First Eagle Investment Bolsters Stake in MAG Silver Corp

First Eagle Investment (Trades, Portfolio) has recently expanded its investment portfolio with the addition of shares in MAG Silver Corp (MAG). On December 31, 2023, the firm executed an addition of 642,494 shares in the Canadian mining company, bringing its total holdings to 6,380,120 shares. This transaction reflects a 0.02% impact on First Eagle's portfolio and positions the firm with a 6.20% stake in MAG Silver Corp. The shares were acquired at a price of $10.41 each, indicating a strategic move by the investment firm to capitalize on the potential of MAG Silver Corp within the metals and mining sector.

First Eagle Investment (Trades, Portfolio)'s Market Strategy

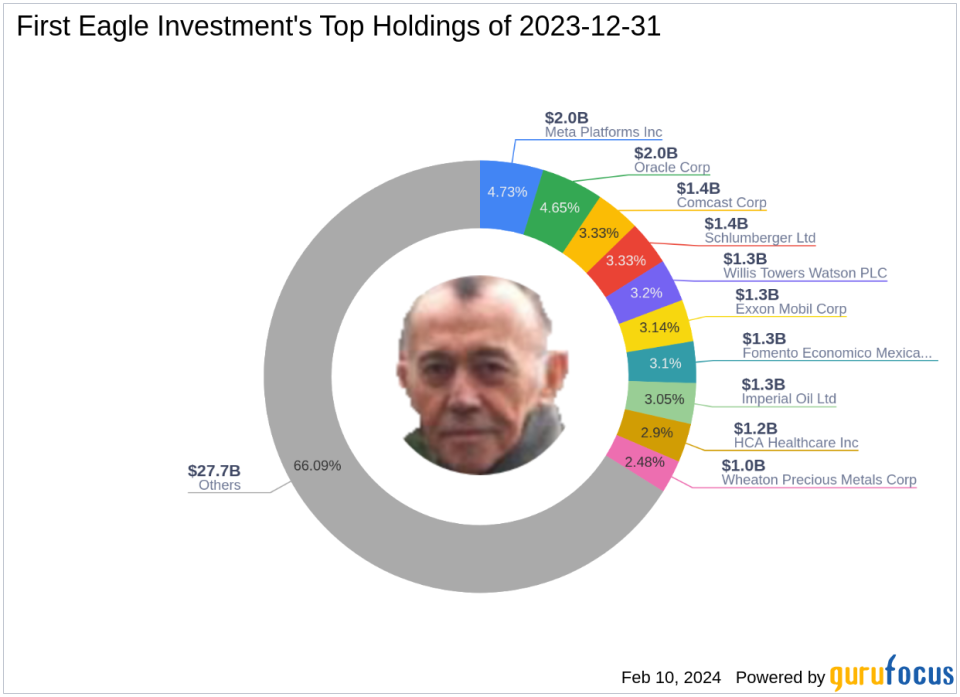

First Eagle Investment (Trades, Portfolio), with a rich history dating back to 1864, is renowned for its independent investment management services. The firm's value-oriented investment philosophy emphasizes absolute long-term performance and capital preservation over short-term index movements. First Eagle's rigorous bottom-up fundamental analysis and on-site research are central to its risk-reduction strategy. The firm's portfolio includes a diverse range of investment strategies and retail mutual funds, with a total equity of $41.97 billion. Technology and Basic Materials are among the top sectors in its investment focus, with leading holdings such as Comcast Corp (NASDAQ:CMCSA), Meta Platforms Inc (NASDAQ:META), and Oracle Corp (NYSE:ORCL).

About MAG Silver Corp

MAG Silver Corp, a Canadian mining company established with an IPO date of July 9, 2007, is on a mission to become a leading primary silver mining company. The company's flagship Juanicipio Project, developed in partnership with Fresnillo Plc, is situated in Mexico's prolific Fresnillo Silver Trend. With a market capitalization of $910.834 million and a current stock price of $8.87, MAG Silver Corp is navigating the challenges of the mining industry. Despite a year-to-date price change ratio of -13.8% and a price change since the transaction of -14.79%, the company's long-term potential remains a point of interest for investors.

Impact of the Trade on First Eagle's Portfolio

The recent acquisition of MAG Silver Corp shares by First Eagle Investment (Trades, Portfolio) has a moderate impact on the firm's portfolio, with a 0.17% position ratio. This strategic move aligns with First Eagle's investment philosophy, as the firm seeks to leverage the intrinsic value and long-term potential of MAG Silver Corp. The trade's significance is underscored by the firm's 6.20% ownership in the mining company, reflecting confidence in MAG Silver Corp's future prospects.

Financial Health and Growth Prospects

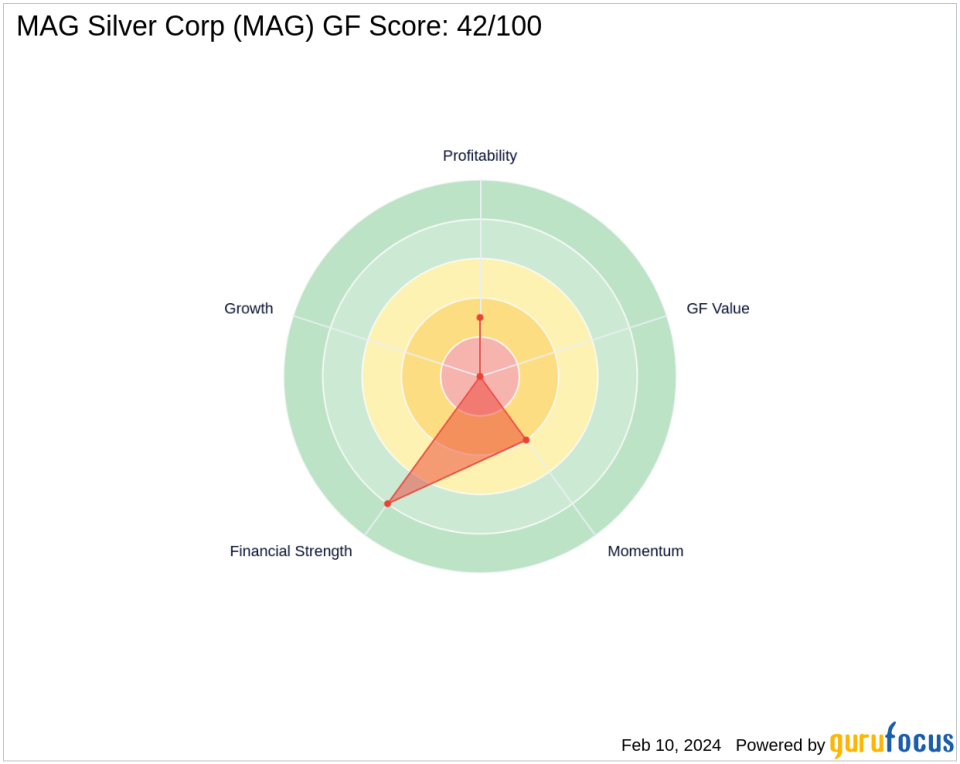

MAG Silver Corp's financial health is indicated by a strong Financial Strength rank of 8/10 and a Piotroski F-Score of 2, suggesting some challenges in terms of operational efficiency. The company's cash to debt ratio of 348.82 is particularly noteworthy, ranking it 974th in this metric. However, the company's Growth Rank and GF Value Rank are not applicable, indicating a lack of sufficient data to evaluate its growth trajectory and intrinsic value. The Profitability Rank stands at 3/10, reflecting some concerns about the company's ability to generate profits in the current market environment.

Comparative Insight and Sector Analysis

First Eagle Investment (Trades, Portfolio) is not the only guru with an interest in MAG Silver Corp. Other notable investors include Mario Gabelli (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio), although First Eagle holds the largest share percentage among them. The metals and mining industry, where MAG Silver Corp operates, is a significant part of the current market landscape, and First Eagle's investment reflects a strategic focus on this sector.

In conclusion, First Eagle Investment (Trades, Portfolio)'s recent trade in MAG Silver Corp shares represents a calculated addition to its portfolio, aligning with the firm's value investing philosophy. While the financial health and growth prospects of MAG Silver Corp present a mixed picture, First Eagle's significant stake in the company demonstrates a belief in its long-term potential. As the mining industry continues to evolve, investors will be watching closely to see how this investment plays out in the context of First Eagle's broader market strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.