First Eagle Investment Reduces Stake in Douglas Emmett Inc

Overview of First Eagle Investment (Trades, Portfolio)'s Recent Transaction

First Eagle Investment (Trades, Portfolio), a seasoned player in the investment management arena, has recently adjusted its holdings in the real estate sector. On December 31, 2023, the firm reduced its stake in Douglas Emmett Inc (NYSE:DEI), a prominent real estate investment trust. The transaction saw a decrease of 64,788 shares, bringing First Eagle Investment (Trades, Portfolio)'s total share count in DEI to 13,778,932. Despite the reduction, the firm maintains a significant position in the company, with DEI representing 0.52% of its portfolio and First Eagle Investment (Trades, Portfolio) holding 8.26% of the traded stock.

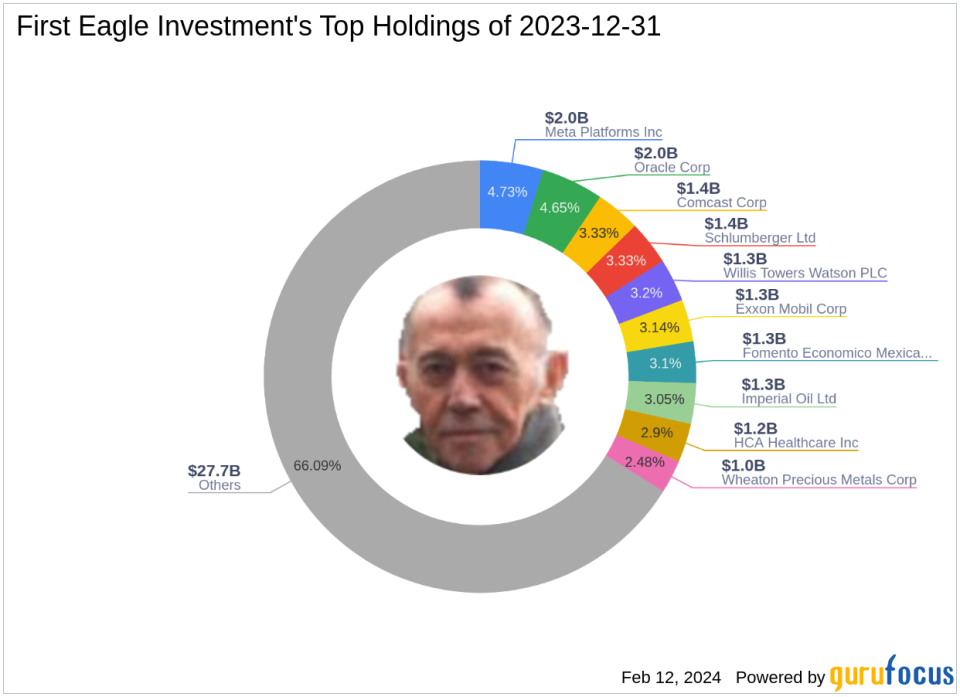

Insight into First Eagle Investment (Trades, Portfolio)

With roots stretching back to 1864, First Eagle Investment (Trades, Portfolio) stands as an independent investment management firm with a rich heritage. The firm offers advisory services across a spectrum of investment strategies and retail mutual funds, catering to a diverse clientele that includes private funds, institutional accounts, and high-net-worth individuals. First Eagle Investment (Trades, Portfolio)'s value-oriented philosophy is anchored in the pursuit of absolute long-term performance, favoring a rigorous bottom-up fundamental analysis over chasing short-term index movements. This approach is complemented by on-site research, where the firm actively engages with company managers to deepen its understanding of investment opportunities.

Douglas Emmett Inc at a Glance

Douglas Emmett Inc, trading under the symbol DEI, is a REIT specializing in the acquisition, development, and management of office and multifamily properties in select markets of Los Angeles, California, and Honolulu, Hawaii. Since its IPO on October 25, 2006, the company has focused on assets in supply-constrained communities, with a significant portion of its portfolio in prime Los Angeles neighborhoods. The majority of Douglas Emmett's income is derived from rental revenue, predominantly from its Los Angeles office buildings, which cater to legal, financial, and entertainment firms. However, the company's financial health and market performance present a mixed picture, with a current market capitalization of $2.22 billion and a stock price of $13.32, reflecting a possible value trap according to the GF Valuation.

Impact of the Trade on First Eagle Investment (Trades, Portfolio)'s Portfolio

The recent trade by First Eagle Investment (Trades, Portfolio) has not significantly impacted its overall portfolio, given the 0% trade impact. However, the transaction does reflect the firm's ongoing portfolio management strategy and its assessment of DEI's future prospects. With a trade price of $14.5 per share, First Eagle Investment (Trades, Portfolio)'s decision to reduce its stake comes amidst DEI's stock price decline of 8.14% since the transaction date.

Market Valuation and Performance Metrics

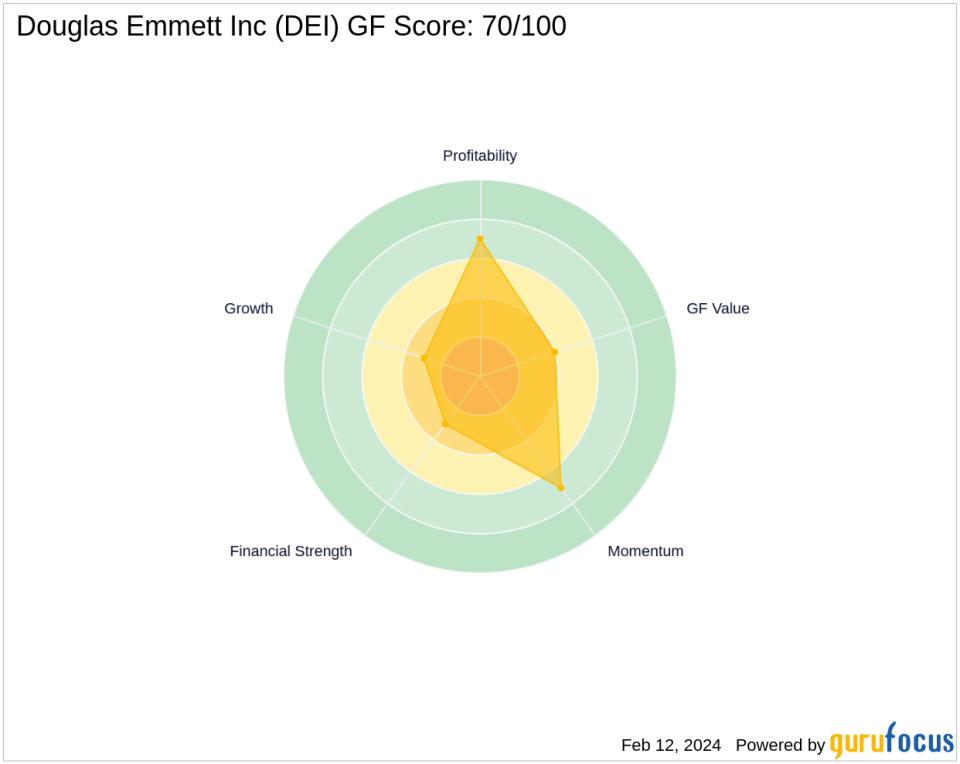

Douglas Emmett Inc's current market valuation presents a cautionary tale for investors. The stock's PE Percentage stands at 0.00, indicating the company is not generating profits. The GF Value of $31.10 suggests a significant discrepancy with the current stock price of $13.32, resulting in a Price to GF Value ratio of 0.43. This discrepancy, along with a GF Score of 70/100, signals poor future performance potential, and the designation of a possible value trap warrants careful consideration before investing.

Comparative Guru Holdings

First Eagle Investment (Trades, Portfolio) is not alone in its interest in Douglas Emmett Inc. Other notable investors, including Ron Baron (Trades, Portfolio), Mason Hawkins (Trades, Portfolio), and Chris Davis (Trades, Portfolio), also hold stakes in the company. However, First Eagle Investment (Trades, Portfolio) remains the largest guru shareholder, indicating a strong conviction in the stock despite the recent reduction in shares.

Sector and Financial Rankings

In the realms of Technology and Basic Materials sectors, Douglas Emmett Inc's standing is overshadowed by its primary classification in the REIT industry. The company's financial rankings reveal challenges, with a Financial Strength rank of 3/10 and a Growth Rank of 3/10. The Profitability Rank fares better at 7/10, but the GF Value Rank of 4/10 and a Momentum Rank of 7/10 suggest a mixed outlook for the company's growth prospects.

Investment Considerations and Risks

Investors considering Douglas Emmett Inc must weigh the potential value trap indicated by the GF Valuation. The stock's GF Score of 70/100, alongside other financial indicators such as the Piotroski F-Score of 5 and an Altman Z-Score of 0.32, provide a nuanced view of the company's financial health and future performance potential. With a Cash to Debt ratio of 0.09, the company's ability to cover its financial obligations is also a critical factor to consider.

Conclusion: Analyzing the Transaction's Influence

The reduction in First Eagle Investment (Trades, Portfolio)'s stake in Douglas Emmett Inc reflects a strategic move within the firm's portfolio. While the trade has not significantly altered First Eagle Investment (Trades, Portfolio)'s overall position, it does highlight the firm's active management approach and its assessment of DEI's valuation and future prospects. As the market continues to evolve, investors will be watching closely to see how this transaction plays out in the context of First Eagle Investment (Trades, Portfolio)'s broader investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.