First Eagle Investment Cuts 3M, Microsoft

Investment firm First Eagle Investment (Trades, Portfolio) sold shares of the following stocks during the fourth quarter.

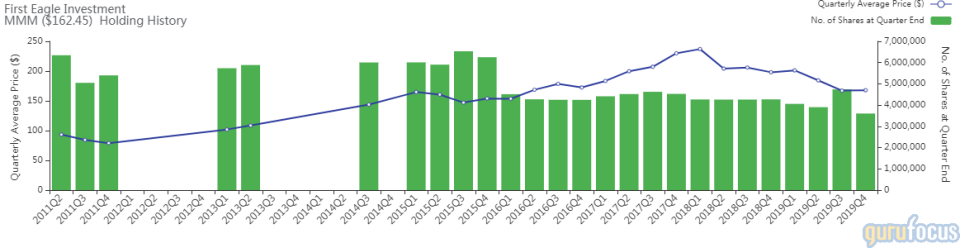

3M

The firm trimmed its 3M Co. (MMM) position by 23.96%. The portfolio was impacted by -0.53%.

The manufacturer of a wide range of industrial and consumer products has a market cap of $93 billion and an enterprise value of $112 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 45.39% and return on assets of 11.32% are outperforming 89% of companies in the industrial products industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.12 is below the industry median of 0.87.

The firm is the largest guru shareholder with 0.63% of outstanding shares, followed by Mairs and Power (Trades, Portfolio) with 0.33% and Jeremy Grantham (Trades, Portfolio) with 0.30%.

Microsoft

The guru trimmed its Microsoft Corp. (MSFT) stake by 21.94%. The portfolio was impacted by -0.40%.

The company, which develops hardware and software, has a market cap of $1.40 trillion.

GuruFocus gives the company a profitability and growth rating of 10 out of 10. The return on equity of 43.84% and return on assets of 16.17% are outperforming 91% of companies in the software industry. Its financial strength is rated 6 out of 10.

The largest guru shareholder of the company is PRIMECAP Management (Trades, Portfolio) with with 0.42% of outstanding shares, followed by Dodge & Cox with 0.34% and Ken Fisher (Trades, Portfolio) with 0.28%.

Synchrony Financial

The investor exited the Synchrony Financial (SYF) holding. The portfolio was impacted by -0.31%.

The credit services provider has a market cap of $20.53 billion and an enterprise value of $29.43 billion.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The return on equity of 25.1% and the return on assets of 3.54% are outperforming 63% of companies in the credit services industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.61 is above the industry median of 0.24.

The largest guru shareholder of the company is Warren Buffett (Trades, Portfolio) with 2.50% of outstanding shares, followed by Seth Klarman (Trades, Portfolio) with 0.60% and Steven Cohen (Trades, Portfolio) with 0.38%.

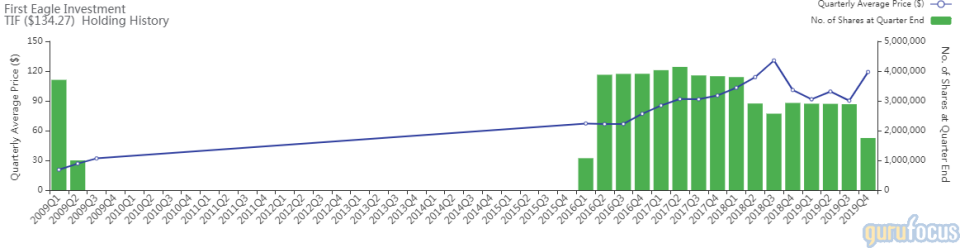

Tiffany

The investment firm curbed its Tiffany & Co. (TIF) position by 39.37%. The trade had an impact of -0.30% on the portfolio.

The jeweler has a market cap of $16.27 billion and an enterprise value of $17.90 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 17.46% and return on assets of 9.3% are outperforming 82% of companies in the retail - cyclical industry. Its financial strength is rated 6 out of 10 with a cash-debt ratio of 0.25.

The company's largest guru shareholders include Steve Mandel (Trades, Portfolio) with 5.28% of outstanding shares, Pioneer Investments (Trades, Portfolio) with 0.81% and Ron Baron (Trades, Portfolio) with 0.42%.

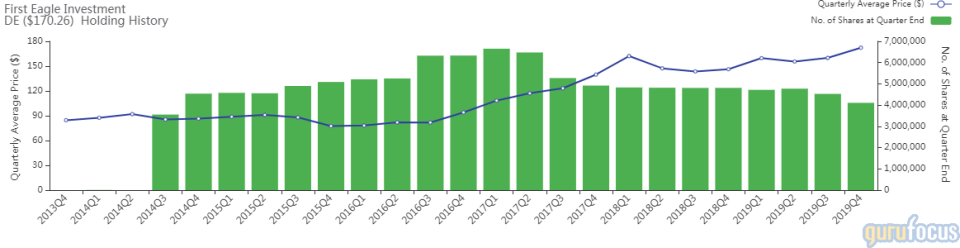

Deere

The guru reduced the Deere & Co. (DE) position by 9.31%. The portfolio was impacted by -0.20%.

The manufacturer of agricultural and forestry machinery has a market cap of $53.60 billion and an enterprise value of $94.50 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 27.94% and return on assets of 4.66% are outperforming 62% of companies in the farm and heavy construction machinery industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.1 is below the industry median of 0.41.

The largest guru shareholders of the company are Al Gore (Trades, Portfolio) with 1.35% of outstanding shares, Tom Gayner (Trades, Portfolio) with 0.32% and PRIMECAP Management (Trades, Portfolio) with 0.26%.

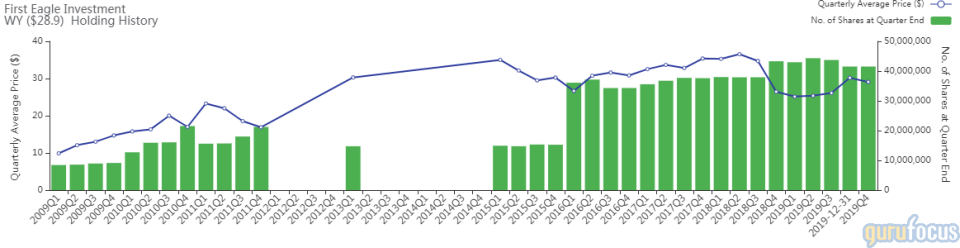

Weyerhaeuser

The firm trimmed its position in Weyerhaeuser Co. (WY) by 5.03%. The portfolio was impacted by -0.19%.

The real estate investment trust has a market cap of $21.53 billion and an enterprise value of $27.41 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of -0.88% and return on assets of -0.45% are underperforming 87% of companies in the REITs industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.08 is above the industry median of 0.06.

Other guru shareholders of the company are T Rowe Price Equity Income Fund (Trades, Portfolio) with 1.14% of outstanding shares, Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.36% and Ken Heebner (Trades, Portfolio) with 0.15%.

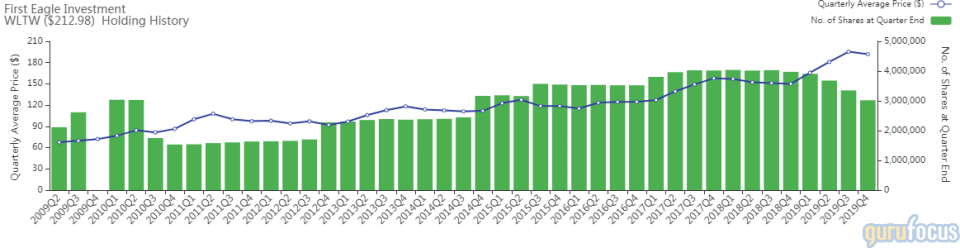

Willis Towers Watson

The investor reduced the Willis Towers Watson PLC (WLTW) position by 9.9%. The portfolio was impacted by -0.18%.

The insurance broker has a market cap of $27.41 billion and an enterprise value of $33.39 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 10.4% and return on assets of 2.99% are outperforming 55% of companies in the insurance industry. Its financial strength is rated 4 out of 10 with a cash-debt ratio of 0.13.

First Eagle Investment (Trades, Portfolio) is the largest guru shareholder of the company with 2.35% of outstanding shares, followed by David Abrams (Trades, Portfolio) with 0.86% and Diamond Hill Capital (Trades, Portfolio) with 0.44%.

Disclosure: I do not own any stocks mentioned.

Read more here:

T. Rowe Price Keeps Buying Fox, General Electrics

6 Stocks Yachtman Asset Management Keeps Buying

6 Stocks Trading With Low Price-Sales Ratios

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.