First Citizens BancShares (FCNCA) to Buy SVB India Business

Almost a year after First Citizens BancShares, Inc. FCNCA acquired the failed Silicon Valley Bank (“SVB”), the company is set to buy latter’s subsidiary, SVB Global Services India LLP.

This was disclosed by SVB in a filing with the Securities and Exchange Commission.

Under the terms of the deal, FCNCA will acquire “100% of the outstanding partnership interest” in the India-based business. The transaction is subject to approval from the United States Bankruptcy Court for the Southern District of New York and Indian regulators.

A hearing in the bankruptcy court is scheduled on Apr 9, 2024, and thereafter, the deal is expected to close.

SVB Financial Group filed for bankruptcy last March following the collapse and seizure of Silicon Valley Bank (on Mar 11, 2023) due to deposit flight amid banking sector turmoil. FCNCA assumed SVB’s assets worth $110 billion, deposits of $56 billion and loans of $72 billion.

Notably, HSBC Holdings HSBC acquired the U.K. arm of Silicon Valley Bank. The deal immensely bolstered the company’s ability to serve innovative and fast-growing firms in the technology and life science sectors. In June 2023, HSBC Innovation Banking was launched, which included SVB UK together with newly formed teams in the United States, Hong Kong and Israel.

Last year’s U.S. regional banking crisis also resulted in the collapse and failure of Signature Bank and First Republic Bank. Signature Bank was acquired by New York Community Bancorp, Inc. NYCB, while JPMorgan JPM bought First Republic Bank.

One year since the collapse and subsequent acquisitions, NYCB has been struggling. This is mainly because of its huge commercial real estate (CRE) exposure. This Signature Bank acquisition followed the buyout of Flagstar Bank in December 2022. Together, this led NYCB’s total assets to cross the $100 billion mark and making the company one of the largest regional lenders. But the tag comes with a lot of regulatory capital requirements and NYCB wasn’t prepared for this as the value of CRE loans plummeted sharply. Though the company has taken a series of steps to enhance its risk-management framework, the effectiveness of the same is still uncertain.

On the other hand, JPMorgan reaped huge benefits from the acquisition of First Republic Bank. Though the company wasn’t untouched by the deposit flight and drastic rise in funding costs (interest expenses surged 212% in 2023), its net income jumped 32% year over year to $49.6 billion. One of the primary reasons for the improvement was the acquisition of First Republic Bank in May. This, along with higher interest rates, strong deposit balance and decent loan demand, offered support.

Now if we see FCNCA’s performance following the acquisition of Silicon Valley Bank, it seems the company is navigating the industry challenges and maintaining a strong capital and liquidity position.

Acquisitions remain a major part of First Citizens BancShares’ business expansion plan as well as top-line and footprint diversification efforts. Since the 2008 financial crisis, the company has successfully integrated almost 20 failed banks. It is not averse to acquiring more regional banks if those complement the existing operations.

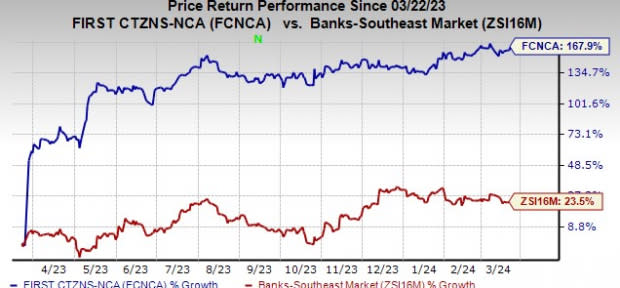

Over the past year, shares of FCNCA have jumped 167.9%, significantly outperforming the industry’s rally of 23.5%.

Image Source: Zacks Investment Research

Currently, First Citizens BancShares carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

First Citizens BancShares, Inc. (FCNCA) : Free Stock Analysis Report

New York Community Bancorp, Inc. (NYCB) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report