First Eagle Investment Bolsters Position in C.H. Robinson Worldwide Inc

Introduction to the Transaction

First Eagle Investment (Trades, Portfolio) has recently expanded its investment portfolio with a significant addition of shares in C.H. Robinson Worldwide Inc (NASDAQ:CHRW). This move underscores the firm's strategic approach to value investing, targeting companies that present long-term growth opportunities. The transaction involved the acquisition of 59,016 shares, reflecting a 0.63% change in the firm's holdings and a modest impact of 0.01% on its portfolio.

Profile of First Eagle Investment (Trades, Portfolio)

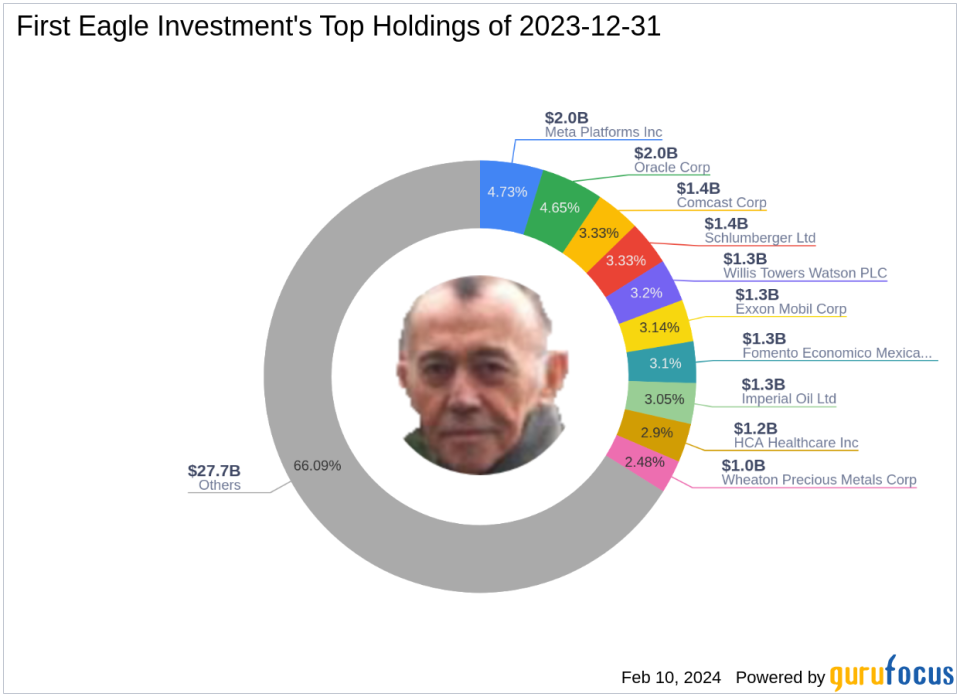

First Eagle Investment (Trades, Portfolio), with a storied history dating back to 1864, stands as an independent investment management firm. The firm's investment philosophy is rooted in a value-oriented approach, focusing on absolute long-term performance and capital preservation over short-term index movements. First Eagle Investment (Trades, Portfolio) employs rigorous bottom-up fundamental analysis and on-site research to identify securities with intrinsic value that surpasses market risk. With 412 stocks in its portfolio and an equity of $41.97 billion, the firm's top holdings include Comcast Corp (NASDAQ:CMCSA), Meta Platforms Inc (NASDAQ:META), and Oracle Corp (NYSE:ORCL), predominantly in the Technology and Basic Materials sectors.

Details of the Trade

The transaction took place on December 31, 2023, with First Eagle Investment (Trades, Portfolio) adding to its position in CHRW. The trade price was $86.39 per share, increasing the firm's total share count to 9,482,897. This trade has elevated CHRW's position to 2.12% of First Eagle Investment (Trades, Portfolio)'s portfolio, indicating a significant stake of 8.13% in the company.

Overview of C.H. Robinson Worldwide Inc

C.H. Robinson Worldwide Inc, a premier non-asset-based third-party logistics provider, has a diversified business model that includes domestic freight brokerage, air and ocean forwarding, and a range of other transportation and logistics services. Since its IPO on October 15, 1997, the company has shown substantial growth, with a market capitalization of $8.71 billion and a stock price of $74.67 as of the latest data. Despite a recent decline of 13.57% in stock price since the transaction, CHRW is considered modestly undervalued with a GF Value of $83.10 and a GF Score of 82/100, indicating good potential for outperformance.

Analysis of the Trade's Significance

The acquisition of additional shares in CHRW by First Eagle Investment (Trades, Portfolio) is a strategic move that aligns with the firm's investment philosophy. The position size of CHRW in the firm's portfolio suggests a strong conviction in the company's future prospects. Considering CHRW's market valuation, which is currently below the GF Value, and its GF Score indicating good outperformance potential, the trade appears to be a calculated decision to capitalize on the company's growth trajectory and financial health.

Sector and Market Context

First Eagle Investment (Trades, Portfolio)'s top sectors include Technology and Basic Materials, with CHRW adding diversity to its portfolio within the Transportation industry. CHRW's standing in the competitive landscape of transportation services is robust, supported by its comprehensive service offerings and strategic growth initiatives.

Performance Metrics and Valuation

CHRW's financial health is reflected in its Profitability Rank of 8/10 and a Growth Rank of 6/10. The company's valuation metrics, such as a PE Ratio of 27.55% and a stock price currently at 90% of its GF Value, suggest a modest undervaluation. Despite recent market volatility, CHRW's strong fundamentals, including a Return on Equity (ROE) of 23.40% and Return on Assets (ROA) of 5.91%, position it as a resilient player in the transportation sector.

Other Notable Investors in CHRW

First Eagle Investment (Trades, Portfolio) is not alone in recognizing the potential of CHRW. Other notable investors include Joel Greenblatt (Trades, Portfolio) and Jefferies Group (Trades, Portfolio), who also maintain positions in the company. As the largest shareholder among the gurus, First Eagle Investment (Trades, Portfolio) Management, LLC, holds a commanding presence in CHRW's investor base.

In conclusion, First Eagle Investment (Trades, Portfolio)'s recent trade action in CHRW reflects a strategic investment decision based on the company's intrinsic value and growth prospects. The firm's significant stake in CHRW, coupled with the company's solid financial metrics and market position, suggests a positive outlook for this addition to First Eagle Investment (Trades, Portfolio)'s portfolio.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.