First American Financial Corp Reports Earnings Amidst Cybersecurity Challenges

Adjusted Earnings Per Share (EPS): Q4 at $0.69, Full Year at $3.80.

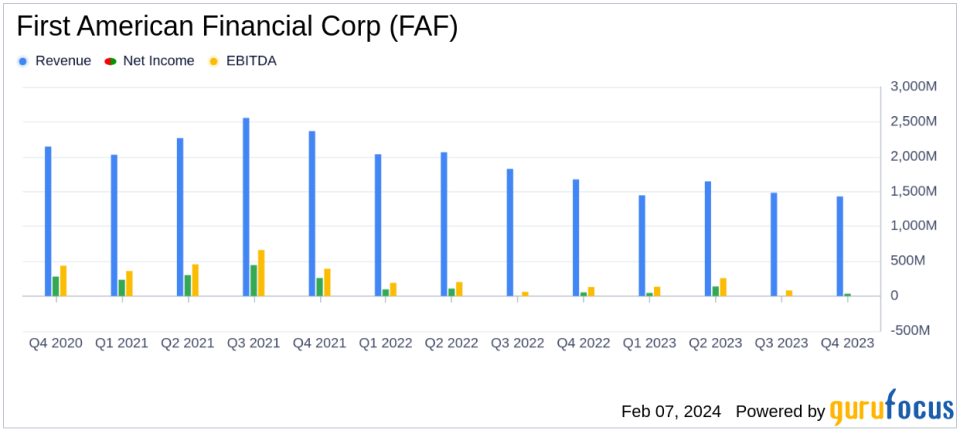

Total Revenue: $1.4 billion in Q4, down 15% YOY; $6.0 billion for Full Year, down 21% YOY.

Net Income: $34.1 million in Q4; $216.8 million for Full Year.

Investment Income: Title Insurance and Services segment maintains $132 million in Q4.

Commercial Revenues: Decreased to $172 million in Q4, a 32% drop YOY.

Share Repurchase: 328,863 shares in Q4; 1.3 million shares for Full Year.

Debt-to-Capital Ratio: 28.6%, or 22.3% excluding certain secured financings.

On February 7, 2024, First American Financial Corp (NYSE:FAF) released its 8-K filing, detailing the financial outcomes for the fourth quarter and full year of 2023. The company, a leading provider of title insurance, settlement services, and risk solutions for real estate transactions, faced significant challenges due to a cybersecurity incident that materially impacted its Q4 results. Despite these challenges, the company's full-year performance reflects its resilience and strategic focus on long-term growth.

Financial Performance Overview

First American Financial Corp reported a decrease in total revenue to $1.4 billion in Q4, a 15% decline from the previous year, and a 21% decrease for the full year, totaling $6.0 billion. The cybersecurity incident had a notable impact on the company's operations, particularly in the fourth quarter. However, the Title Insurance and Services segment reported a steady investment income of $132 million, mirroring last year's performance. The segment's pretax margin stood at 4.5%, or 7.5% on an adjusted basis.

Commercial revenues saw a significant drop of 32% in Q4, amounting to $172 million, while the Home Warranty segment demonstrated a robust pretax margin of 14.9%, or 19.9% on an adjusted basis. The company's debt-to-capital ratio was reported at 28.6%, or 22.3% when excluding secured financings payable of $553 million.

First American Financial Corp also continued its share repurchase program, buying back 328,863 shares in Q4 at an average price of $53.85, and 1.3 million shares for the full year at an average price of $55.18. Additionally, the company raised its common stock dividend by 2% to an annual rate of $2.12 per share.

Income Statement and Balance Sheet Highlights

The company's net income for Q4 was $34.1 million, translating to $0.33 per diluted share, compared to $54.3 million, or $0.52 per diluted share in the same quarter of the previous year. Adjusted net income for Q4 was $72.1 million, or $0.69 per diluted share, a decrease from $147.7 million, or $1.41 per diluted share in Q4 of the prior year. For the full year, net income was $216.8 million, or $2.07 per diluted share, down from $263.0 million, or $2.45 per diluted share in the previous year.

Despite the downturn, CEO Ken DeGiorgio remains optimistic, stating,

We were performing well in a challenging market ahead of the cybersecurity incident... We expect no significant ongoing impact from the incident."

He also highlighted the company's efficient operations and strong balance sheet, which allow for strategic investments and capital return to shareholders.

Strategic Initiatives and Market Outlook

Looking forward, First American Financial Corp anticipates modest growth in its residential and commercial businesses, although this is subject to changes in mortgage rates. The company's commitment to digital transformation and operational efficiency positions it to navigate the persisting difficult market conditions.

First American Financial Corp's performance in 2023, despite the setbacks, underscores its resilience and strategic focus. The company's ability to maintain a steady investment income and manage its debt-to-capital ratio effectively demonstrates its financial prudence and commitment to shareholder value. As the market anticipates a recovery from the cybersecurity incident, First American Financial Corp's strategic initiatives are expected to support its long-term growth and industry leadership.

For more detailed information on First American Financial Corp's financial results, including the full earnings report and management commentary, please visit the company's investor relations website.

Explore the complete 8-K earnings release (here) from First American Financial Corp for further details.

This article first appeared on GuruFocus.