First Eagle Investment Exits JD,com, Cuts Broadcom

First Eagle Investment (Trades, Portfolio) manages a $7.43 billion equity portfolio composed of 142 stocks as of the quarter's end. The firm sold shares of the following stocks during the second quarter of 2020.

JD.com

The fund closed its position in JD.com Inc. (JD). The trade had an impact of -1.87% on the portfolio.

The Chinese e-commerce company has a market cap of $95.14 billion and an enterprise value of $90.09 billion.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The return on equity of 7.77% and return on assets of 2.39% are outperforming 58% of companies in the retail, cyclical industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 2.12 is below the industry median of 0.45.

The largest guru shareholder of the company is Chase Coleman (Trades, Portfolio)'s Point72 Asset Maangement with 3.45% of outstanding shares, followed by Dodge & Cox with 0.88% and Philippe Laffont (Trades, Portfolio) with 0.66%.

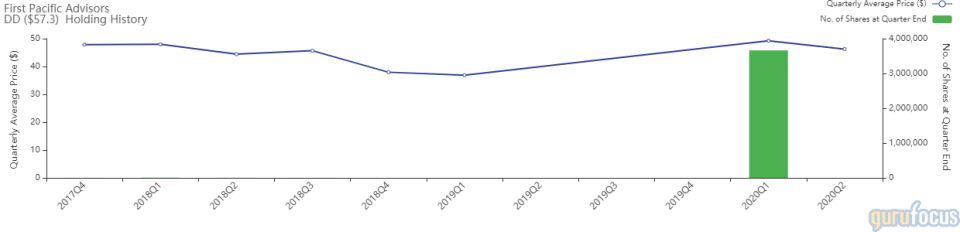

DuPont

The fund closed its DuPont de Nemours Inc. (DD) holding. The portfolio was impacted by -1.77%.

The specialty chemicals company has a market cap of $42.05 billion and an enterprise value of $58.05 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of -6.34% and return on assets of -3.69% are underperforming 90% of companies in the chemicals industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.2 is below the industry median of 0.64.

The largest guru shareholder of the company is Lee Ainslie (Trades, Portfolio)'s Maverick Capital with 1.39% of outstanding shares, followed by T Rowe Price Equity Income Fund (Trades, Portfolio) with 0.82% and Mason Hawkins (Trades, Portfolio) with 0.67%.

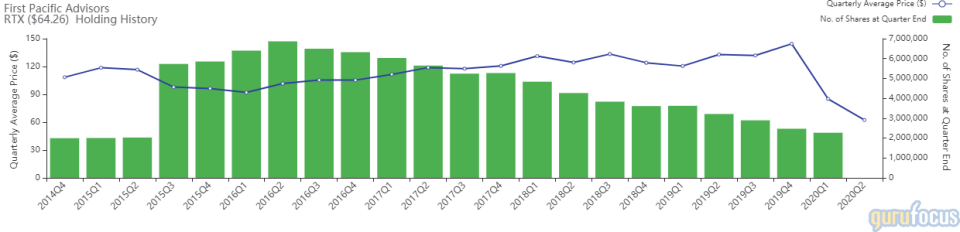

Raytheon

The fund exited its position in Raytheon Technologies Corp. (RTX). The portfolio was impacted by -1.67%.

The industrial company has a market cap of $98.17 billion and an enterprise value of $127.33 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of -3.54% and return on assets of -1.13% are underperforming 71% of companies in the aerospace and defense Industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.2 is far below the industry median of 0.53.

The largest guru shareholder is Dodge & Cox with 1.26% of outstanding shares, followed by Chris Davis (Trades, Portfolio) with 0.58% and Ken Fisher (Trades, Portfolio) with 0.34%.

Analog Devices

The fund reduced its Analog Devices Inc. (ADI) holding by 21.63%, impacting the portfolio by -1.08%.

The chipmaker has a market cap of $43.01 billion and an enterprise value of $47.81 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 9.49% and return on assets of 5.17% are outperforming 64% of companies in the semiconductors industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.14 is above the industry median of 1.49.

The largest guru shareholder of the company is PRIMECAP Management (Trades, Portfolio) with 1.19% of outstanding shares, followed by First Eagle Investment (Trades, Portfolio) with 1.07% and Al Gore (Trades, Portfolio) with 0.75%.

Broadcom

The investment fund trimmed its holding in Broadcom Inc. (AVGO) by 17.56%. The trade had an impact of -0.94% on the portfolio.

The company has a market cap of $130.32 billion and an enterprise value of $167 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 9.96% and return on assets of 3.39% are outperforming 53% of companies in the semiconductors industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.2 is above the industry median of 1.49.

The largest guru shareholders is Barrow, Hanley, Mewhinney & Strauss with 0.45% of outstanding shares, followed by Steven Romick (Trades, Portfolio) with 0.33%.

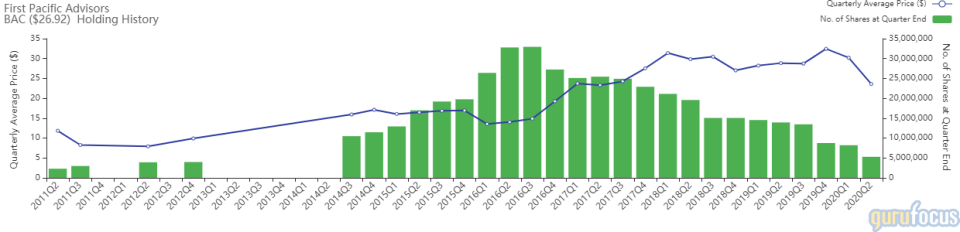

Bank of America

The investment fund reduced its Bank of America Corp. (BAC) position by 34.45%. The trade had an impact of -0.88% on the portfolio.

The American bank has a market cap of $233.24 billion and an enterprise value of $240.88 billion.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The return on equity of 7.06% and return on assets of 0.8% are underperforming 58% of companies in the banks industry. Its financial strength is rated 3 out of 10 with a cash-debt ratio of 1.06%.

The largest guru shareholder of the company is Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway (BRK.A)(BRK.B) with 11.92% of outstanding shares, followed by Dodge & Cox with 1.56% and PRIMECAP Management (Trades, Portfolio) with 0.47%.

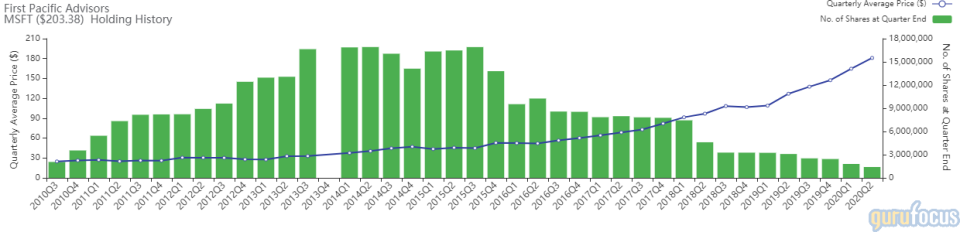

Microsoft

The investment fund curbed its holding in Microsoft Corp. (MSFT) by 21.9%. The trade had an impact of -0.88% on the portfolio.

Microsoft has a market cap of $1.59 trillion and an enterprise value of $1.53 trillion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 40.16% and return on assets of 15.43% are outperforming 92% of companies in the software Industry. Its financial strength is rated 7 out of 10 with a cash-debt ratio of 1.92.

The largest guru shareholder of the company is PRIMECAP Management (Trades, Portfolio) with 0.34% of outstanding shares, followed by Fisher with 0.29% and Dodge & Cox with 0.26%.

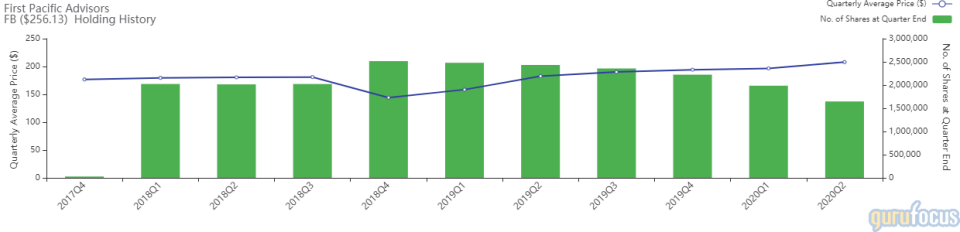

The investment fund trimmed its holding in Facebook Inc. (FB) by 17.1%. The trade had an impact of -0.80% on the portfolio.

The social media company has a market cap of $729.67 billion and an enterprise value of $681.96 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 23.54% and return on assets of 18.01% are outperforming 88% of companies in the interactive media industry. Its financial strength is rated 8 out of 10 with a cash-debt ratio of 5.53.

The largest guru shareholder of the company is Point72 Asset Management with 0.31% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.21% and Frank Sands (Trades, Portfolio) with 0.19%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Diamond Hill Capital Exits Raytheon, Cuts Microsoft

First Eagle Investment Exits Omnicom, Cuts Weyerhaeuser

Viking Global Investors Trims Technology Company Holdings in 2nd Quarter

Not a Premium Member of GuruFocus? Sign up for afree 7-day trial here.

This article first appeared on GuruFocus.