First Eagle Investment Bolsters Portfolio with Red Robin Gourmet Burgers Inc Acquisition

Introduction to the Transaction

First Eagle Investment (Trades, Portfolio) has recently expanded its investment portfolio with the addition of shares in Red Robin Gourmet Burgers Inc (NASDAQ:RRGB). On December 31, 2023, the firm acquired 889,413 shares of the casual-dining restaurant operator, reflecting a significant commitment to the company. The transaction, executed at a trade price of $12.47 per share, represents a 0.03% position in First Eagle Investment (Trades, Portfolio)'s portfolio and a 5.75% stake in Red Robin Gourmet Burgers Inc.

Profile of First Eagle Investment (Trades, Portfolio)

With roots stretching back to 1864, First Eagle Investment (Trades, Portfolio) is a venerable institution in the investment management landscape. The firm offers advisory services across a spectrum of investment strategies and retail mutual funds, catering to a diverse clientele that includes private funds, institutional accounts, and high-net-worth individuals. First Eagle Investment (Trades, Portfolio) is known for its value-oriented investment philosophy, which emphasizes absolute long-term performance and capital preservation over short-term index movements. The firm's bottom-up fundamental analysis and on-site research are cornerstones of its risk mitigation strategy. Currently, First Eagle Investment (Trades, Portfolio) manages an equity portfolio worth $41.97 billion, with top holdings in sectors such as Technology and Basic Materials.

Red Robin Gourmet Burgers Inc Company Overview

Red Robin Gourmet Burgers Inc, trading under the symbol RRGB, is a prominent player in the North American restaurant industry. Since its IPO on July 19, 2002, the company has been dedicated to developing, operating, and franchising casual-dining and fast-casual restaurants. Red Robin's diverse revenue streams include restaurant operations, franchise royalties, gift card breakage, and other miscellaneous sources. Despite a challenging market, the company boasts a market capitalization of $160.373 million. However, the stock is currently trading at $10.36, which is below the trade price and indicates a fair valuation according to GuruFocus's GF Value of $11.00.

Analysis of the Trade Impact and Position

The acquisition of Red Robin shares by First Eagle Investment (Trades, Portfolio) is a strategic move that diversifies the firm's portfolio within the restaurant sector. Although the trade impact on the overall portfolio is minimal, the firm's 5.75% holding in RRGB is a testament to its confidence in the company's potential. This investment aligns with First Eagle's philosophy of seeking out undervalued securities with long-term growth prospects.

Market Performance of Red Robin Gourmet Burgers Inc

Since the trade date, Red Robin's stock performance has seen a decline of 16.92%, with a year-to-date change of -12.43%. The current stock price of $10.36 represents a 0.94 ratio to the GF Value, suggesting that the stock is fairly valued. Despite the recent dip, First Eagle Investment (Trades, Portfolio)'s acquisition may be based on a belief in the company's future recovery and growth.

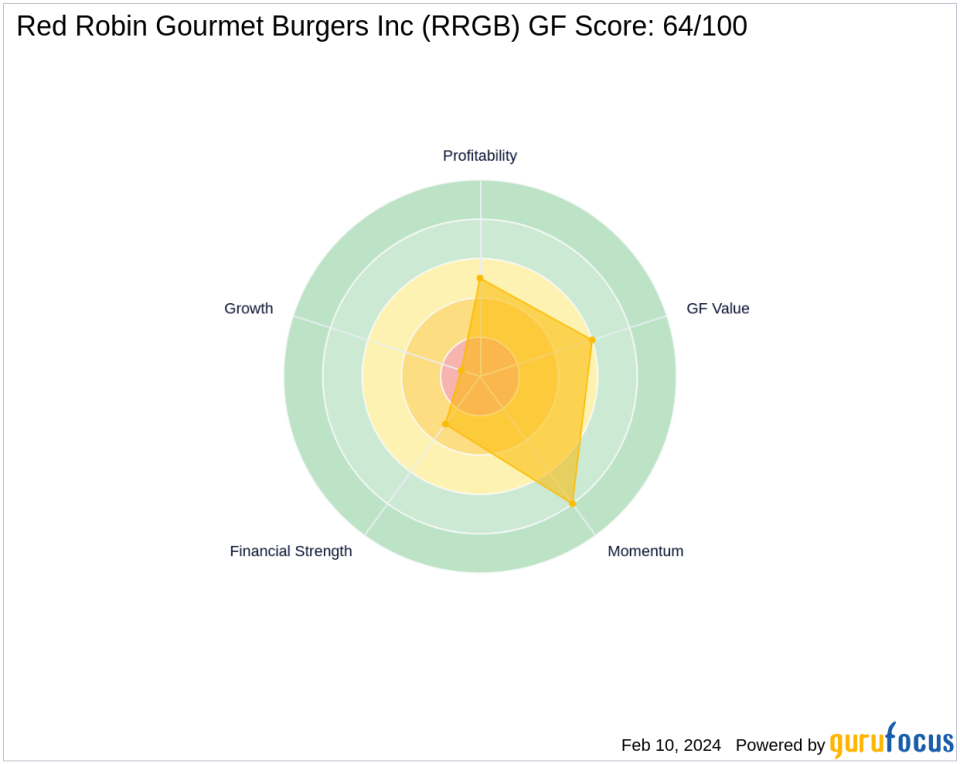

Fundamental Analysis of RRGB

Red Robin's financial health and growth prospects are mixed, with a GF Score of 64/100, indicating moderate future performance potential. The company's Financial Strength and Growth Rank are low, at 3/10 and 1/10 respectively, while the Profitability Rank stands at a moderate 5/10. The Piotroski F-Score of 5 suggests average financial health, and the Altman Z score of 1.32 indicates some financial distress. However, the company's Momentum Rank is strong at 8/10, which may signal a potential turnaround.

Sector and Industry Context

First Eagle Investment (Trades, Portfolio)'s top sectors include Technology and Basic Materials, with Red Robin Gourmet Burgers Inc adding to the firm's exposure in the restaurant industry. The company's competitive position within the industry is challenged by its financial metrics, but First Eagle's investment could be a vote of confidence in Red Robin's ability to navigate the competitive landscape and improve its financial standing.

Conclusion

The recent acquisition of Red Robin Gourmet Burgers Inc by First Eagle Investment (Trades, Portfolio) is a noteworthy development for value investors. The firm's commitment to the restaurant operator, despite its current financial challenges, may indicate a belief in the company's intrinsic value and long-term growth potential. As the market continues to evolve, this transaction will be an interesting case study in value investing and portfolio strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.