantage Corp for further details.

This article first appeared on GuruFocus.