First Bancorp (FBNC) Reports Mixed Results Amidst GrandSouth Acquisition

Net Income: $29.7 million for Q4 2023, down from $38.4 million in Q4 2022.

Earnings Per Share (EPS): $0.72 for Q4 2023, compared to $1.08 in Q4 2022.

Annual Net Income: $104.1 million for 2023, a decrease from $146.9 million in 2022.

Loan Growth: Loans totaled $8.2 billion, a 22.3% increase year-over-year.

Net Interest Margin (NIM): Decreased to 2.88% in Q4 2023 from 3.32% in Q4 2022.

Noninterest Income: Slightly decreased to $14.5 million in Q4 2023 from $14.6 million in Q4 2022.

Capital Ratios: Common equity tier 1 ratio at 13.20% and total risk-based capital ratio at 15.54% as of Q4 2023.

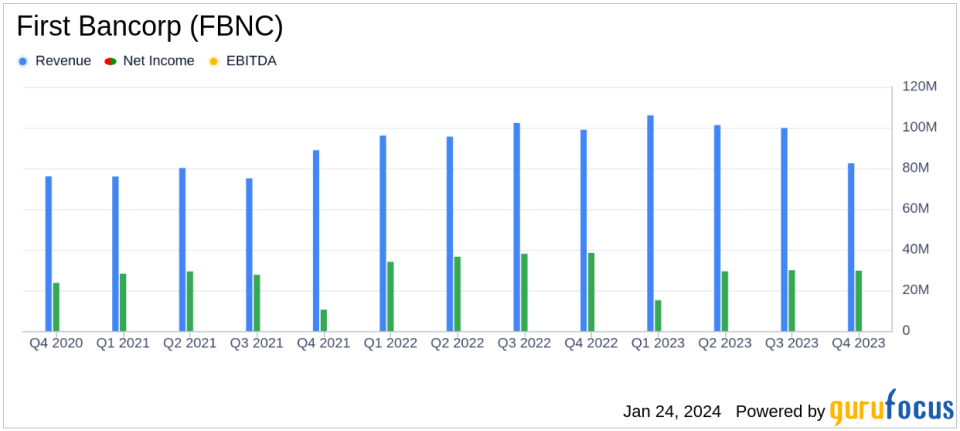

On January 24, 2024, First Bancorp (NASDAQ:FBNC) released its 8-K filing, announcing its financial results for the fourth quarter and full year of 2023. The bank holding company, which operates First Bank and provides a range of banking services, reported a decline in net income and earnings per share compared to the same quarter in the previous year, as well as a decrease in annual net income. However, the company also highlighted significant loan growth and a strong capital position.

Financial Performance and Challenges

First Bancorp's net income for the fourth quarter of 2023 was $29.7 million, or $0.72 per diluted common share, a decrease from $38.4 million, or $1.08 per diluted common share, in the fourth quarter of 2022. The annual net income for 2023 was $104.1 million, or $2.53 per diluted common share, compared to $146.9 million, or $4.12 per diluted common share, for 2022. The company's performance reflects the impact of its acquisition of GrandSouth Bancorporation, which contributed $1.02 billion in loans and $1.05 billion in deposits. The results for 2023 include merger expenses totaling $13.7 million and an initial loan loss provision of $12.2 million for acquired loans.

CEO Richard H. Moore commented on the company's resilience and commitment to growth, stating,

This past year, our Company had great success maintaining and strengthening our core banking relationships with our customers at a time when many banks struggled to do so. In 2024, we will continue to do what we do best serve our customers and our communities all while managing risk and taking advantage of any opportunities that come our way. I am proud of our steady and solid performance in 2023 and look forward to continued growth in 2024."

Key Financial Metrics

First Bancorp's loan portfolio showed robust growth, with loans totaling $8.2 billion at the end of December 2023, marking an annualized growth rate of 6.1%. The total loan yield increased to 5.39%, up from 4.62% in the fourth quarter of 2022. Despite the increase in loan yields, the company's net interest margin declined to 2.88% from 3.32% in the same period last year, primarily due to market-driven increases in rates on liabilities.

Noninterest income remained relatively stable at $14.5 million, while noninterest expenses increased to $56.4 million for the fourth quarter of 2023, up from $45.7 million in the fourth quarter of 2022, largely due to the GrandSouth acquisition. The company's asset quality remained strong with a nonperforming assets to total assets ratio of 0.37%.

Total assets grew to $12.1 billion, a 14.0% increase from the previous year, driven by the GrandSouth acquisition and organic growth. The company's capital ratios remained solid, with a total common equity tier 1 ratio of 13.20% and a total risk-based capital ratio of 15.54%.

Analysis of Company's Performance

First Bancorp's mixed financial results reflect the challenges and costs associated with the GrandSouth acquisition, which has expanded the company's loan portfolio and deposit base. While the acquisition has contributed to significant growth in loans and deposits, it has also led to increased expenses and provisions for loan losses. The company's decrease in net interest margin suggests that the rising cost of funds is outpacing the growth in loan yields, a trend that may continue to affect profitability if interest rates continue to rise.

However, the company's strong capital and liquidity positions, along with its robust loan growth, indicate a solid foundation for future growth. First Bancorp's focus on maintaining core banking relationships and managing risk positions it well to capitalize on opportunities in the coming year.

For more detailed information on First Bancorp's financial results, visit the full 8-K filing.

Explore the complete 8-K earnings release (here) from First Bancorp for further details.

This article first appeared on GuruFocus.