First BanCorp's Meteoric Rise: Unpacking the 24% Surge in Just 3 Months

First BanCorp (NYSE:FBP), a financial holding company operating in the banking industry, has seen a significant surge in its stock price over the past three months. The company's stock price has risen by 24.42%, from $14.31 to a market cap of $2.55 billion. Over the past week alone, the stock has gained 4.47%. This impressive performance is reflected in the company's GF Value, which has increased from $16.83 to $17.49 over the past three months. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. The stock's GF Valuation has also improved, moving from 'Significantly Undervalued' to 'Modestly Undervalued'.

Company Overview

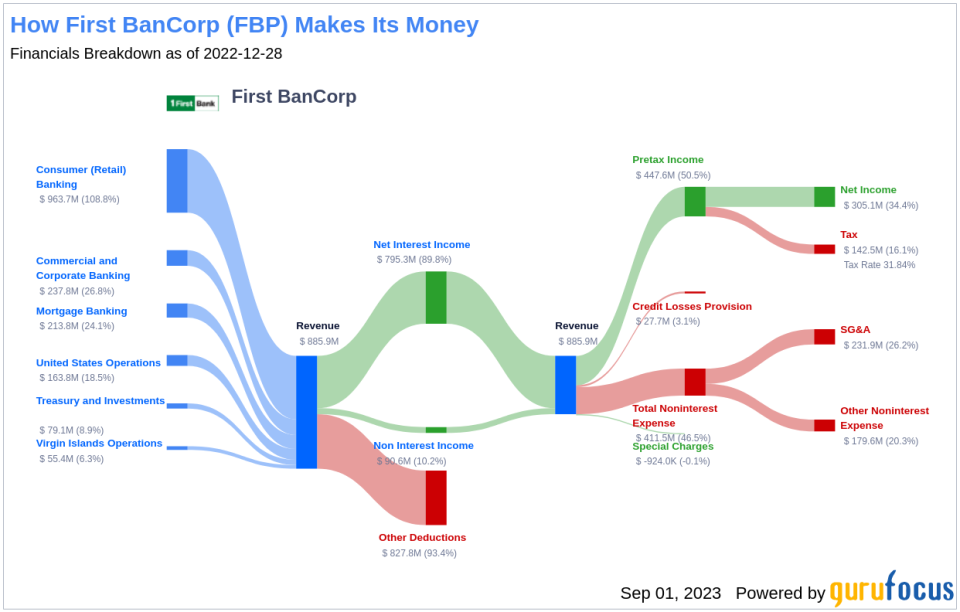

First BanCorp is a financial holding company with a diverse portfolio of operations. The company's primary revenue generation comes from its Consumer (Retail) Banking segment, which includes consumer lending and deposit-taking activities conducted mainly through its branch network and loan centres. The company has a strong geographical presence in Puerto Rico, where it derives a majority of its revenue.

Profitability Analysis

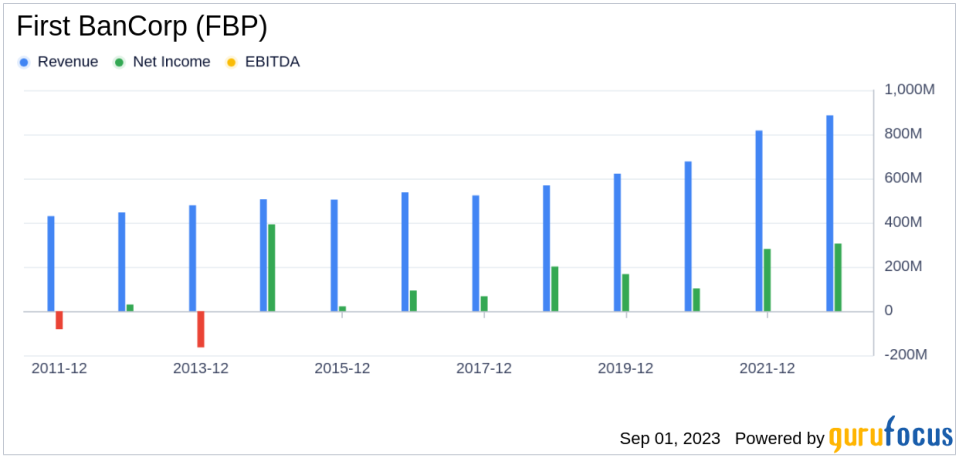

First BanCorp's profitability is commendable, with a Profitability Rank of 5/10. This rank indicates the company's relative profitability within the banking industry. The company's Return on Equity (ROE) stands at 20.79%, which is better than 91.23% of 1448 companies in the same industry. The company's Return on Assets (ROA) is 1.53%, outperforming 78.99% of 1452 companies in the banking industry. Over the past 10 years, the company has demonstrated consistent profitability, better than 34.4% of 1462 companies.

Growth Prospects

First BanCorp has shown promising growth, with a Growth Rank of 5/10. This rank indicates the company's relative growth within the industry. The company's 3-Year and 5-Year Revenue Growth Rate per Share are 17.30% and 13.60% respectively, outperforming 86.5% and 84.78% of companies in the same industry. The company's 3-Year and 5-Year EPS without NRI Growth Rate are 27.90% and 28.90% respectively, better than 84.24% and 90.56% of companies in the banking industry.

Major Stock Holders

The top three holders of First BanCorp's stock are HOTCHKIS & WILEY, Paul Tudor Jones (Trades, Portfolio), and Mario Gabelli (Trades, Portfolio). HOTCHKIS & WILEY holds 890,555 shares, accounting for 0.5% of the company's stock. Paul Tudor Jones (Trades, Portfolio) holds 228,967 shares, representing 0.13% of the company's stock. Mario Gabelli (Trades, Portfolio) holds 84,000 shares, accounting for 0.05% of the company's stock.

Competitive Landscape

First BanCorp operates in a competitive industry, with major competitors including CVB Financial Corp (NASDAQ:CVBF) with a market cap of $2.51 billion, Axos Financial Inc (NYSE:AX) with a market cap of $2.63 billion, and First Hawaiian Inc (NASDAQ:FHB) with a market cap of $2.47 billion.

Conclusion

In conclusion, First BanCorp's impressive stock performance, robust profitability, promising growth prospects, and strong shareholder base position it well in the banking industry. Despite facing stiff competition, the company's consistent profitability and growth indicate a promising future. Investors should keep a close eye on this stock as it continues to demonstrate strong performance.

This article first appeared on GuruFocus.