First BanCorp (FBP) Reports Mixed Results Amid Economic Challenges

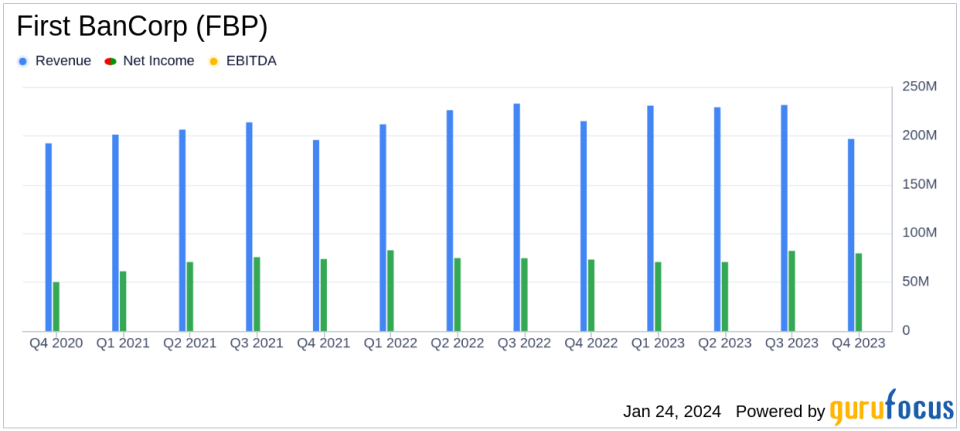

Net Income: Q4 net income of $79.5 million, or $0.46 per diluted share; full-year net income of $302.9 million, or $1.71 per diluted share.

Return on Average Assets: 1.70% for Q4, a slight decrease from 1.72% in Q3; annual return improved to 1.62% from 1.57%.

Net Interest Income: Decreased to $196.7 million in Q4 from $199.7 million in Q3; net interest margin remained flat at 4.14%.

Provision for Credit Losses: Increased to $18.8 million in Q4, up from $4.4 million in Q3, due to higher charge-offs and loan volume growth.

Non-Interest Income: Rose to $33.6 million in Q4, aided by a $3.0 million gain on the sale of a banking premise.

Efficiency Ratio: Worsened to 54.98% in Q4 from 50.71% in Q3, impacted by an FDIC special assessment.

Loan Portfolio: Grew by $233.0 million to $12.2 billion as of December 31, 2023.

On January 24, 2024, First BanCorp (NYSE:FBP) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a financial holding entity operating primarily through its Consumer (Retail) Banking segment, faced a challenging economic environment yet managed to report solid loan growth and maintain strong capital ratios.

Performance and Challenges

FBP's net income for Q4 2023 was $79.5 million, or $0.46 per diluted share, a slight decrease from the $82.0 million, or $0.46 per diluted share, reported in the previous quarter. The annual net income for 2023 was $302.9 million, or $1.71 per diluted share, compared to $305.1 million, or $1.59 per diluted share, in the previous year. The inclusion of a one-time FDIC special assessment expense impacted the net income for both the quarter and the year.

The company's return on average assets (ROAA) experienced a slight dip in Q4 to 1.70% from 1.72% in Q3, while the annual ROAA improved to 1.62% from 1.57%. The net interest income saw a decrease in Q4 due to an increase in interest expense and a reduction in average interest-earning assets, although the net interest margin remained relatively stable.

FBP's provision for credit losses increased significantly in Q4, attributed to higher charge-off levels and loan volume growth across all classes. Non-interest income saw an increase, mainly due to a gain on the sale of a banking premise. However, non-interest expenses also rose, largely due to the FDIC special assessment, resulting in a less favorable efficiency ratio.

Financial Achievements

Despite the challenges, FBP achieved a robust loan growth, with total loans increasing by $233.0 million to $12.2 billion as of December 31, 2023. This growth was primarily driven by commercial and construction loans, as well as consumer loans, particularly auto loans and finance leases. The company also returned approximately $300 million to shareholders through stock repurchases and dividends, demonstrating a strong commitment to shareholder returns.

Key Financial Metrics

Important metrics such as the ratio of the allowance for credit losses to total loans held for investment decreased slightly to 2.15% as of December 31, 2023, from 2.21% as of September 30, 2023. Non-performing assets decreased by $4.3 million to $125.9 million, mainly driven by the commercial and construction loan portfolios.

"We closed an unprecedented and challenging year for the banking industry with another quarter of strong financial performance and solid loan growth for our franchise," said Aurelio Aleman, President and CEO of First BanCorp.

Aleman highlighted the company's strategic initiatives, including digital banking user growth and infrastructure enhancements, and expressed confidence in the economic prospects of their primary market.

Analysis of Company's Performance

FBP's performance in Q4 and the full year of 2023 reflects resilience in the face of economic headwinds. The company's ability to grow its loan portfolio and maintain strong capital ratios is commendable. However, the increased provision for credit losses and the rise in non-interest expenses due to the FDIC special assessment are areas of concern that investors should monitor.

For a detailed analysis of First BanCorp's financial results, including comprehensive financial tables and metrics, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from First BanCorp for further details.

This article first appeared on GuruFocus.