First Business Financial Services Inc Reports Q4 2023 Results

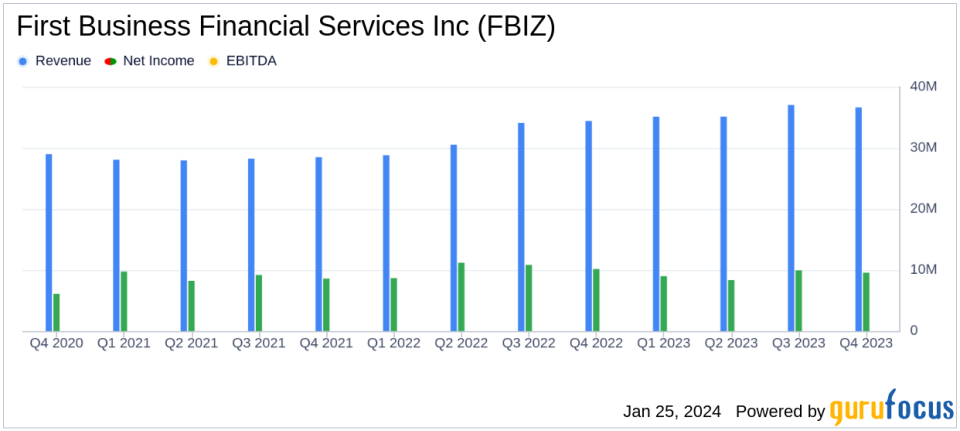

Net Income: $9.6 million for Q4 2023, compared to $9.7 million in Q3 2023 and $9.9 million in Q4 2022.

Earnings Per Share: Diluted EPS of $1.15 for Q4 2023, down from $1.17 in Q3 2023 and $1.18 in Q4 2022.

Loan Growth: Loans increased by 17% year-over-year, with a $86.2 million or 12.5% annualized increase from Q3 2023.

Deposit Growth: Deposits grew by 29% year-over-year, with a $139.8 million or 21.0% annualized increase from Q3 2023.

Net Interest Margin: Declined to 3.69% in Q4 2023 from 3.76% in Q3 2023 and 4.15% in Q4 2022.

Tangible Book Value Per Share: Increased by 13.9% annualized from Q3 2023 and 12.9% from Q4 2022.

Private Wealth Assets: Surpassed $3 billion in assets under management, marking a new milestone.

On January 25, 2024, First Business Financial Services Inc (NASDAQ:FBIZ) released its 8-K filing, announcing its financial results for the fourth quarter of 2023. The company, operating as a business bank, focuses on delivering a full line of commercial banking products to small and medium-sized businesses, executives, professionals, and high-net-worth individuals in the United States.

FBIZ reported a slight decrease in net income available to common shareholders to $9.6 million, or $1.15 per diluted share, compared to $9.7 million, or $1.17 per share, in the third quarter of 2023, and $9.9 million, or $1.18 per share, in the fourth quarter of 2022. Despite the marginal decline, the company achieved significant growth in loans and deposits, surpassing the goals set in its five-year strategic plan.

Corey Chambas, Chief Executive Officer, highlighted the success in attracting new client relationships, which drove the record pre-tax, pre-provision income. Chambas also noted the bank's ability to manage net interest margin amidst the current interest rate environment and the success of its deposit-centric strategy.

"We had tremendous success attracting new client relationships in the fourth quarter, which again drove robust loan and deposit growth and resulted in record pre-tax, pre-provision income," said Corey Chambas, Chief Executive Officer.

FBIZ's loan portfolio saw an increase of $86.2 million, or 12.5% annualized, from the third quarter of 2023, and a 16.7% increase from the fourth quarter of 2022. The deposit growth was even more pronounced, with a $139.8 million, or 21.0% annualized increase from the third quarter, and a 29.0% increase from the fourth quarter of 2022. This growth reflects the bank's successful execution of client deposit initiatives and its ability to attract new relationships.

However, the net interest margin declined to 3.69%, a decrease of seven basis points from the linked quarter, primarily due to recent deposit client acquisition and retention at higher deposit rates. Despite this, the bank's net interest income expanded by 3.3% from the linked quarter and 7.6% from the prior year quarter.

The tangible book value per common share grew by 13.9% annualized compared to the linked quarter and 12.9% compared to the prior year quarter, indicating strong earnings generation. Additionally, Private Wealth assets under management and administration grew to record levels, exceeding $3 billion for the first time.

FBIZ's performance demonstrates its ability to grow its balance sheet and revenue effectively, even in a challenging interest rate environment. The bank's focus on relationship-based deposit generation and efficient execution of revenue growth strategies has contributed to its solid financial achievements.

For a detailed financial analysis and the full earnings report, please refer to the 8-K filing.

Explore the complete 8-K earnings release (here) from First Business Financial Services Inc for further details.

This article first appeared on GuruFocus.