First Eagle Investment Reduces Stake in Novagold Resources Inc

Overview of First Eagle Investment (Trades, Portfolio)'s Trade

First Eagle Investment (Trades, Portfolio), a seasoned investment management firm, has executed a reduction in its holdings of Novagold Resources Inc (NG). On December 31, 2023, the firm decreased its position in the mineral exploration company by 24,443 shares. This trade has adjusted First Eagle Investment (Trades, Portfolio)'s total shareholding in Novagold Resources to 18,713,936 shares, reflecting a subtle yet strategic portfolio move.

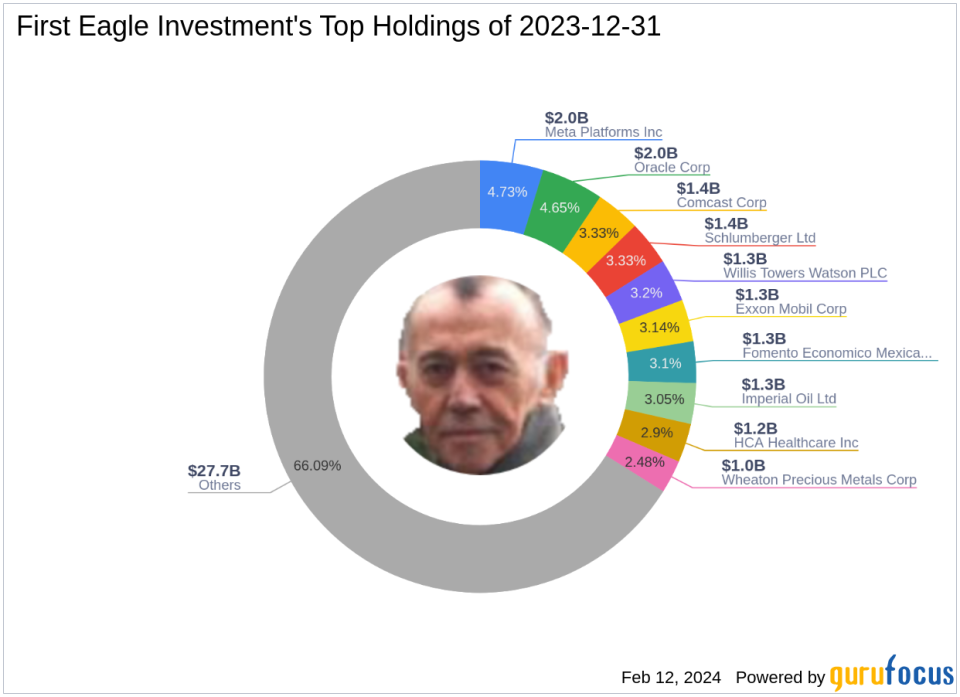

Insight into First Eagle Investment (Trades, Portfolio)

With roots stretching back to 1864, First Eagle Investment (Trades, Portfolio) stands as an independent entity specializing in a variety of investment advisory services. The firm's investment philosophy is grounded in a value-oriented approach, emphasizing absolute long-term performance and capital preservation over short-term index movements. First Eagle Investment (Trades, Portfolio) is known for its meticulous bottom-up fundamental analysis and on-site research, which informs its investment decisions. Currently, the firm manages an equity portfolio worth $41.97 billion, with top holdings in diverse sectors such as technology and basic materials.

Novagold Resources Inc at a Glance

Novagold Resources Inc, trading under the symbol NG, is a USA-based mineral exploration company with a focus on the development of its 50% owned Donlin Gold project in Alaska. Since its IPO on December 2, 2003, the company has navigated the volatile metals and mining industry, currently holding a market capitalization of $822.174 million. Despite the challenges, Novagold Resources continues to explore opportunities within its segment.

Details of the Transaction

The transaction, which took place on December 31, 2023, saw First Eagle Investment (Trades, Portfolio) reduce its stake in Novagold Resources by 24,443 shares at a trade price of $3.74 per share. This reduction has had a negligible impact on the firm's portfolio, with Novagold Resources now constituting a 0.18% position. The trade also represents a 5.60% ownership of the company by First Eagle Investment (Trades, Portfolio).

Post-Transaction Position and Impact

Following the trade, First Eagle Investment (Trades, Portfolio)'s holding in Novagold Resources stands at 18,713,936 shares. This position signifies a strategic stake in the company, although it comprises a modest portion of the firm's extensive portfolio. The significance of this holding reflects First Eagle Investment (Trades, Portfolio)'s confidence in the long-term prospects of Novagold Resources, despite the recent reduction.

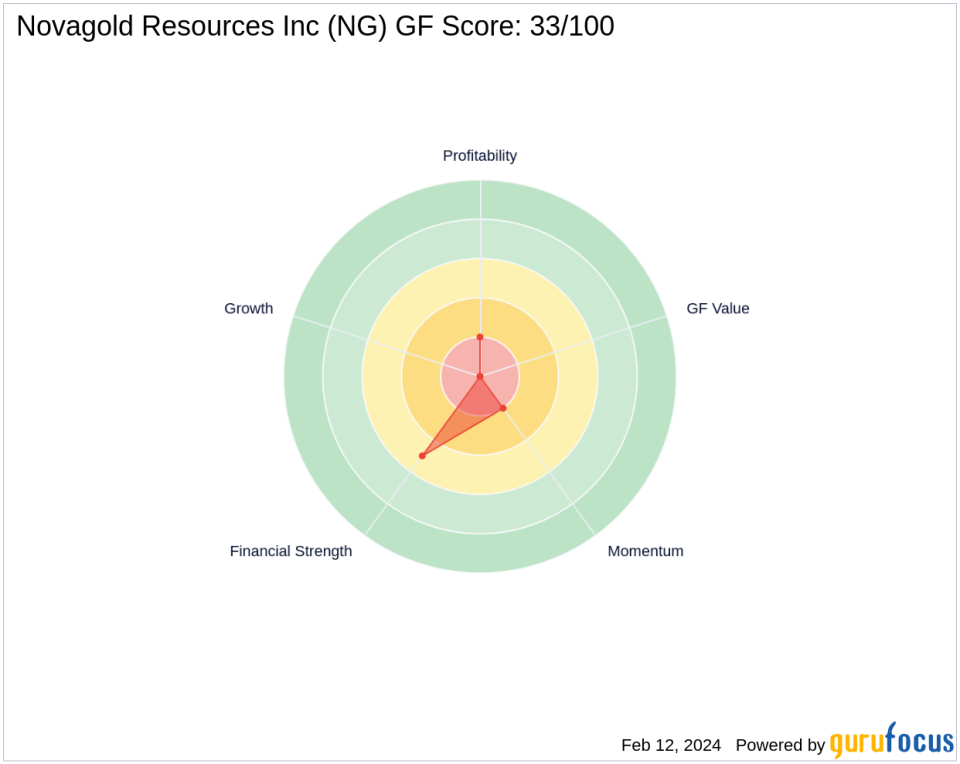

Analysis of Novagold Resources Inc Stock

Novagold Resources Inc's stock price has experienced a decline since the trade, currently priced at $2.45, which is a 34.49% decrease from the trade price. The stock's performance has been underwhelming since its IPO, with a decrease of 42.89%, and it has also seen a year-to-date drop of 35.53%. The company's financial health and growth prospects are concerning, with a GF Score of 33/100, indicating poor future performance potential. The stock's financial strength and profitability ranks are also low, at 5/10 and 2/10 respectively, while growth and GF Value ranks are not applicable due to insufficient data.

Market Context and Other Investors

Paulson & Co. is currently the largest guru shareholder of Novagold Resources, although the specific share percentage is not disclosed. First Eagle Investment (Trades, Portfolio) remains a notable investor in the company, maintaining a significant position despite the recent reduction.

Conclusion

The recent trade by First Eagle Investment (Trades, Portfolio) has slightly altered its stake in Novagold Resources Inc, reflecting a strategic adjustment rather than a major shift in investment stance. The stock's current market performance and financial metrics suggest a cautious outlook, aligning with First Eagle Investment (Trades, Portfolio)'s value-oriented and long-term investment philosophy. Investors will be watching closely to see how this trade influences both Novagold Resources' trajectory and First Eagle Investment (Trades, Portfolio)'s portfolio in the future.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.